ECB preview: Will the ECB deliver a hawkish cut?

The ECB is expected to cut interest rates by 25 basis points on Thursday, the first time interest rates will have been cut in the currency bloc since 2019. There is currently a 99% probability of a cut priced into the Eurozone swaps market. When a rate cut is so anticipated, the focus shifts to what comes next.

Shifts in ECB expectations

As we lead up to this meeting, there has been a recalibration of rate cut expectations for the ECB. There is only a 12% chance of a back-to-back cut in July, and the probability of rate cuts in September and December have been scaled back in recent days. There is now a 62% chance of a cut in September and a 54% chance of a cut in December. Even though the ECB is expected to cut rates on Thursday, this could be considered a hawkish cut, as the market expects the ECB to tread carefully when it comes to future rate cuts.

There is currently less than 2.5 rate cuts expected from the ECB this year, this is down from 3 rate cuts that had been expected in recent weeks. As you can see in the chart below, rate expectations for December have been rising sharply since January. The market now expects rates in the currency bloc to end the year at 3.27%, in January, this had been just above 2.2%. The outcome of this meeting will determine if longer term rate expectations continue to creep higher, or if they stabilize at this level.

Chart: Eurozone swaps market expectation for December 2024 interest rates

Source: XTB and Bloomberg

ECB staff forecasts

The ECB will also release their updated macroeconomic forecasts at this meeting. These will be worth watching because the inflation rate ticked higher in May. Back in March, the last time the staff forecasts were updated, the ECB expected inflation to fall sharply in the coming years. Inflation was expected to be 2.3% in 2024, before falling further to 2% in 2025, and 1.9% in 2026. However, the inflation rate ticked up from 2.4% in April to 2.6% in May, which suggests that price pressures are moving in the opposite direction of the ECB’s most recent forecasts. Added to this, price pressures may persist. For example, negotiated wage growth in the Eurozone rose by 4.7% in Q1 from 4.5% in Q3. Wage growth may persist since the unemployment rate in the Eurozone fell to a record low of 6.5% in Q1. This suggests that tightness in the Eurozone labour market could keep upward pressure on inflation down the line.

Thus, we could see the ECB upgrade their inflation forecasts for this year and next. If this happens, then we may see a further recalibration of ECB rate cuts in the coming days, with cuts pushed further out into the future.

Lagarde tries to find a path that pleases all of the ECB

A number of ECB members have voiced concern about inflation pressures and the risk of cutting rates too far when inflation pressures remain, for example the heads of the German and the Austrian central banks. However, there is some pressure to cut rates at a faster clip. The Bank of Italy governor said on Tuesday that prompt, gradual cuts could avoid ‘tardy, hasty ones later’. The contrasting stances between some ECB members makes the outlook for policy harder to gauge. We shall see if ECB President Lagarde can find a path that suits all members at this Thursday’s meeting.

Europe against the US

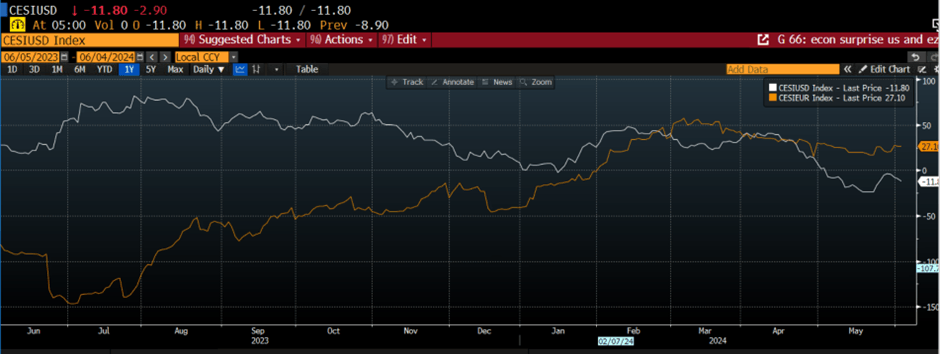

Overall, we think that Lagarde will need to tread a more cautious path when it comes to future rate cuts. Not only are inflation pressures rising, but economic data has also ticked higher. The chart below shows the Citi economic surprise index for the US and the Eurozone (orange line). This chart shows that since the start of May, US economic data has surprised on the downside more often than European economic data. There are growing signs that the US economy is weakening sharply, the Atlanta Fed GDPNow model is predicting Q2 GDP growth for the US to be 1.8%, down from 2.7% a week ago. With US economic data underperforming the Eurozone, the market may have to readjust its view that the ECB will cut rates more frequently than the Fed this year. If this occurs, then we may see two things happen: 1, rate cuts for the Eurozone get pushed further into the future and 2, upward pressure on the euro.

Chart: Eurozone and US economic surprise index

Source: XTB and Bloomberg

The market impact of this meeting

EUR/USD has traded in a tight range in recent weeks, between $1.08 and $1.09, if the ECB upgrades their inflation forecasts then we could see the market test the $1.09 level and target $1.10. Stocks may also get hit. There has been a risk-off tone to markets this week as election surprises from Mexico and India dented sentiment towards global risky assets. A hawkish ECB could add to the downward pressure on risk assets. Italian stocks could be vulnerable, as higher interest rates in the currency bloc could hurt the most indebted members. Added to this, interest rate sensitive sectors in the Eurostoxx 600 index such as real estate and consumer discretionary stocks could also come under pressure.

Overall, the ECB may shift to a more hawkish stance at this meeting, and a rate cut could be a one-off. The market has already reduced its expectations of ECB rate cuts for the rest of the year, but there could be further to go if the ECB staff forecasts revise inflation higher and if Christine Lagarde does not signal more rate cuts are in the picture for 2024.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.