EUR/CAD analysis: Bullish sequence extends from blue box

EUR/CAD is clearly in a bullish sequence from August 22, 2022, in the primary degree wave count. This cycle forms a 3-wave structure. Wave ((A)) ended in April 2023. Then, a wave ((B)) pullback followed and completed at the September 2023 low. From that low, the pair rallied and breached the wave ((A)) high, kickstarting wave ((C)).

As a result of that breach, a bullish sequence is now confirmed. Ideally, traders should buy dips in a bullish market and sell bounces in a bearish one. Wave (1) and (2) of ((C)) ended in November 2023 and November 2024, respectively. Then, wave (3) began from the November 2024 low.

Currently, wave (3) is nearing completion. In such a strong trend, there will be opportunities to buy from pullback extremes. The most recent was in mid-July 2025, marking the end of wave ((iv)) of 5 of (3). Wave ((C)) should ideally reach the 1.6400 equal leg for completion.

EUR/CAD bullish setup – 17th July 2025

On July 17, 2025, we shared the chart above with members. Earlier, we had identified a 7-swing pullback as wave ((iv)). In addition, we marked the 1.5886–1.5771 area as the blue box extreme. From that zone, we recommended a Long opportunity to members.

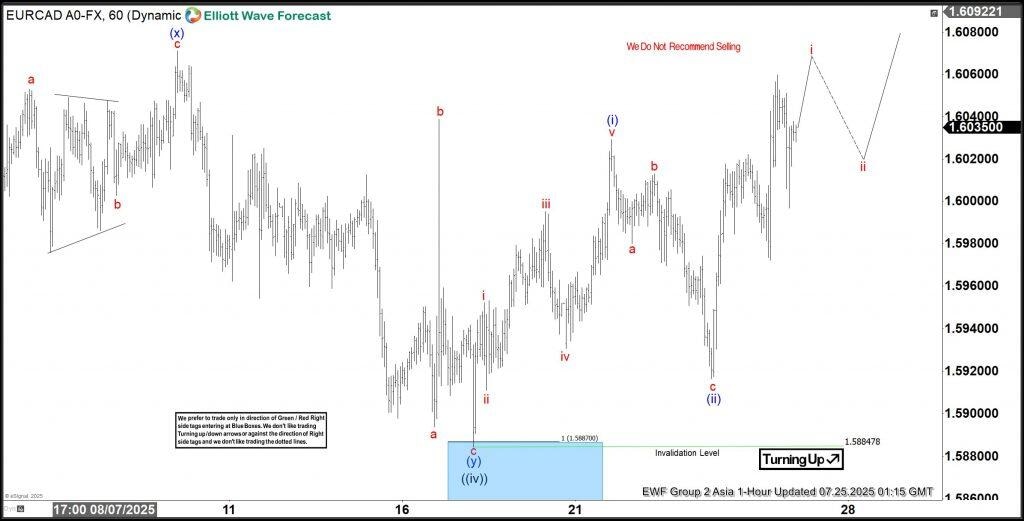

EUR/CAD bullish setup – 25th July 2025

On July 25, 2025, we shared the chart above with members during the Asia update. The H1 chart showed price hitting the blue box and bouncing off it immediately. Buyers have now closed half of their positions in profit and moved the rest to breakeven.

Looking ahead, price may either break into a new high within the April cycle or complete a 3-swing bounce from the blue box and turn lower for a deeper ((iv)) via a 15-swing pullback. In either scenario, we already have a trade plan. So, nothing catches us by surprise.

EURCAD has rallied over 150 pips from the blue box. If the setup plays out fully, members could gain around 270 pips in total profit.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com