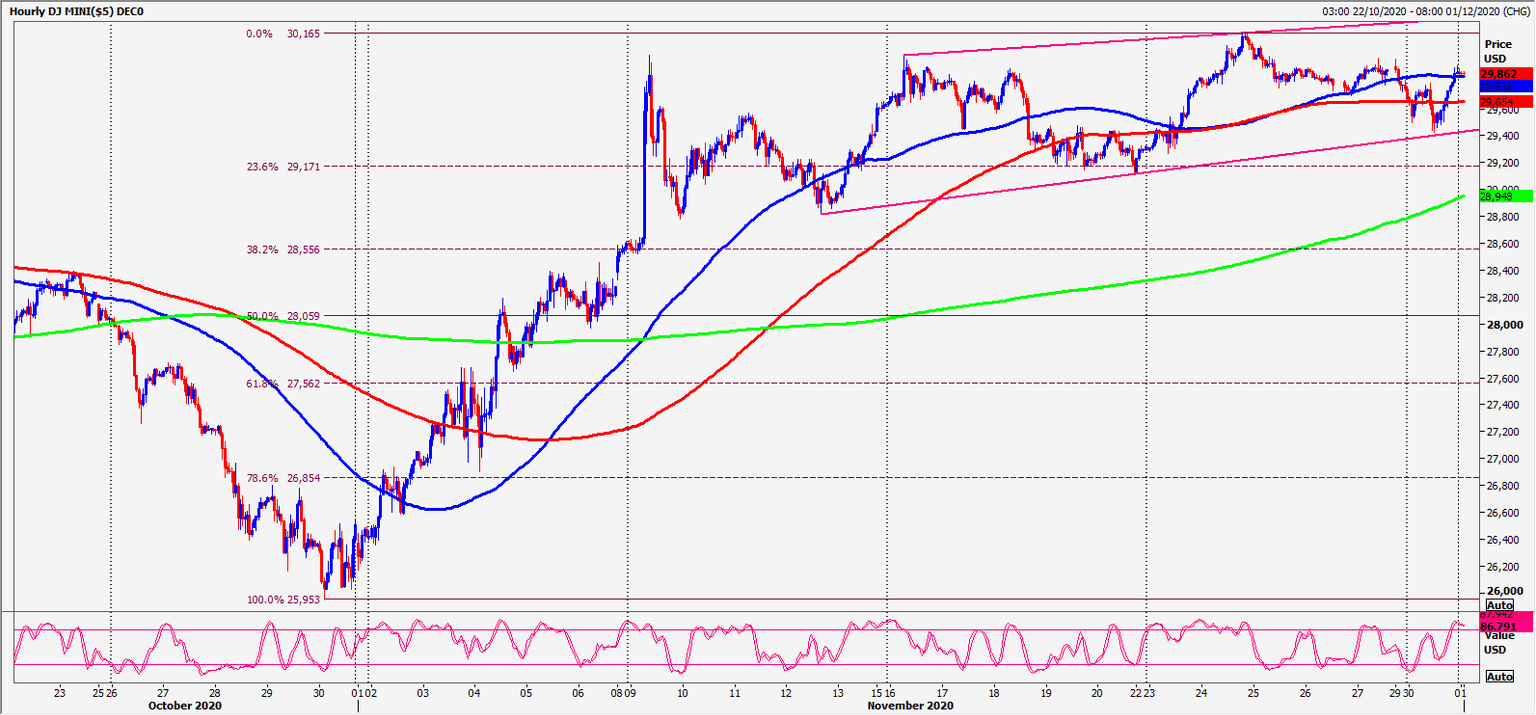

Emini Dow Jones longs at the buying opportunity at 29550/500

Emini Dow Jones – Nasdaq

Emini Dow Jones December longs at our buying opportunity at 29550/500 workedperfectly offering up to 400 ticks profit as I write.

Nasdaq December retests important resistance at the double top all time high at12410/465. A triple top is very rare, but if formed it is a strong sell signal. Obviously asustained break above here is a buy signal.

Daily Analysis

Emini Dow Jones longs at the buying opportunity at 29550/500 work on the bounceback to 29900. Holding here risks a slide to 29780/750 & 29660/640. Downside isexpected to be limited in the strong bull trend but further losses give us a secondbuying opportunity at 29550/500. Longs need stops below 29400. Be ready to sell abreak below targeting a buying opportunity at 29200/150 with stops below 29050.

Bulls need to sustain a break above 30000. Above 30200 look for 30250 &30400/450, perhaps as far as 30620/660.

Nasdaq retests important resistance at the double top all time high at 12410/465.This could be a very important day! Obviously a sustained break above here is a buysignal. Be ready to buy a break above 12500.

Below 12330 is less positive. Minor support at 12200/190 but below here targets12130 with a short term buying opportunity at 12090/060. Stop below 12000. Abreak below here is an important sell signal

Chart

Author

Jason Sen

DayTradeIdeas.co.uk