- AUD/USD has been whipsawed by the RBA and coronavirus headlines.

- A speech by the RBA governor, several Chinese publications, and US consumer data are on the list.

- Early February's daily chart is painting a mixed picture.

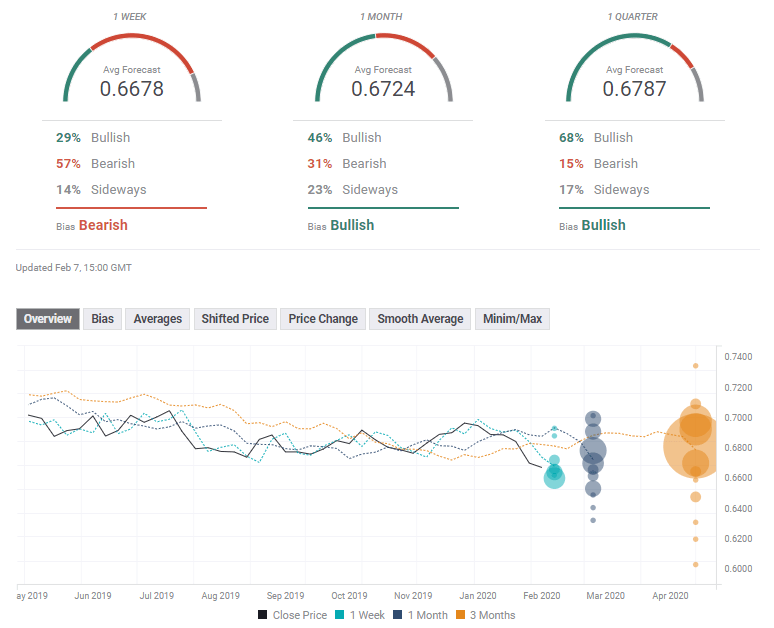

- The FX Poll is pointing to gains in the medium and long terms.

The Australian dollar initially benefited from receding fears about the coronavirus and upbeat statements from the central bank while ignoring weak data – only to flip back down and hit decade lows. Both topics in focus in the upcoming week.

This week in AUD/USD: RBA, coronavirus whipsaw

Is a coronavirus cure on the cards? Not so fast, but markets have seized upon medical efforts to develop or reuse existing medicine to cure the respiratory disease. The virus originating in Wuhan has taken the lives of hundreds of people, but financial markets are pleased with the immense efforts to contain the outbreak. The recovery of stock markets has helped the Australian dollar, a risk currency, recover.

However, Australian Prime Minister Scott Morrison has warned of the economic damage from the disease, citing his country's high-dependency on the world's second-largest economy.

Nevertheless, Aussie traders seemed to lean more towards another policymaker – Phillip Lowe, Governor of the Reserve Bank of Australia. The RBA left its interest rates unchanged at 0.75% as expected, seeing the glass half full and especially content with the labor market. Moreover, Lowe spoke later on and seemed to play down the chances of further rate cuts. The RBA slashed borrowing costs three times in 2019.

The central bank – and markets – seemed to ignore downbeat economic figures. Retail sales slipped by 0.5% in December, and the trade surplus fell short of expectations with only $5.22 billion.

The Governor had the last word of the week when he presented the bank's Statement of Monetary Policy – where he sent the Aussie down by suggesting the RBA considered a rate cut.

Moreover, the A$ succumbed to US dollar strength. A winning streak of robust economic indicators, from the forward-looking purchasing managers' indexes through productivity figures and culminating in job numbers all benefitted the greenback. The American economy gained 225,000 jobs in January, beating initial estimates.

Chinese economic indicators were satisfactory, but do not reflect the coronavirus outbreak. Caixin's Manufacturing Purchasing Managers' Index ticked down to 51.8 points in January, yet continues reflecting growth. The official Manufacturing PMI stood at 51.1.

Australian and Chinese events: Seeing the impact of the virus?

The coronavirus outbreak, also known as the Wuhanflu, is set to continue dominating the headlines for at least another week. Apart from the number of cases and the rising death toll, the global mood will likely be set economic developments. These include flight cancelations, the shutdown of plants in China, downgraded forecasts, and any hard statistics that may lower the level of uncertainty.

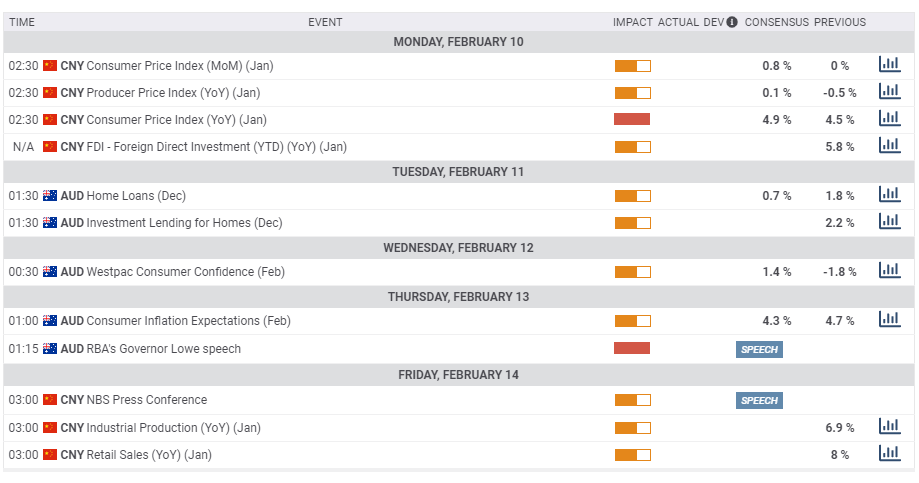

The economic calendar provides some data, albeit partial.

