Emerging markets stocks and ETFs for 2021

There’s not a rigid definition of what an emerging market is. For example, China is still the leading country in many emerging market ETFs and funds. But is it fair to consider China an emerging market any longer? It has nearly 1.4 billion people and was the only major economy globally to see GDP growth in 2020.

That’s like calling Giannis Antetokounmpo an up and coming superstar despite winning the last two NBA MVP awards.

But even if I did see China as an emerging market, it wouldn’t be my top choice for 2021.

If you’ve been reading my newsletters, you know that I love emerging market exposure this year. The dollar is weakening and should continue to weaken with trillions more in stimulus and rising commodity prices.

Meanwhile, emerging markets are perfectly positioned to exploit this and grow as a result.

You also know that I’ve been talking about specific emerging markets like Taiwan, Thailand, and Russia.

But in this special emerging markets newsletter , I will aim to further talk about what to look for when investing in a country, what other emerging markets to consider, and why I think they are set to outperform the US markets this year, after many years of underperformance.

Why emerging markets?

For several reasons!

For one, did you know these facts about emerging markets? They have:

-85% of the world population

-77% of the land mass

-63% of global commodities

-59% of global GDP (using PPP)

-12.5% of world’s market cap

Consider this for long-term investing too. Advanced economies are aging rapidly while emerging economies have youthful demographics.

That’s why PWC believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average.

For emerging markets, this could be very advantageous in the coming decades.

With American debt building up at an alarming rate, and the U.S. Dollar set for broader declines, this trend could begin sooner than we realize.

U.S. investors also usually have >5% exposure to emerging markets, making this an even more untapped opportunity.

Aren’t emerging markets risky?

Of course, you have to consider political risk, credit risk, and economic risk for emerging markets.

But did you see the U.S. Capitol two weeks ago? Have you noticed how its currency has performed since March?

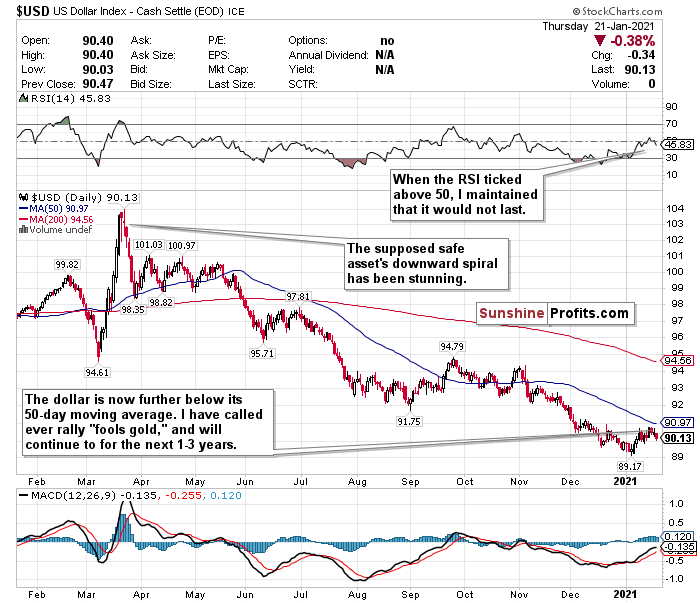

Figure 1- U.S. Dollar $USD

Have you also seen the Fed’s balance sheet? Have you seen the S&P’s valuation and the tech IPO market?

I would even argue that emerging markets could hedge against America’s political, economic, and currency risks right now. The pandemic only exacerbated this.

