EUR/USD analysis: Respects simple moving averages

EUR/USD

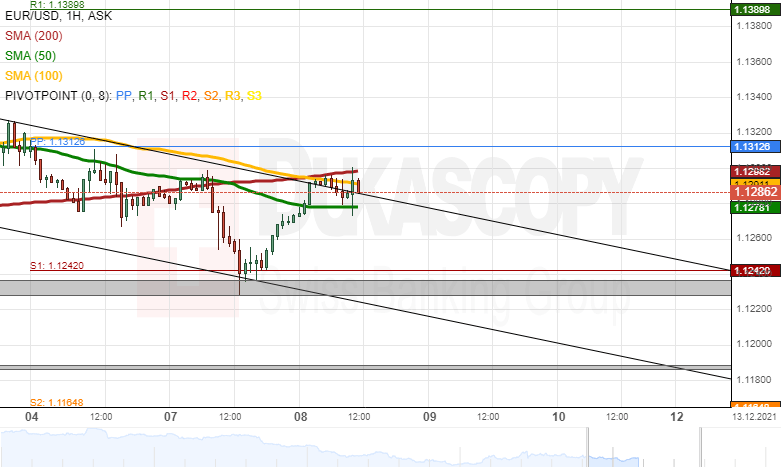

On Tuesday, the EUR/USD found support in the support levels near 1.1235. The event resulted in a surge, which passed the resistance of the channel down pattern. However, the rate started to respect the resistance of the 100 and 200-hour simple moving averages and the support of the 50-hour simple moving average.

If the EUR/USD breaks resistance of the 100 and 200-hour simple moving averages and the 1.1300 mark, a potential surge would encounter resistance at the weekly simple pivot point at 1.1313. Above the pivot point, there is no technical resistance as high as the weekly R1 simple moving average at 1.1390.

On the other hand, a move below the 50-hour SMA and the 1.1280 level might result in a decline to the combined support of the 1.1250 mark, the weekly S1 simple pivot point at 1.1242 and the support zone at 1.1228/1.1237.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.