Elliott Wave View: Oil about to end short term 5 waves impulse [Video]

![Elliott Wave View: Oil about to end short term 5 waves impulse [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/clean-up-crude-oil-stain-27379325_XtraLarge.jpg)

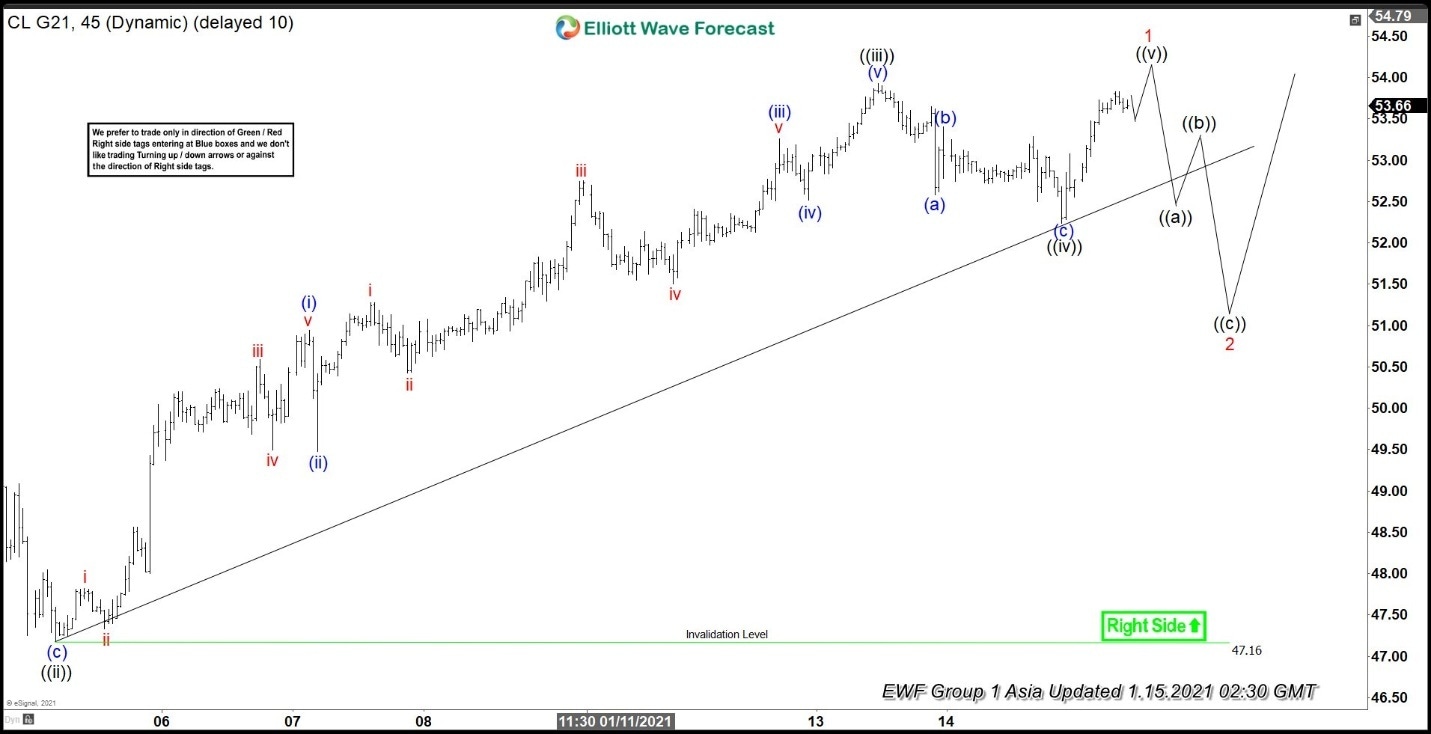

Elliott Wave structure of the rally in Oil from December 23, 2020 low is unfolding as a 5 waves impulse. Up from December 23 low, wave ((i)) ended at 48.62 and dips in wave ((ii)) ended at 47.18. The commodity then continues the rally higher in wave ((iii)) with subdivision as another impulse in lesser degree. Up from wave ((ii)), wave (i) ended at 50.94 and pullback in wave (ii) ended at 49.48. Wave (iii) ended at 53.26 and pullback in wave (iv) ended at 52.52. The last move higher in wave (v) ended at 53.93 which completed wave ((iii)).

Pullback in wave ((iv)) ended at 52.24 as a zigzag Elliott Wave structure. Wave (a) ended at 52.58, bounce in wave (b) ended at 53.4, and wave (c) of ((iv)) ended at 52.24. Expect Oil to end wave ((v)) of 1 soon with another marginal high. Afterwards, it should correct cycle from December 23 low in wave 2 before the rally resumes. Pullback should unfold in the sequence of 3, 7, or 11 swing and as far as pivot on December 23 low at 46.16 stays intact, expect pullback to find buyers and Oil to resume higher.

Oil 45 Minutes Elliott Wave Chart

CL G21 Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com