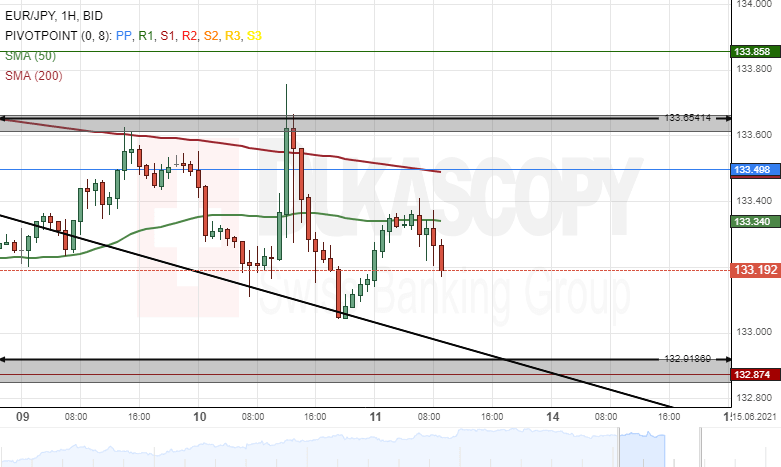

EUR/JPY analysis: Decline likely to continue

EUR/JPY

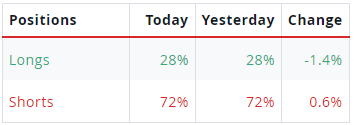

Downside risks dominated the EUR/JPY currency pair yesterday. The exchange rate fell by 71 pips or 0.53% during Thursday's trading session.

All things being equal, the Eurozone single currency is likely to continue to weaken against the Japanese Yen during the following trading session. The possible target for the currency exchange rate could be near the 132.53 area.

However, bearish traders may encounter a support line near the weekly S1 at 132.97 during the following trading session.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.