Emerging countries: Disparities and reshuffling

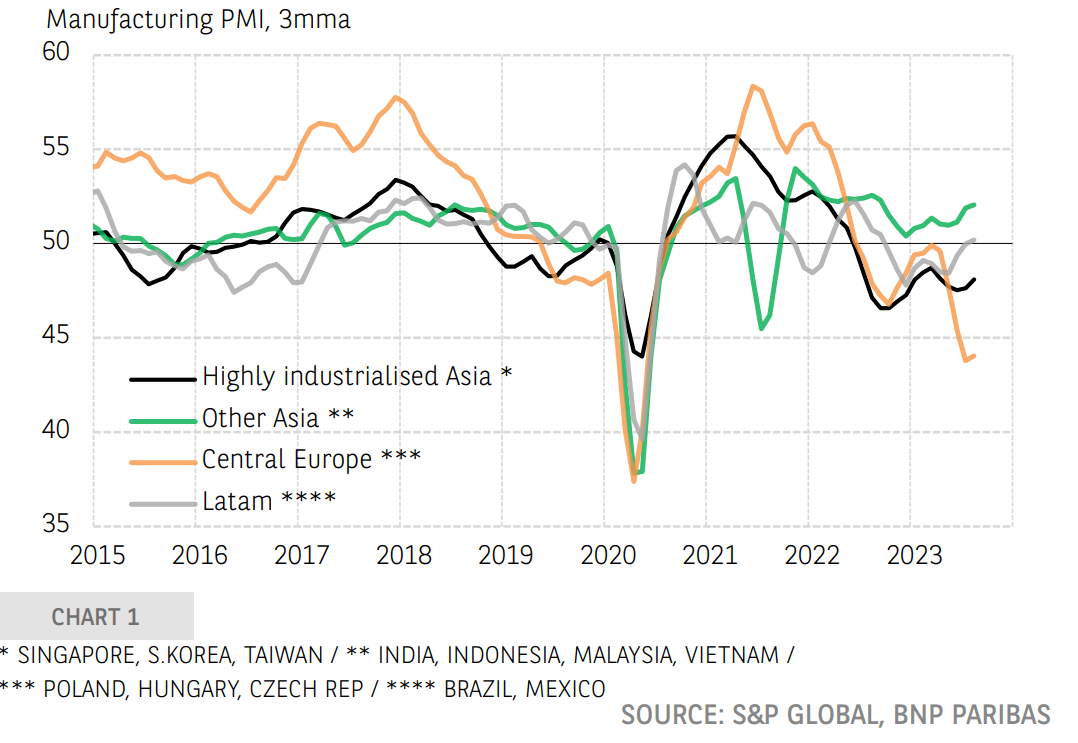

Growth in emerging countries held up quite well in H1 2023, thanks to countries in Asia, Brazil and Mexico. In Asia, inflation returned to very moderate levels in August or September (with the exception of India) and, compared to other areas, monetary tightening between mid-2021 and mid-2023 was on a much smaller scale. This helped offset the drop in exports. However, Central European countries did not benefit from this offset effect. Business and household surveys indicate that disparities between areas became more pronounced over the summer. These surveys also show that the heavyweights in Latin America (Brazil, Mexico) are better positioned within the major EM regions.

Up until spring 2023, growth in emerging economies held up well overall, but disparities were significant. Measured year-on-year, real GDP growth in our sample of 26 countries accelerated sharply, reaching 5% in Q2 2023 after 3.3% in Q1 2023 and 2.6% in Q4 2022. Excluding China and Hong Kong, the acceleration is less marked (from 2.6% to 3.9%). On a sequential basis (i.e. quarter-on-quarter and annualised), economic growth, excluding China and Hong Kong, was stable at 4%. In Q2 2023, GDP fell for around a quarter of emerging economies (either y/y or q/q).

Emerging countries: Business climate in manufacturing sector

Outside China, economic growth in Asia surprised on the upside in H1 2023. Growth was maintained at around 2% on a sequential basis in industrialised countries (Korea, Singapore, Taiwan) and was firmly sustained at between 5% and 7% in India, Indonesia and Malaysia.

Conversely, the main Central European economies experienced a recession or a stagnation, Hungary being the most affected with a drop in GDP over 4 consecutive quarters (-2.3% cumulative). Turkey is proving the exception in Europe, with growth boosted by accommodating monetary policy at the time.

The situation varies most widely in Latin America with, on the one hand, Brazil, where growth has surprised on the upside, and Mexico, where growth has held, and, on the other hand, economies that are in recession (Argentina and, to a lesser extent, Chile and Peru) or experiencing a very significant slowdown (Colombia).

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.