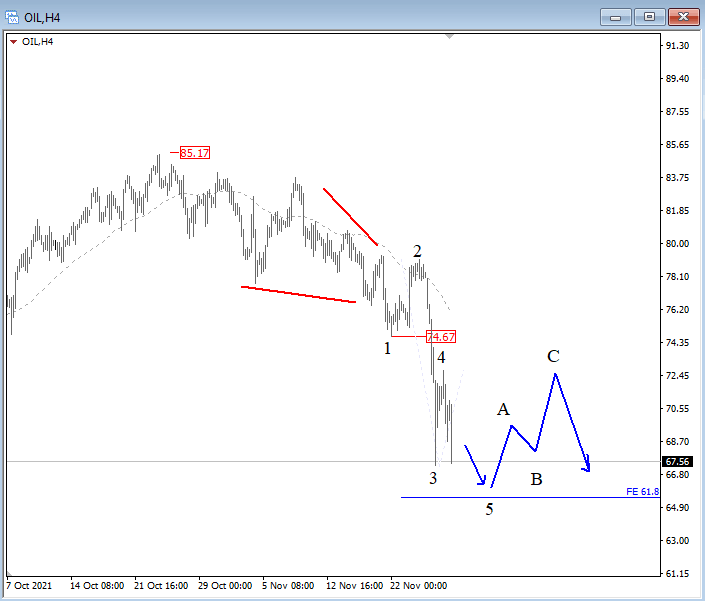

Elliott Wave analysis: Crude oil eyes down to 60 level

Crude oil is lower, firstly after the US announcement about the release of oil reserves, and now also on worries about the new covid variant, that can bring new lockdowns across the globe. As such, OPEC may take a cautious approach to oil demand at the meeting this week.

Crude oil is sharply down in the 4-hour chart, ideally unfolding and finishing a five-wave cycle within wave A), so seems like a higher degree A)-B)-C) correction is now in progress on a daily chart that can send the price back to 60 support area, just be aware of an A-B-C corrective recovery in wave B).

Crude oil 4h Elliott Wave analysis

Check more of our analysis for currencies and cryptos in members-only area. Visit Wavetraders for details!

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.