ETH/USD meltdown continues as stablecoins safety remains

Cryptocurrency prices continued their downward momentum as many investors continued dumping their stakes. Bitcoin dropped below the important resistance at $27,000 while Ethereum dropped below $2,000. As a result, the total market cap declined to over $1.2 trillion. This decline happened as concerns about stable coins continued. This week, Terra UST imploded as it lost its algorithmic peg. And today, Tether moved to 90 cents as people continued to dump their coins. Crypto prices have also declined because of the rising interest rates.

Global stocks were in the red again as concerns about inflation continued. In Asia, the Nikkei 225 and Hang Seng indices declined by more than 1.50%. Nikkei dropped sharply after Softbank announced that it had lost over $27 billion as its tech holdings slumped. In Europe, the DAX index declined by more than 2.3% as gas prices surged. Gas prices rose above 100 euros per megawatt as Moscow imposed sanctions on European gas companies that Berlin has seized. These companies include Gazprom Europe and Astora. In the UK, the FTSE 100 index declined by more than 2.5%.

The British pound declined after the relatively weak economic data from the UK. According to the Office of National Statistics, the British economy contracted by 0.1% in March as prices increased. In the first quarter, the country’s economy expanded by 0.8%, which was lower than the median estimate of 1.0%. On a year-on-year basis, the economy rose by 8.7%, which was also lower than expectations. Other numbers like manufacturing and industrial production data also declined sharply.

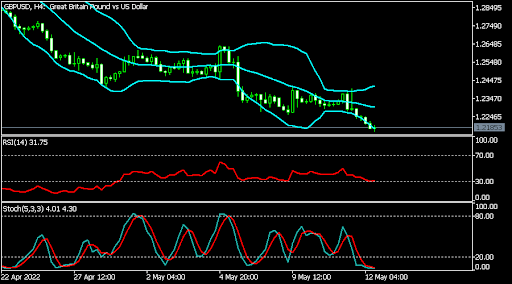

GBP/USD

The GBPUSD pair crashed after the relatively weak economic numbers from the UK. It declined to a low of 1.2184, which was substantially lower than this week’s high of 1.2390. It has moved to the lower line of the Bollinger Bands. Also, the Relative Strength Index and the Stochastic Oscillator has moved below the oversold level. Therefore, the pair will likely keep falling as bears target the key support at 1.2100.

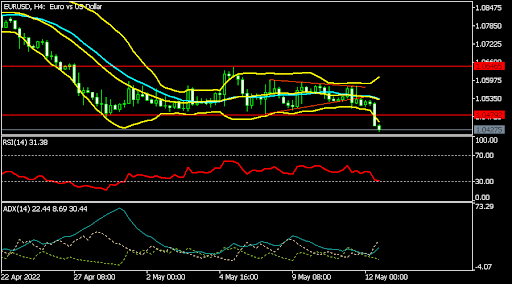

EUR/USD

The EURUSD pair declined below the important support at 1.0480 as investors focused on the strong US inflation data. On the four-hour chart, it managed to move below the important support at 1.0480. It also moved below the 25-day moving average while the Relative Strength Index has dropped below the oversold level. The Average Directional Index has pointed slightly upwards. The pair will likely keep falling as bears target the key support at 1.0400.

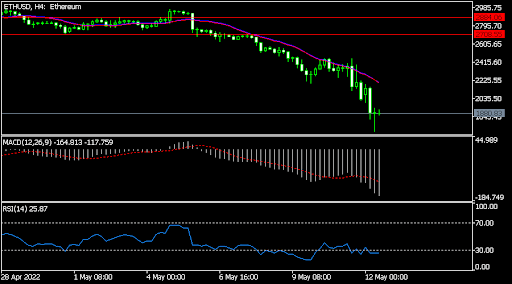

ETH/USD

The ETHUSD pair plunged to a low of 1,780, which was the lowest level in months. The pair moved below all moving averages while the MACD has declined below the neutral level. The RSI has also dropped below the oversold level. Therefore, the pair will likely keep falling as bears target the key support level at 1,500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.