Emini Dow Jones: Key support 29950

Emini Dow Jones – Nasdaq

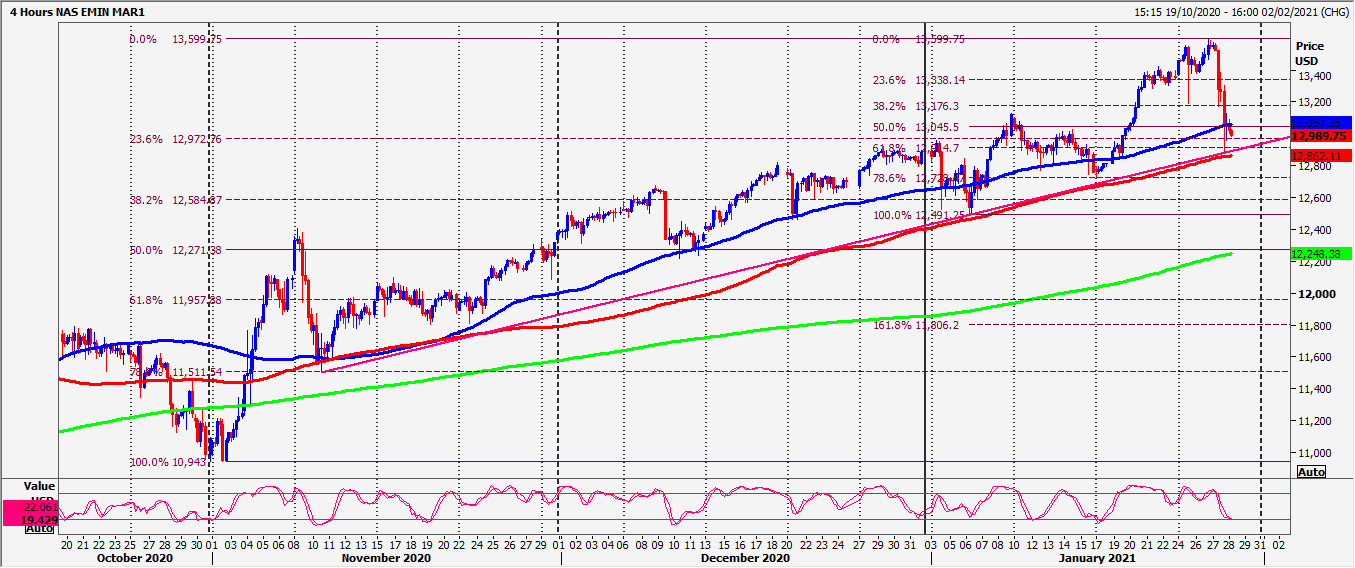

Emini Dow Jones March Nasdaq key support at 12950/900 today**

We have crashed over 1200 points in a week.

Nasdaq March crashed through good support at 13500/400 for a buying opportunityat 13180/140. Longs worked on the bounce to 13383. However we then crashedanother 300 points to 12885.

Daily Analysis

Emini Dow Jones key support at 29950/900 today. First resistance at 30220/260 butabove 30300 targets 30400/450, perhaps as far as 30500. Strong resistance at30700/800 but shorts need stops above 30900.

Longs at key support at 29950/900 need stops below 29800. A break lower is a sellsignal targeting 29700 & 29570/550.

Nasdaq key support at 12950/900 today. Longs need stops below 12830. Minorresistance at 13000/050 but above here targets strong resistance at 13150/200. Thisis the best chance of a high for the day so bears can try shorts with stops above13270. A break higher is a buy signal targeting 13330/350 & above 13400 is the nextbuy signal.

Be ready to sell a break below 12830 for a test of last week’s low at 12740/20. Notethat a weekly close below here tomorrow leaves a bearish engulfing candle (sellsignal) on the weekly chart. Further losses today meet strong support at 12600/560.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk