EUR/USD Forecast: A bottom not yet at sight

- US employment data failed to impress, but the greenback retained its strength.

- Federal Reserve Chief Powell will testify before a special commission this week.

- EUR/USD at risk of losing 1.0878, the low from 2019.

The shared currency had no chances this past week, falling to fresh 2020 lows against its American rival. Solid US data, coronavirus concerns, and worrisome macroeconomic figures in Germany were behind the pair’s slump.

Fear and data led the way

The week kick-started with the release of the final versions of the Markit PMI for both economies, which were mostly revised higher, generating some optimism among speculative interest. However, the US official ISM Manufacturing PMI jumped to 51.9 while the Services PMI came in at 55.5, both surpassing the market’s expectations. Being official numbers, these reports tend to have more weigh on price than the Markit ones.

As for the US employment sector, the ADP survey on private jobs indicated an increase of 291K positions, far above the 156K expected. This Friday, the Nonfarm Payroll report showed that the country added 225K new jobs, but the positive headline was overshadowed by a higher unemployment rate, which rose to 3.6%, despite the participation rate decreased to 63.4%. Wages’ growth was also uneven when compared to the market’s expectations, up by 0.2% MoM and by 3.1% YoY.

Germany released December Factory Orders, which unexpectedly fell by 2.1% monthly basis, while the annual decline was larger-than-anticipated, down by 8.7%. Industrial Production in the same month has also contracted, down by 0.7% MoM and by 6.8% YoY. The figures point to a persistent economic slowdown in the EU’s largest economy.

A whole different chapter is the Chinese coronavirus outbreak. The infection continues to spread outside China, with the death toll above 600 at the time being. The WHO declared it a global health emergency, although Dr Tedros, WHO Director, said that there’s no need to interfere with global travel or trade at this point. Concerns related to how the outbreak would affect global growth are still high, although not always reflected in financial assets.

What’s next in the data front

The upcoming week will have some interesting events to take care of. The European Commission will release its Economic Growth Forecasts next Tuesday, while the Union’s Industrial Production will be out next Wednesday.

Germany will release January’s inflation figures, with the annual CPI foreseen at 1.5%. Germany and the EU will also unveil their Q4 GDP figures.

As for the US, Fed’s Chief Powell is scheduled to testify before the Congress next Wednesday. On Thursday, the country will release January inflation figures. The annual CPI is foreseen at 2.4%, slightly better than the previous 2.3%, while the core yearly CPI is seen at 2.2% from 2.3%.

EUR/USD technical outlook

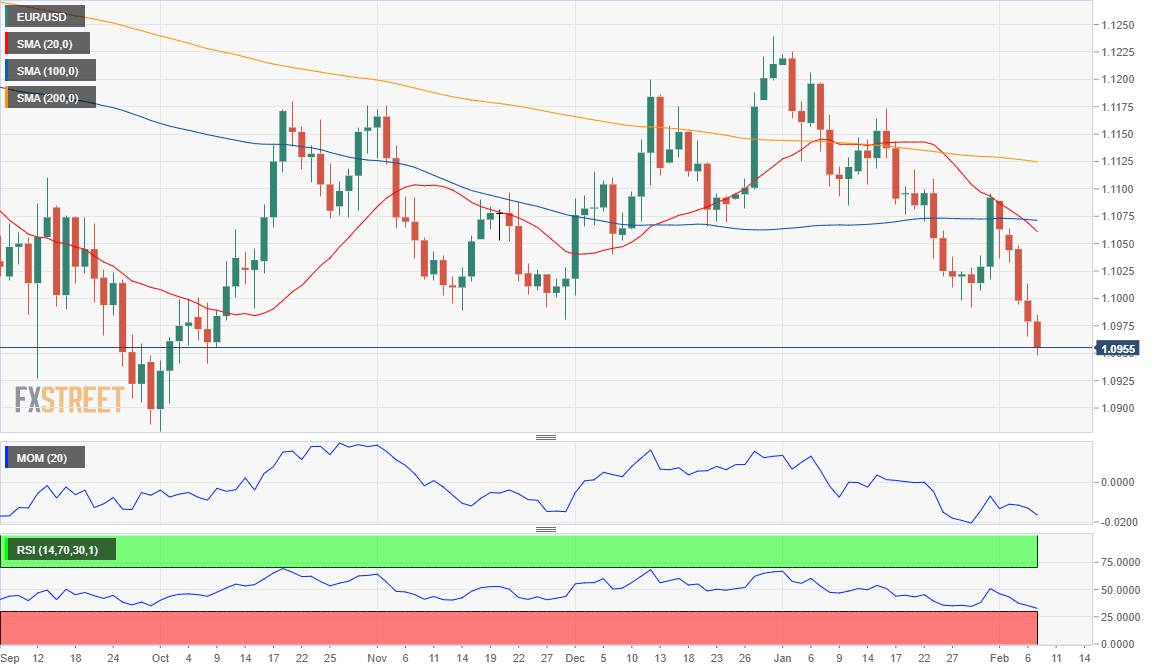

The EUR/USD pair is trading at levels last seen in October 2019, and the weekly chart indicates that the slump may continue. The pair has extended its decline below a flat 20 SMA after failing to surpass it. Meanwhile, technical indicators head firmly south at fresh multi-month lows, while the 100 SMA is about to cross below the 200 SMA, both above the current level.

The pair is also bearish in its daily chart, developing below all of its moving averages, and with the 20 DMA now breaking below the 100 DMA, both in the 1.1060/70 price zone.

The first support comes at 1.0878, 2019 low, en route to the 1.0810 price zone. Above 1.1000, the 1.1060/70 area is the next resistance, ahead of 1.1120.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that investors are betting on a downward extension next week but that sentiment turns bullish afterwards. On average, the pair is seen at 1.0957 weekly basis, with bears accounting for 56% of the polled experts. Bulls lead with over 50% in the monthly and quarterly view, wit but the pair is seen on average in 1.10 handle.

The Overview chart shows that most targets accumulate below the current level only in the shorter perspective, with room to advance up to 1.1200 in the monthly view. The moving averages in both time-frame offer bearish slopes. However, the 3-month view indicates a wide spread of possible targets, with the largest accumulation between 1.10 and 1.11. The moving average is mostly neutral, with a modest downward slope.

Related Forecasts:

AUD/USD Forecast: Coronavirus and RBA remain in focus as Aussie eyes the abyss

GBP/USD Forecast: Bears leading in battle between Boris' Brexit blues and bullish economy

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.