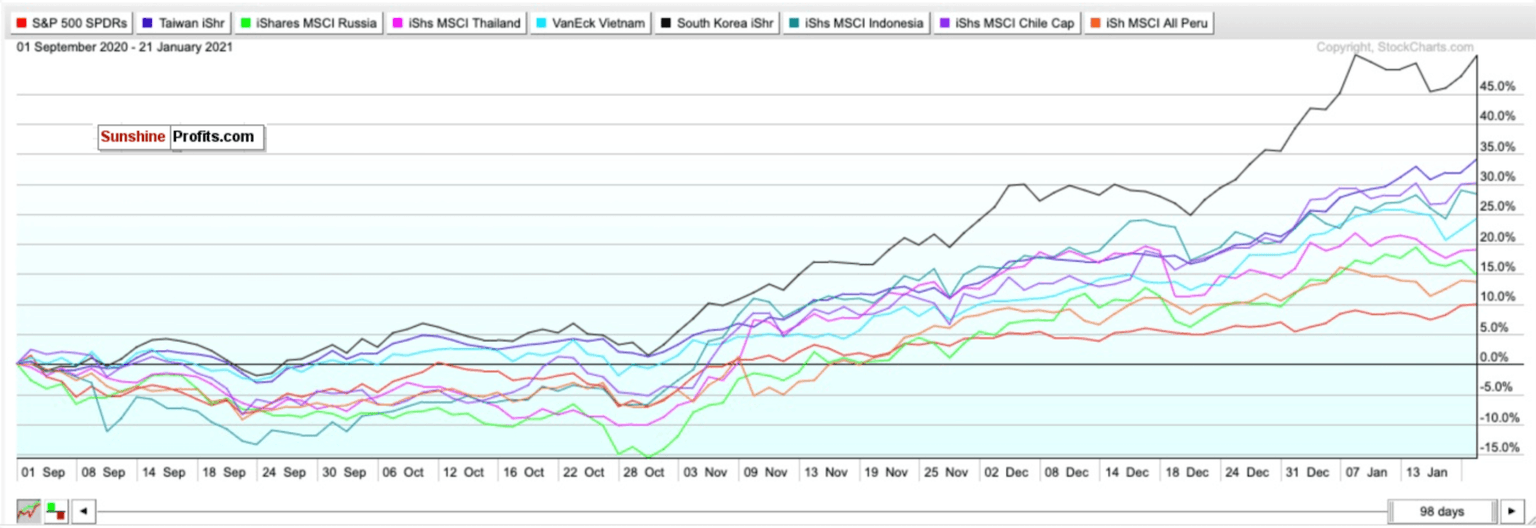

Furthermore, if you look at the returns of the emerging markets I will discuss today: Taiwan (EWT), Russia (ERUS), Thailand (THD), Vietnam (VNM), South Korea (EWY), Indonesia (EIDO), Chile (ECH), and Peru (EPU), you will see that all have outperformed the S&P 500 (SPY) since September.

Figure 2-SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Taiwan iShares ETF (EWT)

Figure 3-iShares MSCI Taiwan ETF (EWT)

The Taiwan iShares ETF (EWT) has overheated more than the other emerging market ETFs based on its RSI that I will discuss. But if you’ve been reading my newsletters, you know I love Taiwan.

Taiwan has also arguably been the best call I’ve made since starting these newsletters.

I have been consistently calling Taiwan a better buy than China, despite China’s undeniable upside. Taiwan has the same sort of regional upside, without the same kind of geopolitical risks.

Consider this too. Despite China’s robust economic response to COVID-19, retail sales still fell 3.9% over the full year, marking the first contraction since 1968. Lockdowns have also returned to China with a vengeance thanks to a new wave in COVID-19 infections.

Ever since I called the EWT a buy on December 3rd, it has gained nearly 16% and outperformed the MSCI China ETF (MCHI) by approximately 3%.

It has also outperformed the SPY S&P 500 ETF by nearly 11%.

Taiwan also is unique for a developing country because of its stable fundamentals. It has low inflation, low unemployment, consistent trade surpluses, and high foreign reserves.

It also has a diverse and modern hi-tech economy, especially in the semiconductor industry. With a diverse set of trade partners, Taiwan could only be scratching the surface of its potential.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Matthew Levy, CFA

Sunshine Profits

After graduating with a Bachelor of Science in Economics from the University of Victoria in 2010, Matthew developed a passion for helping clients meet their financial freedom through strong, risk-adjusted portfolios.