EUR/JPY Trades Sideways Range - Traders Awaits Breakout!

The Japanese cross EUR/JPY is consolidating within a sideways range after placing a high around 121.250 points. The demand for the Japanese yen is weakening in the wake of reduced safe-haven appeal.

Both of the nations, the US and China, said that they had made headway in discussions aimed at resolving their prolonged 16-month trade war. The US officials announced a contract could be confirmed this month.

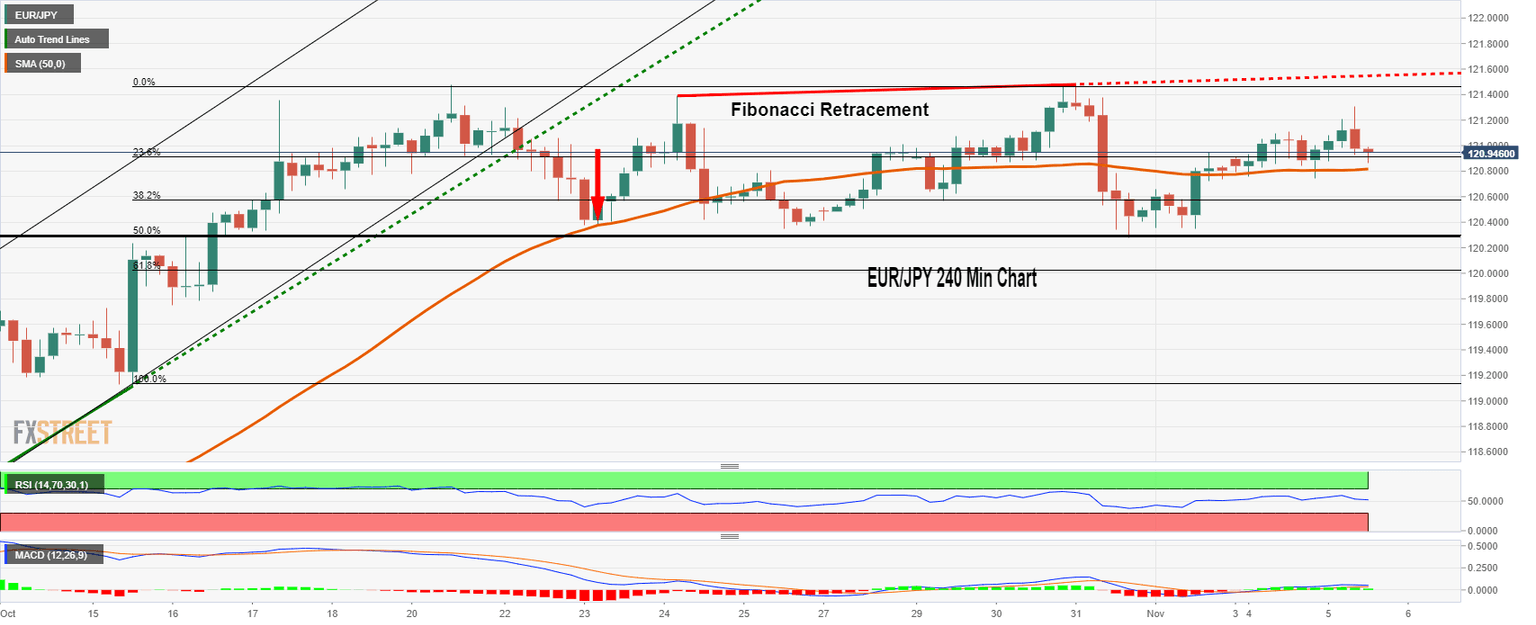

Zooming out on the 4-hour graph of the EUR/JPY, the pair was consolidating in a slightly bullish tone, facing the resistance at 121.400 while the support rests at 120.6500 levels.

The 50 period EMA lingers nearby 120.750 level, where the current market price for EUR/JPY is 120.050. It indicates the EUR/JPY still has room for additional buying above 120.750.

|

Support |

Pivot Point |

Resistance |

|

120.72 |

120.91 |

121.02 |

|

120.61 |

121.21 | |

|

120.31 |

121.51 |

On the 4 hour chart, the EUR/JPY is trading in a bullish zone as we can see the MACD and RSI, both of the leading indicators are holding above 0 and 50 figure, respectively, suggesting chances of a bullish trend.

EUR/JPY Trade Setup

Sell Below 121

Take Profit 120.600 & 120/400

Stop Loss 121.400

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and