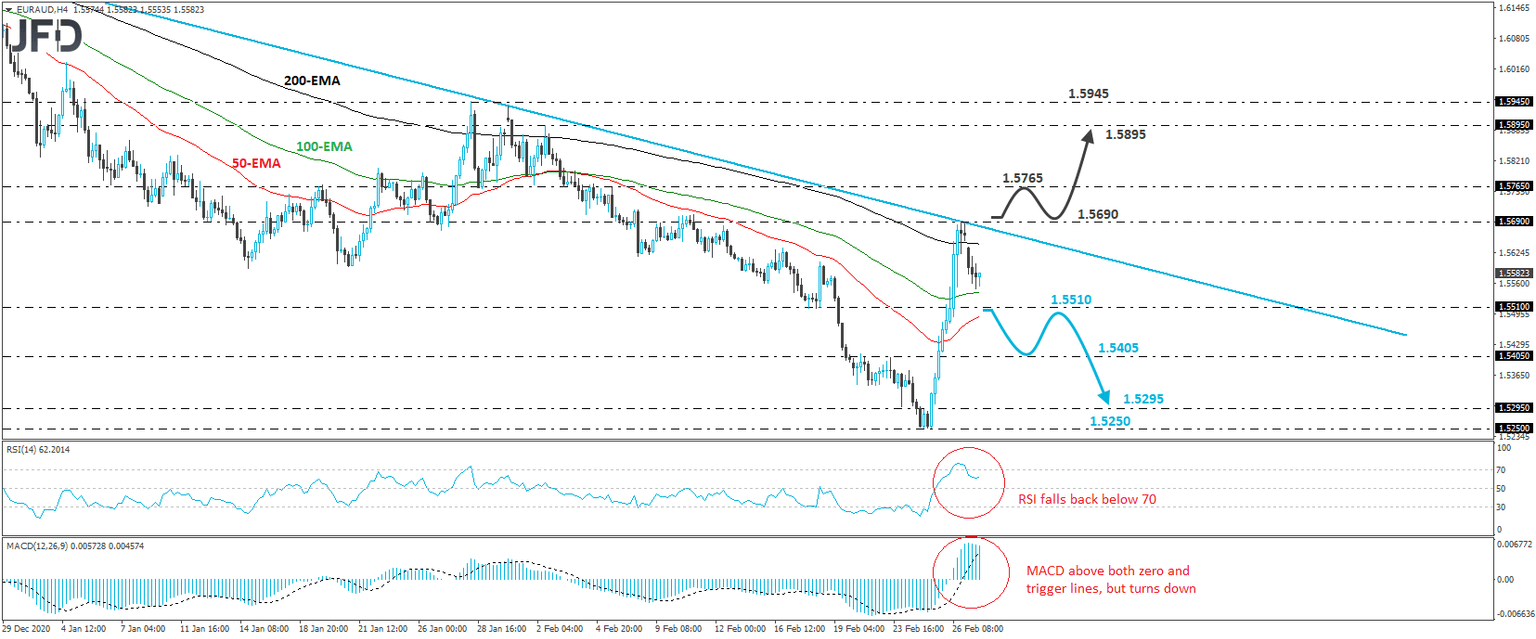

EUR/AUD hits a downtrend line and slides

EUR/AUD rallied on Thursday and Friday, but hit resistance at 1.5690, near the downside resistance line drawn from the high of October 20th, and then it retreated. In our view, as long as the rate continues to trade below that line, the downtrend remains intact and thus, we will adopt a cautiously bearish approach for now.

If the bears are strong enough to push the battle below 1.5510, marked by the low of February 18th, this may confirm the case for further declines and may initially pave the way towards the 1.5405 territory marked by the inside swing high of last Tuesday. If that barrier is not able to stop the decline either, then we may experience extensions towards the 1.5295 level, or the 1.5250 hurdle, marked by Thursday’s low.

Shifting attention to our short-term oscillators, we see that the RSI turned down and fell back below its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. Both indicators suggest that last week’s upside speed is decreasing, which adds to the case of seeing some further declines, at least in the short run.

In order to start examining the case of a bullish reversal, we would like to see a clear close above 1.5690. This may also take the rate above the aforementioned downside line and may encourage advances towards the high of February 5th, at 1.5765. Another break, above 1.5765, may set the stage for extensios towards the peak of February 2nd, at 1.5895, or the high of January 28th, at 1.5945.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD