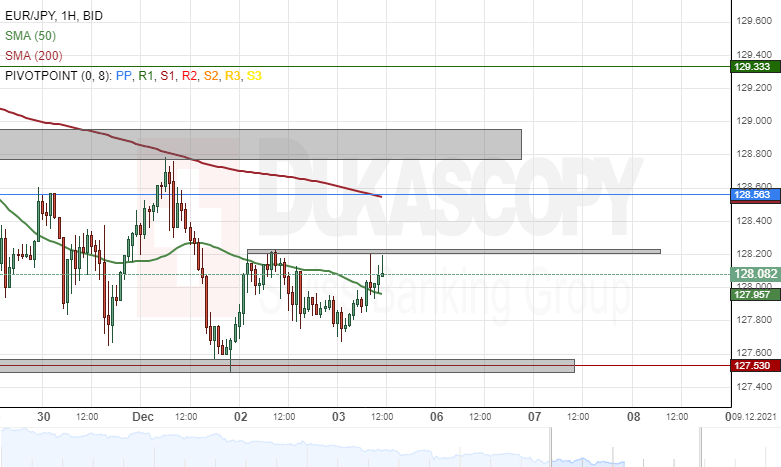

EUR/JPY analysis: Finds resistance at 128.20

EUR/JPY

On Thursday, the EUR/JPY currency exchange rate found resistance in the 128.20 level. The 128.20 mark's resistance was tested two times before a decline of the pair began. On Friday morning, the rate was being pushed down by the 50-hour simple moving average.

If the pair continues to decline, it would most likely once again look for support in the 127.50 mark and the weekly S1 simple pivot point at 127.53 This week, the rate found support in these levels two times. Below these levels, there is no technical support as low as the weekly S2 simple pivot point at 126.76. However, take into account that the 127.00 mark might act as support.

Meanwhile, a passing of the resistance of the 50-hour simple moving average and the 128.20 mark, could result in the rate reaching the resistance of the weekly simple pivot point and the 200-hour simple moving average at 128.56.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.