EUR/CHF impulsive rebound signals potential trend, Swiss inflation data in focus [Video]

![EUR/CHF impulsive rebound signals potential trend, Swiss inflation data in focus [Video]](https://editorial.fxsstatic.com/images/i/coin-frontal-pedestal-chf_XtraLarge.jpg)

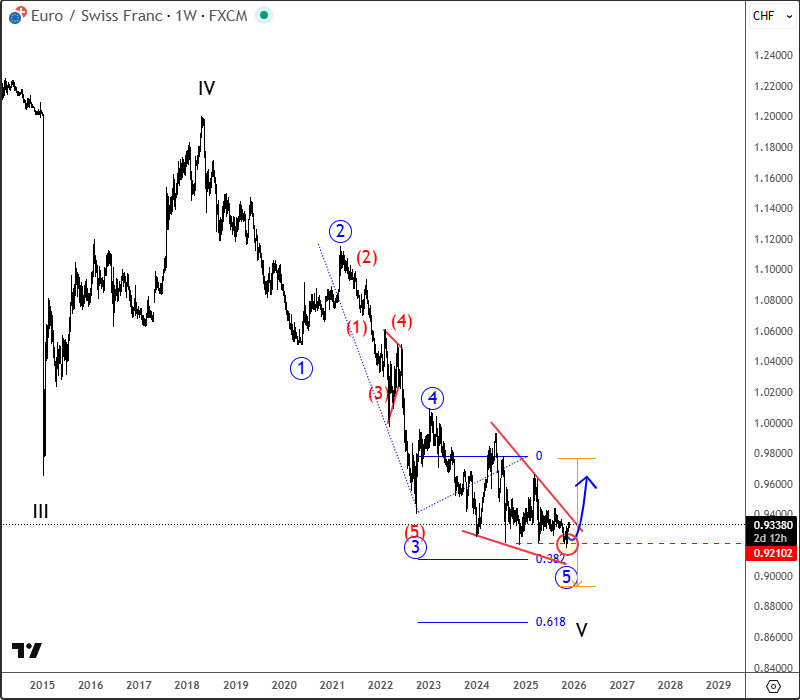

EURCHF is in a multi-year downtrend, but what stands out now is a potential wedge formation down from the 2023 highs, with the recent spike to a new low below 0.9210. We know the Swiss National Bank watches CHF strength very closely, and they prefer a weaker franc since Swiss exporters rely heavily on sales to Europe and the US, so whenever this pair goes too far, they are ready to act. They even mentioned several times this year that intervention or negative-rate tools are still on the table.

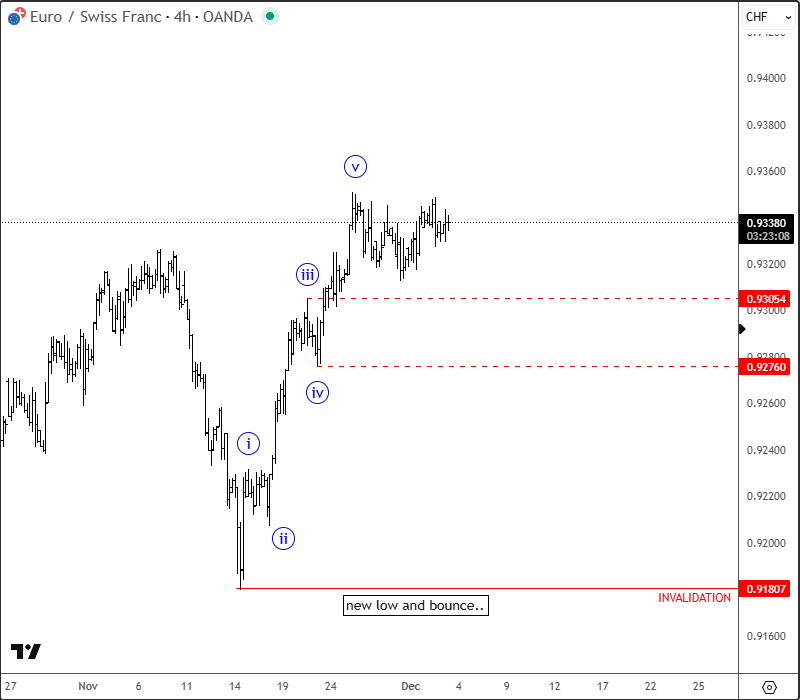

What really matters is that from the most recent lows we can clearly see five waves up on the intraday chart, and this type of impulsive structure usually indicates completion of a higher-degree downtrend, or at least a temporary recovery phase that should extend higher after some slowdown. And with latest Swiss inflation report showing drop in prices, that could be the next important trigger for fresh upside on EUR/CHF pair.

Swiss CPI MoM Actual -0.2% (Forecast -0.1%, Previous -0.3%).

Swiss Core CPI YoY Actual 0.4% (Forecast 0.5%, Previous 0.5%).

Swiss CPI YoY Actual 0% (Forecast 0.1%, Previous 0.1%).

If we see a dip into the 0.9276–0.9305 area, we think this could offer an opportunity to join the strength, while the market trades above 0.9180 invalidation level.

For a detailed view and more analysis like this, you can watch below our latest recording of a live webinar streamed on December 01:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.