USD/CHF reaches 5-month high

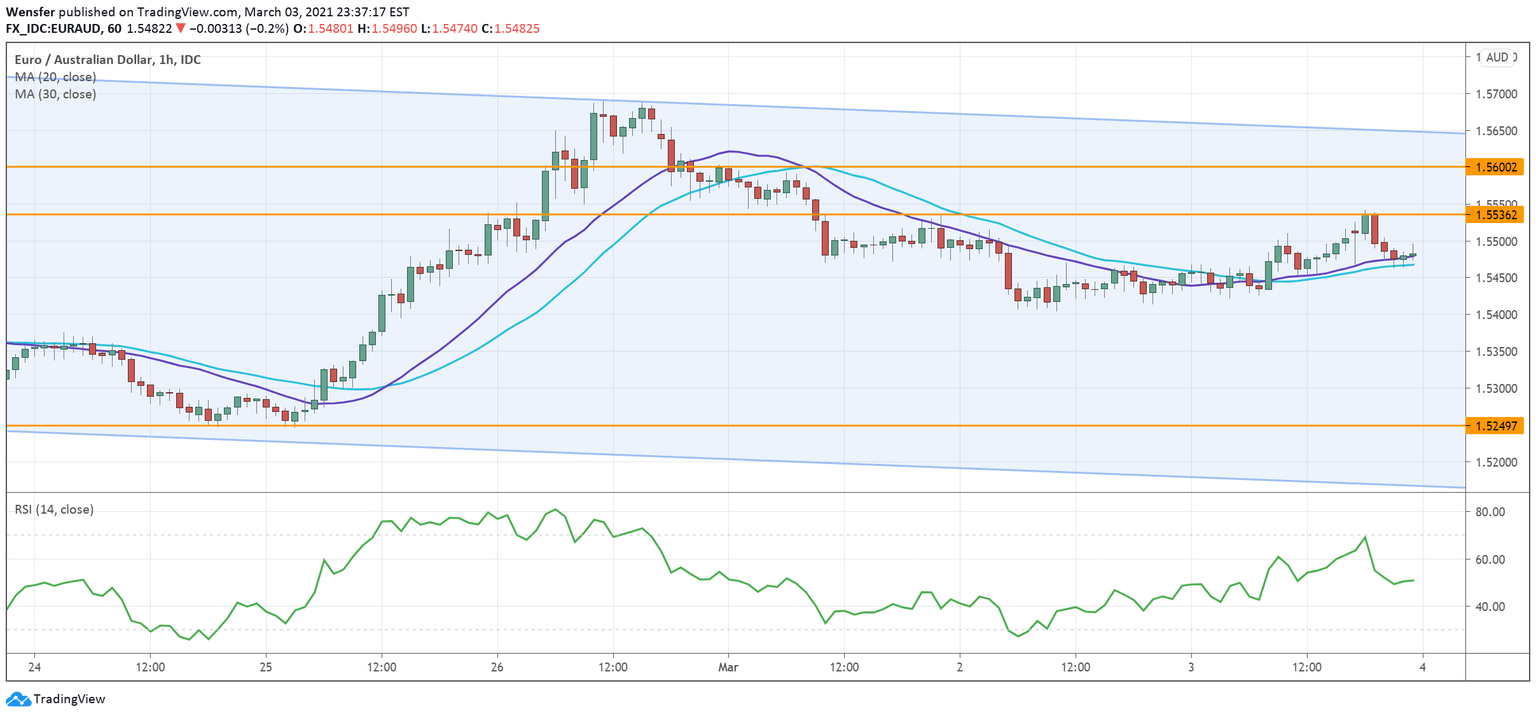

EUR/AUD capped by falling channel

Despite Australia’s soft retail sales number, the euro remains under technical pressure. The pair has been sliding within a bearish channel since last October and the eurozone’s retail reading today is unlikely to change the course.

As the pair rebounds after the RSI dipped into the oversold territory, the euro may encounter stiff selling pressure in the 1.5530-1.5600 supply zone.

On the downside, 1.5250 is the next target should the sell-off accelerate.

USD/CHF reaches 5-month high

Today’s jobless claims may stir up the volatility in the US dollar. A low number would heighten the reflation fear as the labour market may have recovered faster than expected.

The pair is hovering right under last October’s high around 0.9200. The recent drop of the RSI from the overbought area would suggest some leeway to the upside.

A bullish breakout could trigger an extended rally as shorts cover their positions. On the downside, 0.9130 is the intraday support to monitor.

XAG/USD tests 12-month long trendline

Precious metals have taken a toll as the greenback made a comeback. Silver is trying to hold on to its near-year-long rising trendline, and a successful bounce could resume the uptrend.

The double dip on the line (25.80) is a serious test of the buyers’ commitment. However, an RSI divergence showing a loss in the bearish momentum may give the buy-side an edge.

A rebound will need to lift offers around 27.00 to gain traction. Failing that, the price could start to reverse.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.