EUR/USD Forecast: A move to 1.1000 remains a feasible target

- EUR/USD faced renewed downside pressure on Monday.

- A decent bounce in the Greenback collaborates with the pair’s decline.

- The next risk event emerges from the US CPI on Tuesday.

The resurgence of a modest rebound in the US Dollar (USD) put EUR/USD under some fresh downside pressure, motivating it to start the new trading week on the defensive and clock its second consecutive day of losses.

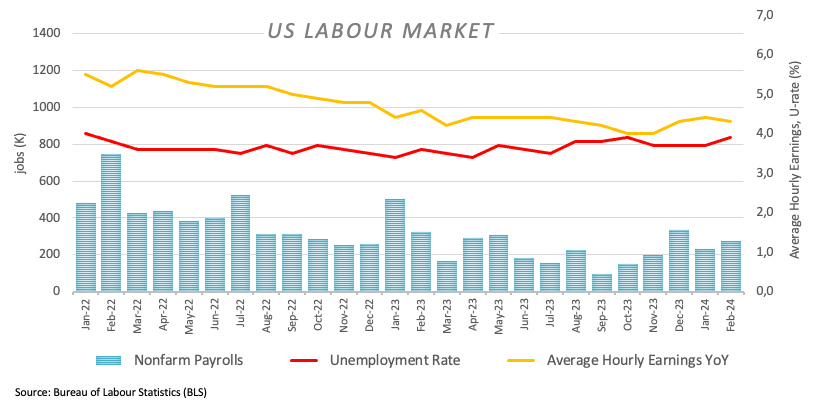

In the meantime, the USD Index (DXY) managed to regain a small smile and rose to the vicinity of the 103.00 hurdle as investors continued to assess Friday’s publication of US Non-farm Payrolls, where the economy added 275K jobs in February, although the jobless rate ticked higher (3.9%) and wage inflation cooled somewhat.

The recovery in the Dollar also came on the back of the equally humble rebound in US yields across the curve, somehow alleviating the weakness in place since late February. The German 10-year bund yields followed suit, regaining the 2.30% level after two daily pullbacks in a row.

Back to the macro scenario, both the Federal Reserve (Fed) and the European Central Bank (ECB) are predicted to start their easing cycles early in the summer (June). The pace of the subsequent interest rate cuts, a priori, is what could make a difference between both central banks, however. Despite this, the ECB is unlikely to fall much behind the Fed.

According to the FedWatch Tool by CME Group, expectations of a rate cut in June have increased to approximately 55%.

Returning to the ECB, Board member P. Kazimir highlighted earlier on Monday that although inflation is declining, the desired target has not yet been reached. He supports an approach to policy easing that is characterized by a "smooth and steady" cycle. Kazimir believes that the confidence to implement rate reductions will only emerge by June.

Overall, the stagnant fundamentals of the euro area compared to the robust resilience of the US economy support the notion of a stronger Dollar on the medium-term horizon, especially given the possibility of both the ECB and the Fed initiating their easing programmes nearly simultaneously. In such a scenario, EUR/USD could experience a more pronounced correction, initially targeting its YTD low around 1.0700 before potentially revisiting lows from late October 2023/early November in the 1.0500 region.

EUR/USD daily chart

EUR/USD short-term technical outlook

The surpass of the March peak of 1.0981 (March 8) could encourage EUR/USD to attempt an assault of the weekly high of 1.0998 (January 11), which reinforces the psychological barrier of 1.1000 and comes ahead of the December 2023 top of 1.1139 (December 28).

On the downside, if the pair falls below the 200-day SMA at 1.0834, it might test the 2024 low of 1.0694 (February 14). The November 2023 low of 1.0516 (November 1) is followed by the weekly low of 1.0495 (October 13, 2023), the 2023 low of 1.0448 (October 3), and the round level of 1.0400.

Meanwhile, the EUR/USD remained above its 200-day Simple Moving Average (SMA) of 1.0831, indicating a positive outlook.

Looking at the 4-hour chart, the pair looks to have entered some consolidation in the near term. That being said, the next upward obstacle seems to be 1.0981, followed by 1.0998. The initial level of support is 1.0867, followed by the 200-SMA at 1.0819 and 1.0761. The Moving Average Convergence Divergence (MACD) remained positive, while the Relative Strength Index (RSI) dropped below 56.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.