EUR/CAD: Potential rounding bottom pattern suggest to buy

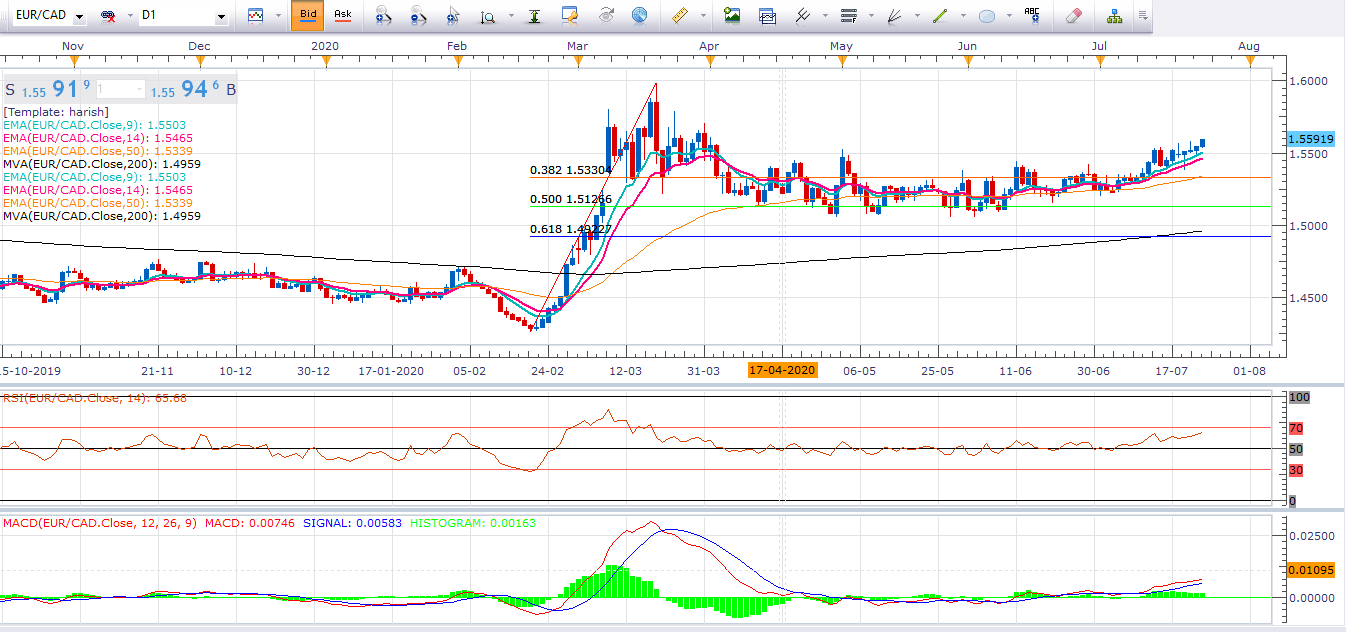

Overview: By looking at the daily chart we can see that pair is heading towards the north side after testing the 50% retracement line which is a strong key support level. The price action on the daily chart seems like no more selling sentiments in the pair and it’s time to buy the pair once again where bulls did their job already with a fabulous bounce is the eyewitness of their courage. Now it seems like bulls are approaching the recent swing’s high of 1.6000 level in near term.

In our previous report also we mentioned buying at 1.5300-05 level target is 1.5450 and 1.5600 level with the tight stop loss of 1.5140 level and our target has been achieved already. Well, it’s perfect time to enter with the buy position in the pair. The bears have become exhausted now as we can witness on the chart that bears are no more interested to move down and pair is now trying to head north side which is a recent development on the chart. The overall picture looks mildly bullish and updating the sign of buying.

Odds are in favor of bulls. Intraday bias remains bullish on the pair as long as 1.5400 level remains intact on a closing basis. The short term to intermediate picture is bullish. Short term to the intermediate-term trend is up so in an uptrend market, buy on dips will be a profitable strategy.

Technical Analysis: From a technical perspective we can see that a rounding bottom pattern is in the process of formation and bulls are approaching the previous high of 1.6000 level. The pair has bounced back from the 50% Fibonacci level which can’t be ignored and further upside rally is still on the cards. On 4 hourly chart an uptrend line is lying which is providing us a bullish signal for intraday point of view.

The RSI indicator is favoring the bulls from the positive territory whereas on the MACD indicator is also supporting the buyers on the 4 hourly chart which is a recent development. The 1.5440 is the key support level followed by 1.5330 where 1.5800 is key resistance level followed by 1.5950 level.

Trade idea: Based on chart and studies above, we can say that one can go for buy at 1.5580 level target is 1.5750 and 1.5950 level with the tight stop loss of 1.5400 level.