ECB Special Meeting Preview: Three potential EUR/USD movers to watch

- The ECB will likely move toward a more symmetric inflation target, and that is already priced in.

- Including housing in price rise calculations could boost the euro.

- Leaning toward employment and inequality goals could weigh on the common currency.

As Euro 2020 is being played in 2021, the European Central Bank's strategic review planned for last year is being fought out only now – and it could have consequences for EUR/USD.

Modeled after the German Bundesbank, the ECB has had a "single needle in its compass" – a sole mandate of preserving price stability, without taking employment into account, as the Fed does. Moreover, the Frankfurt-based institution's target of "below, but close to, 2%" is more hawkish than most other central banks. That is about to change.

ECB President Christine Lagarde has reignited efforts to conclude the strategic review she initiated early in 2020 and it might be concluded as soon as July 8. The gap between northern hawks and southern doves remains intact, but the bank could still forge a new, market-moving vision.

Here are three things to watch out for, and how they could move the euro.

1) Symmetric inflation target

By dropping a single word, "below," the ECB would be sending a signal that it does not see 2% annual headline inflation as a ceiling, but rather as a more symmetric target. Will Europe take a page from America? The Fed went further by allowing future, hot inflation to compensate for past weakness. That would probably be a step too far for the German hawks.

However, changing the language to target "around 2% inflation" would serve as a logical compromise. Would that push the euro down? Probably not, as markets have been anticipating such a change toward price targets of other central banks.

An upside surprise for the euro would be leaving the current language unchanged, while the euro could fall in the unlikely chance the ECB would let inflation overheat.

At the moment, price rises have barely hit the 2% target in May, and only thanks to base effects – falling inflation around this time last year, at the peak of the pandemic. The headline Consumer Price Index dropped back to 1.9% in June.

Source: FXStreet

2) Including housing?

Another important topic on the ECB's agenda is changing the formula of how inflation is calculated. The bank's CPI excluded prices of homes, which are seen as an investment rather than a consumer good. However, the cost of dwellings cannot be brushed off as prices across the continent are rising.

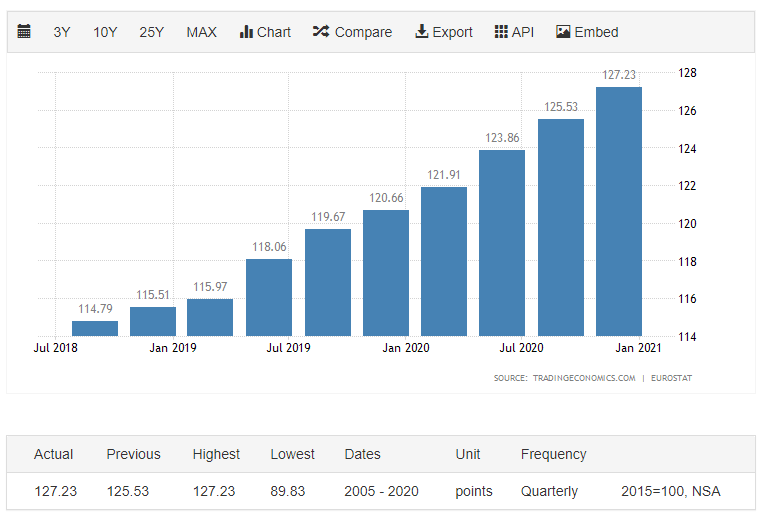

As the chart below shows, house prices have risen by 5.4% in 2020, despite the pandemic. That far exceeds other costs, even though it is lower than double-digit increases in the US:

Source: Trading Economics

If the ECB opts to use housing as part of its new formula – even if consisting of only a minor portion – it could push overall inflation higher. That means that the bank would be quicker to withdraw its accommodative policies. Printing fewer euros and eventually hiking interest rates could boost the common currency.

3) Unemployment and inequality

In recent years, the ECB has become more concerned about the impact of its policies, including potentially contributing to wider wealth gaps. Quantitative Easing (QE) is blamed for enriching those who already had substantial capital while others do not benefit.

Moreover, populists have been gaining traction and mainstream politicians have adopted the stance of helping protect those left behind. The bank cannot brush off such concerns and may begin the process of incorporating unemployment into targets.

While a full adoption of the Fed's dual mandate – price stability and full employment – is unlikely, any push toward taking labor into account could weigh on the common currency. Why? It would means lower interest rates for longer in order to allow everybody to "level up."

What about climate change? Environmental issues are high on ECB President Lagarde's agenda. The bank could adopt a policy of favoring cleaner companies when buying corporate bonds and shying away from others. However, forex traders would be wise to dismiss any such headlines, as they are unlikely to impact the common currency.

Conclusion

The ECB's strategic review could have long and short-term impacts on the euro's direction. While a symmetric inflation target is priced in, changes to the CPI formula and taking unemployment into account would have an impact on the euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.