Elliott Wave View: Bitcoin should continue to extend higher [Video]

![Elliott Wave View: Bitcoin should continue to extend higher [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Bitcoin/bitcoin-64028817_XtraLarge.jpg)

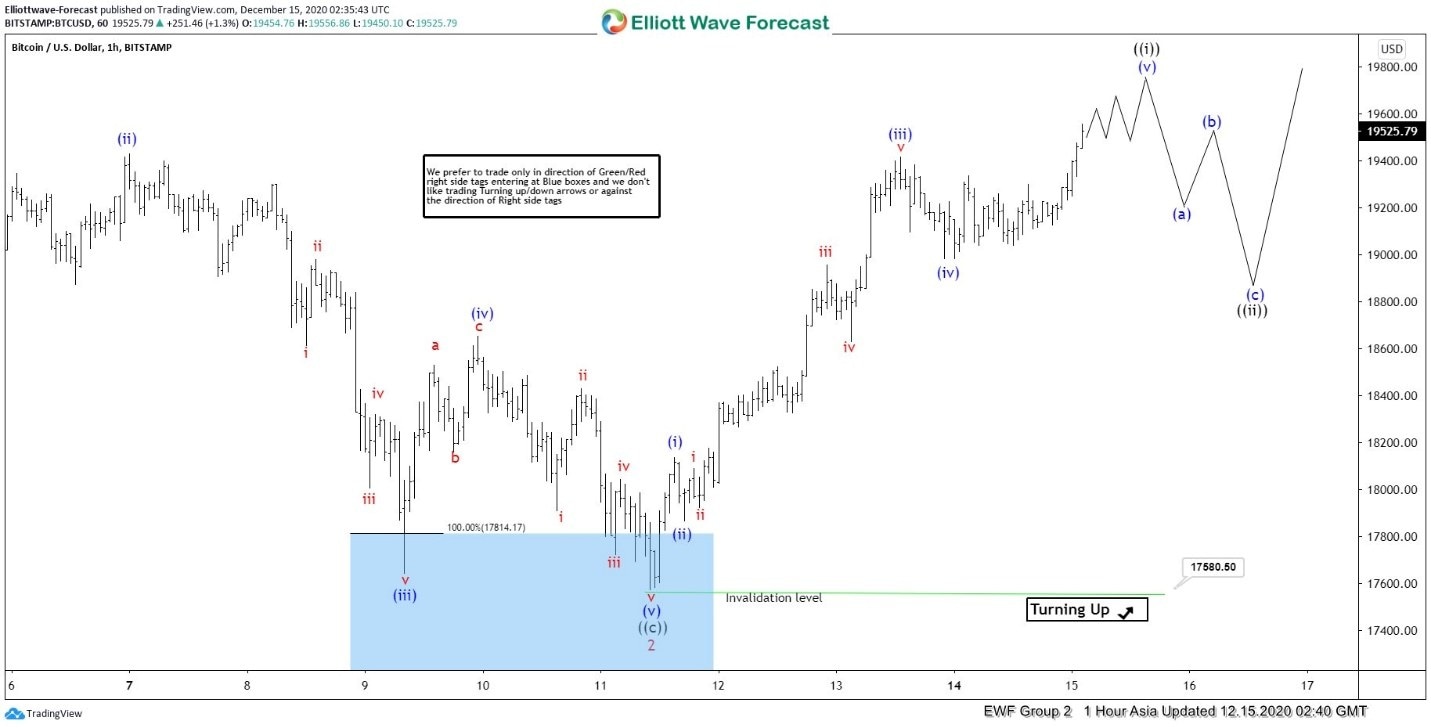

Cycle from November 26, 2020 low in Bitcoin remains in progress as a 5 waves impulsive Elliott Wave structure. Up from November 26 low, wave 1 ended at 19918 and pullback in wave 2 ended at 17580.5. Internal subdivision of wave 2 unfolded as a regular flat. Wave ((a)) ended at 18100, wave ((b)) ended at 19621 and wave ((c)) of 2 ended at 17580.5.

Wave ((c)) of the flat correction ended at the 100% – 161.8% extension of wave ((a)), as indicated with the blue box. Since then, Bitcoin has started to turn higher from the blue box in wave 3. Up from wave 2 low at 17580.5, wave (i) ended at 18136.33 and dips in wave (ii) ended at 17865.21. The crypto currency then resumed higher in wave (iii) towards 19416.64, and pullback in wave (iv) ended at 18979.21. Expect the crypto currency to end wave (v) soon with a few more high and this should complte wave ((i)) of 3 in higher degree.

The crypto currency should then pullback in wave ((ii) to correct cycle from December 11 low before the rally resumes. As far as wave 2 pivot low at 17580.5 low stays intact, expect dips to find support in 3, 7, or 11 swing for more upside.

Bitcoin 60 Minutes Elliott Wave Chart

Bitcoin Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com