EUR/USD Fibonacci analysis: Upside pressure and potential for the bullish continuation

Shift in the momentum and Fibonacci support

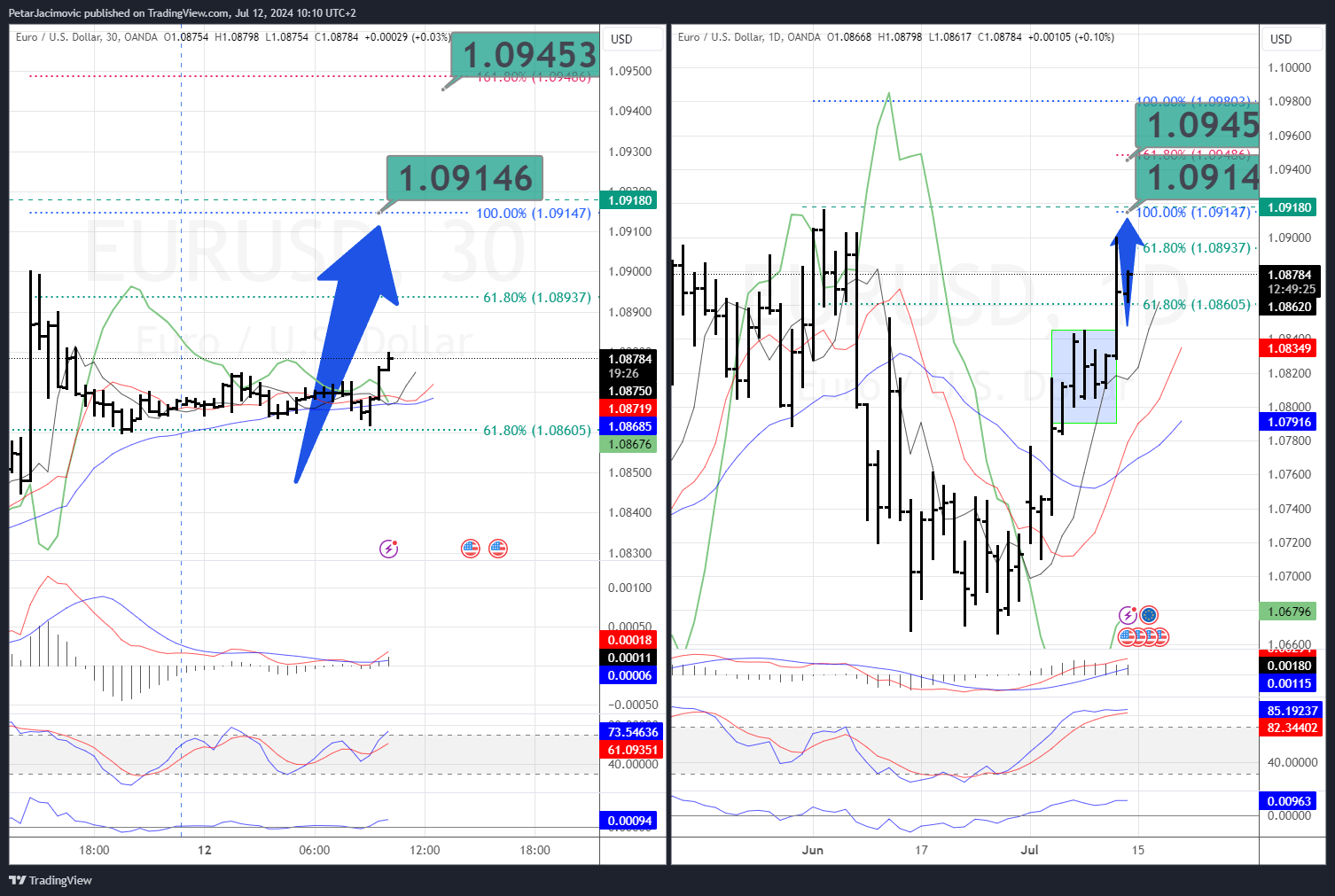

In the 30-minute timeframe, we observed a strong rally in EUR/USD following yesterday’s CPI numbers, pushing the price towards 1.0900. During the Asian session, the market traded within a tight range around the Fibonacci retracement level of 61.8% at 1.0860, acting as intraday support. We noted a rejection at this support level, indicating potential momentum for an upside continuation towards projected Fibonacci expansion levels.

Our intraday upside objectives are set at 1.0910 and 1.0945. On the daily timeframe, there was a breakout from a multi-day consolidation, suggesting a likely continuation of the rally. The oscillators on the daily timeframe are showing bullish conditions, aligning well with the recent price action.

Traders should closely monitor price action around these Fibonacci levels and the behavior of the Stochastic Oscillator. Significant divergence or convergence at these points could provide early signals for potential reversals or continuations in the trend. Additionally, staying updated with macroeconomic events or market news that might impact sentiment is crucial for making informed trading decisions.

Author

Petar Jaćimović

FXCentrum

Petar Jaćimović was born on 8 July 1989 in Jagodina, Serbia.