Escape velocity

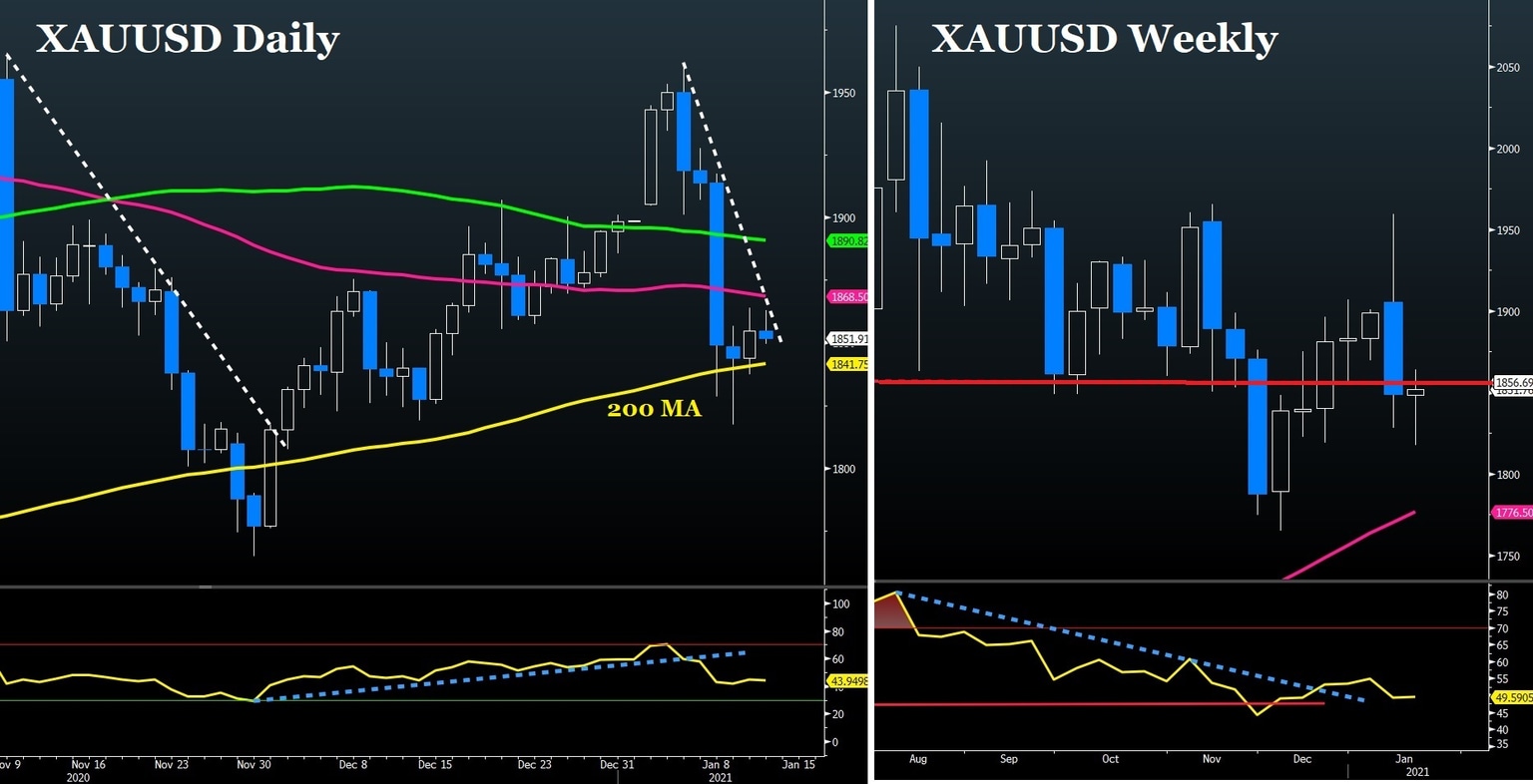

The US dollar re-emerges following an abruptly drop Tuesday as Treasury yields reversed. The quick loss of dollar altitude raises questions about the sustainability of any dollar bid. Fed talk continues to dominate the schedule. The 2-way EURUSD trade for WhatsApp Broadcast Group members mentioned on here hit both targets. The chart below conveys this morning's quick short trade on XAUUSD to the WBG.

We have been waiting for a day of flat Treasury yields to see how the dollar would react. Early signs aren't encouraging for dollar bulls as it slumped across the board as the worst performer Tuesday. Maybe that was a simple retracement after a six-day move but maybe it was a sign that the dollar bid is fleeting.

We liken it to a launching rocket that needs incredible amounts of fuel to rise higher, rather than a spaceship that will coast along in orbit. Rising bond yields have been the fuel since the Georgia runoffs but they sputtered Tuesday after a strong auction and the dollar nosedived immediately afterwards.

For its part, Fed talk continues to be a modest tailwind. Comments continue to focus around better economic prospects and tapering. We will hear from Brainard and Clarida Wednesday but all the chatter about more QE or a WAM extension is gone.

We will continue to keep a close eye on the dollar in the day ahead, along with a 30-year auction that could steer the next move. If this is it for the dollar bounce, it's a feeble one even by the standards of short squeezes.

Author

Adam Button

AshrafLaidi.com

Adam Button has been a currency analyst at Intermarket Strategy since 2012. He is also the CEO and a currency analyst at ForexLive.