EUR/USD Analysis: Post-NFP upsurge stalls ahead of 1.2200 mark, bullish potential intact

- EUR/USD surged to the highest level since February in reaction to the dismal US NFP report.

- The latest optimism over the COVID-19 vaccine deal by the EU further underpinned the euro.

- Move beyond the 1.2200 mark would set the stage for an extension of the positive momentum.

The EUR/USD pair gained strong follow-through traction on the last day of the week and was supported by a combination of factors. The shared currency found some support after the European Central Bank Governing Council member, Martins Kazaks said that a decision to slow bond purchases is possible in June. He further added that the ECB might not use the full PEPP envelope of €1.85 trillion and that there is no reason to believe that the program will extend beyond March 2022. Apart from this, a broad-based US dollar selloff provided an additional boost to the major.

The USD witnessed aggressive selling in reaction to the disappointing US monthly jobs report, which showed that the economy added only 266K new jobs in April. This was well below consensus estimates pointing to a reading of nearly one million. Adding to this, the previous month's reading was also revised down to 770K from 916K reported earlier and the unemployment rate unexpectedly edged higher to 6.1% from 6.0% in March. The data reaffirmed expectations that the Fed will keep interest rates low for a longer period and exerted heavy downward pressure on the greenback.

The pair posted strong gains for the fourth week in the previous five and climbed to the highest level since February 26 during the Asian session on Monday. However, a modest US dollar rebound – led by an uptick in the US Treasury bond yields – capped the upside. That said, any pullback is likely to remain limited amid the weekend news over the coronavirus vaccine deal by the European Union (EU). European Commission (EC) President Ursula von der Leyen announced on Saturday that the EU has struck a deal with BioNTech/Pfizer for up to 1.8 billion extra doses of their Covid-19 vaccine.

Market participants now look forward to the release of the EU Sentix Investor Confidence Index for some impetus. Meanwhile, there isn't any major market-moving economic data due for release from the US. That said, a scheduled speech by Chicago Fed President Charles Evans, along with the US bond yields might influence the USD price dynamics and produce some trading opportunities around the major.

Short-term technical outlook

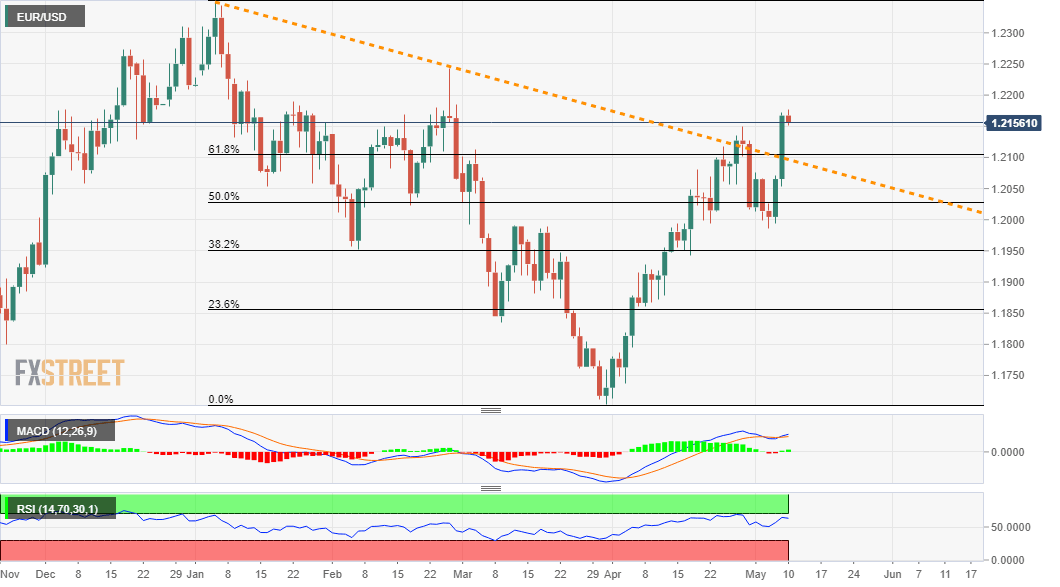

From a technical perspective, Friday’s strong positive move confirmed a near-term bullish breakout through the 1.2100 confluence hurdle. The mentioned level comprised of a near four-month-old descending trend-line and the 61.8% Fibonacci level of the 1.2350-1.1704 downfall, which should now act as a key pivotal point for short-term support. Sustained weakness below might prompt some technical selling and accelerate the slide towards the 50% Fibo. level, around the 1.2040-35 region. Any subsequent decline will now be seen as a buying opportunity and remain limited near the key 1.2000 psychological mark.

On the flip side, bulls might take a brief pause near the 1.2200 mark. Some follow-through buying has the potential to lift the pair further towards February monthly swing highs, around the 1.2240-45 region. The momentum could further get extended and allow bulls to aim back to reclaim the 1.2300 round-figure mark. The next relevant resistance is pegged near YTD tops, around mid-1.2300s, which if cleared decisively should pave the way for additional near-term gains.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.