Equities rebound as Trump says OPEC will cut production

Euro Maintains Declines Amid A Strong USD

The euro currency is down another 0.8% on the day. The declines could likely see a move to the lower support level at 1.0787.

There is scope for a modest rebound ahead of the decline to the support level. However, the resistance level at 1.1030 will be coming under a second retest.

As long as this resistance holds, the downside is likely. In the event that the support fails at 1.0787, then we expect a move lower to 1.0663.

GBP/USD Continues To Maintain A Sideways Range

The British pound continues to trade flat, maintaining a sideways range since March 27.

The Stochastics also remains rather flat in the near term. This suggests that the momentum is still weak at the moment.

However, we expect to see a breakout off this level. We expect this breakout to be strong.

The bias remains mixed at the moment, opening the risk on either side.

Crude Oil Rises To A Two-Week High

Oil prices are caught in a bid, rising to a two-week high. The gains came after President Trump’s announcement about a possible OPEC supply cut.

WTI crude oil rose to intraday highs of 27.31 before retracing some of the gains.

Despite the short term gains, the hidden divergence suggests that price action will be forming a bottom in the near term.

In the event of a break down below 22.00, then we expect further consolidation or a possible decline further.

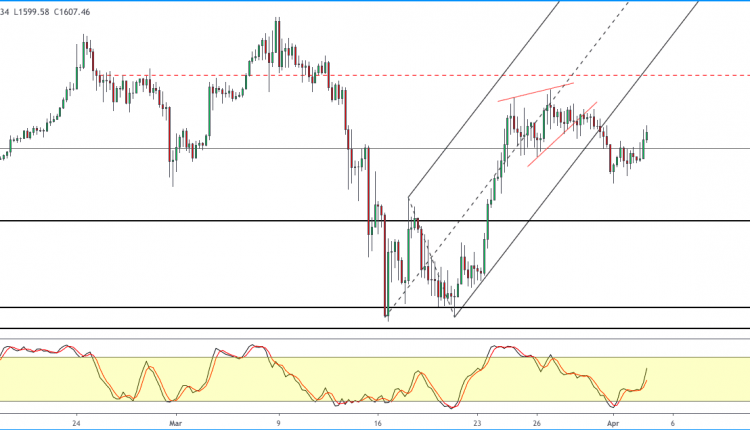

XAU/USD Attempts To Move To The Upside

Gold prices are slightly bullish, rising over 1.50% on the day. Price action reclaimed the resistance level of 1594.

This puts the upside bias into the picture. In the event that prices pullback lower, then we expect the 1594 level to hold out as support.

To the upside, the next target is at 1655 handle. Alternately, if price fails at 1594, then we expect a move lower.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.