Equities rebound on rebound of virus slowdown

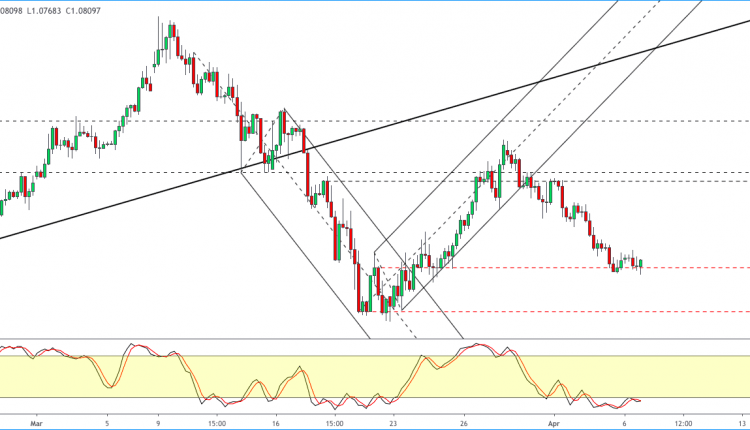

Euro holding on to 1.0787 support

The euro currency is trading near the support level 1.0787 level.

With the Stochastics oscillator moving from the oversold level, we expect the momentum to push prices higher.

If the correction persists, then we expect a move towards a test of 1.1030.

To the downside, if the support fails near 1.0787, then we expect a move lower to the 1.0663 region.

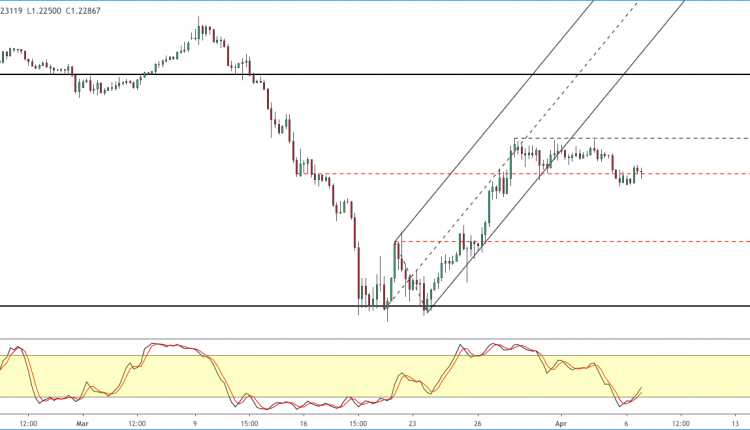

Sterling creeps back into range

The GBPUSD currency pair is rising back into range after slipping to the downside of 1.2280.

The bias remains mixed for the moment. If GBPUSD enters into the range, then we expect the upside near 1.2485 to hold the gains in the near term.

We expect this sideways range to continue for the short term. A strong breakout from this range will probably set the direction.

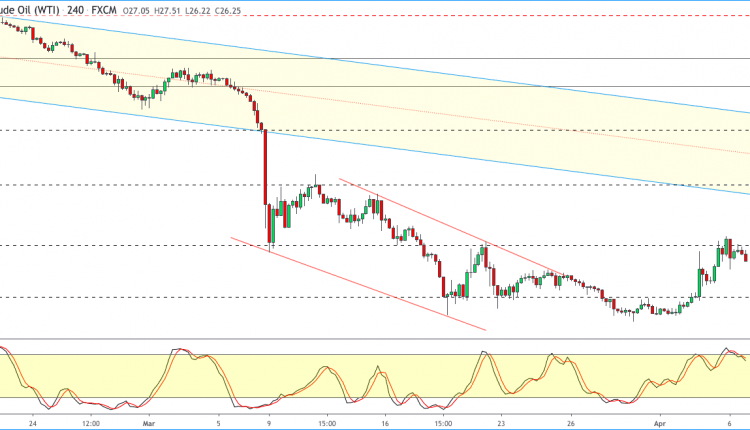

WTI crude oil fails to breakout off resistance

Oil prices continue to maintain a strong gain, building upon the momentum over the past few sessions.

Price action is back to the resistance level of 28.00. Following this, oil prices are slipping back off this level.

In the near term, we expect crude oil to consolidate within the 28.00 and 22.00 region in the short term.

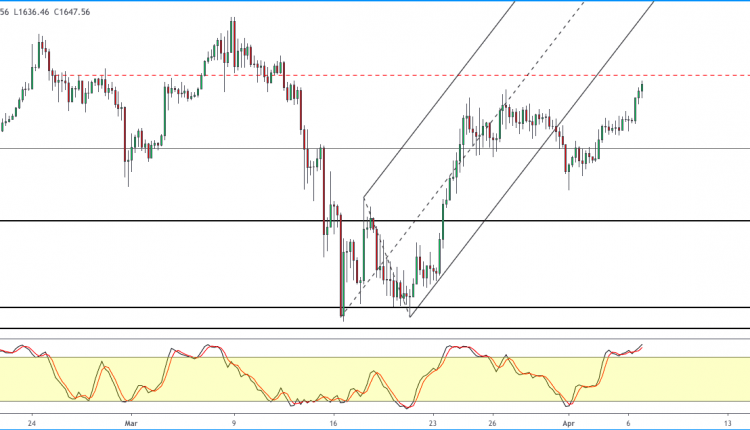

XAU/USD rises to a four-week high

Gold prices are holding on to the bullish gains with prices rising sharply to a four-week high.

This comes after the breakout above the previous pivot high of 1630. To the upside, the next main price level is at 1655.

Failure to breakout above this level means we can expect gold to settle within the said levels of 1655 and 1630.

A breakout from this range, we can expect the direction to be maintained. To the downside, the support at 1594 will be the target.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.