Chinese inflation figures for January kick off the week. Economists expect the annual Consumer Price Index to remain hot, driven by high pork prices. An unexpected drop – due to the coronavirus – may weigh on markets.

Several Australian consumer figures are of interest, but the main event of the week is another speech by Governor Lower. The central banker may shed further light on the economic situation, primarily if he refers to the bank's response to the outbreak.

China closes the week with top-tier economic indicators for January – Industrial Production and Retail Sales. Both figures may be skewed by a duo of factors – activity ahead of the Lunar New Year and the Wuhanflu. It will be interesting to see if markets will shrug off the data as messy or become more sensitive to any drop.

Here the most prominent Australian and Chinese releases on the economic calendar:

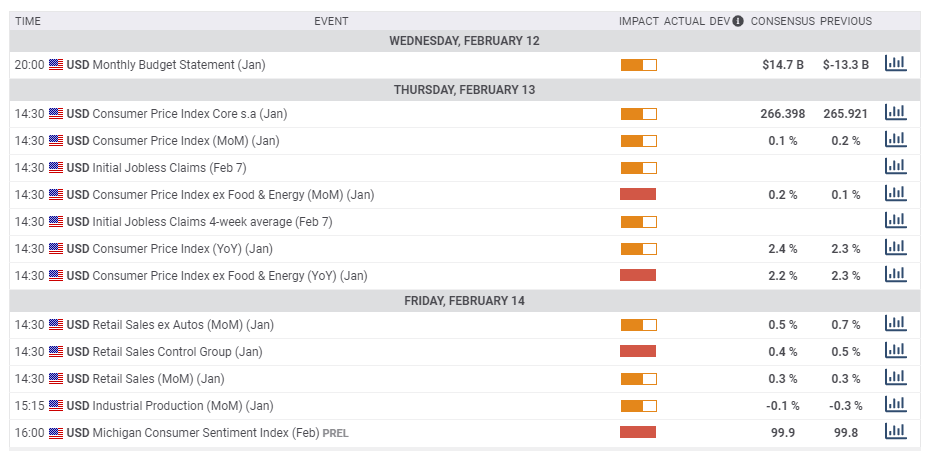

US events: Further trade speculation, housing, PMIs

While US politics is fascinating with President Donald Trump's impeachment and the Democratic Party's primaries, markets will likely continue ignoring these developments.

The economic calendar is centered on the consumer, starting with inflation figures. Energy prices have likely driven the headline Consumer Price Index level higher, but Core CPI – which is watched by the Federal Reserve – has probably slipped. Economists expect underlying inflation to have decelerated from 2.3% to 2.2% in January.

The Retail Sales report for January carries expectations for rises in all gauges. Most importantly, the Control Group is set for another healthy advance of 0.4% after rising by 0.5% in December.

An up-to-date look at shopping trends awaits traders at the close of the week. The University of Michigan's preliminary measure of Consumer Sentiment in February is set to remain near 100, representing an upbeat mood.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

The Relative Strength Index on the daily chart is flirting with 30 – which indicates oversold conditions and implies a bounce. Bulls may also be encouraged that downside momentum is not at its worst. On the other hand, AUD/USD is trading well below the 50, 100, and 200-day Simple Moving Averages.

The recent trough of 0.6675 remains a significant battle line. It is closely followed by the October low of 0.6665, and then by the January 2019 flash crash low of 0.6620 – which was momentary. More importantly, AUD/USD would fall to the lowest since early 2009 – the weakest in over a decade.

Resistance is at 0.6720, which was a support line in October, followed by 0.6755, a low point in late November. It is followed by 0.6785, February's high. The next lines to watch are 0.68, 0.6845, and 0.6860, which is the confluence of the 100 and 200-day SMAs.

AUD/USD Sentiment

While the Aussie may respond to oversold conditions with a bounce, the fresh dovishness by the RBA and the coronavirus outbreak – which is far from over – may continue weighing on AUD/USD.

The FX Poll is showing a bearish trend in the short term but a robust recovery afterward. Do experts think the sell-off is exaggerated? Perhaps, yet the average targets have been downgraded in the past week.

Related Forecasts

- GBP/USD Forecast: Bears leading in the battle between Boris' Brexit blues and a bullish economy

- EUR/USD Forecast: A bottom not yet at sight

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.

-637166666441521944.png)