Elliott Wave view: EUR/USD seven swing rally [Video]

![Elliott Wave view: EUR/USD seven swing rally [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/iStock-919003044_XtraLarge.jpg)

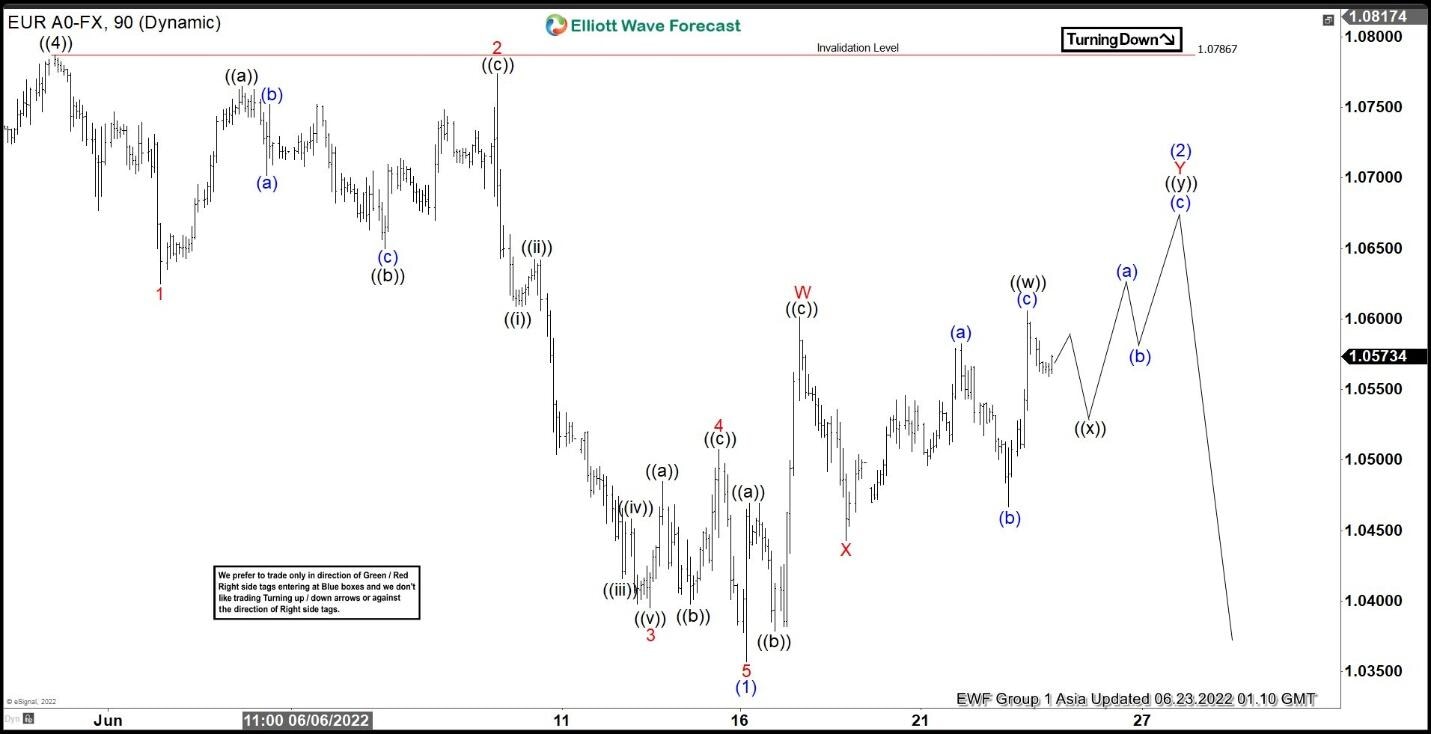

Short term Elliott Wave in EURUSD suggests rally to 1.078 ended wave ((4)). Wave ((5)) lower is currently in progress with subdivision as a 5 waves impulse Elliott Wave structure. Pair however still needs to break previous wave ((3)) low at 1.0348 on May 13, 2022 to rule out a double correction. Down from wave ((4)), wave 1 ended at 1.0625 and rally in wave 2 ended at 1.0774. Pair then resumes lower in wave 3 towards 1.0395, and rally in wave 4 ended at 1.0508. Final leg lower wave 5 ended at 1.0357 which also completed wave (1) in higher degree.

Wave (2) rally is in progress to correct cycle from 5/31/2022 high before the decline resumes. Subdivision of wave (2) is unfolding as a double three Elliott Wave structure. Up from wave (1), wave ((a)) ended at 1.0469 and pullback in wave ((b)) ended at 1.0379. Wave ((c)) higher ended at 1.0601 which completed wave W. Pullback in wave X ended at 1.044 and pair can extend higher in wave Y of (2) now towards 1.069 – 1.0746 area before the decline resumes. Near term, as far as pivot at 1.078 holds, expect rally to fail in 3, 7, 11 swing for further downside.

EUR/USD 90 minutes Elliott Wave chart

EUR/USD Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com