EUR/JPY analysis: Two scenarios likely

EUR/JPY

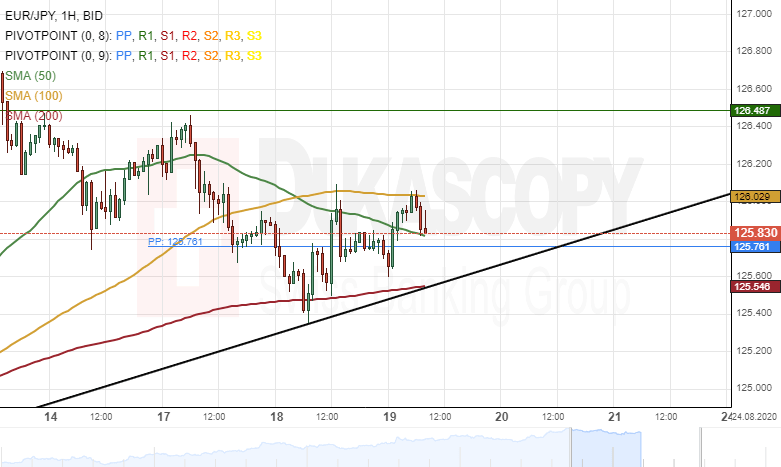

The common European currency surged by 55 points or 0.44% against the Japanese Yen on Tuesday. The currency pair tested the 100– hour simple moving average at 126.00 during yesterday's trading session.

Currently, the exchange rate is testing a resistance level formed by the 100– hour SMA. If the resistance line holds, a breakout through the lower boundary of an ascending channel pattern could occur.

However, if the currency exchange rate passes the 100– hour SMA, bullish traders would dominate Wednesday's trading session.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.