ECB February Preview: Euro bulls hope for a hawkish ECB on hot EU inflation

- EUR/USD has been rising steadily since the beginning of the week.

- Annual HICP in the euro area came in much higher than expected in January.

- Euro could lose its bullish momentum if ECB downplays inflation concerns.

The shared currency suffered heavy losses against the dollar last week after FOMC Chairman Jerome Powell confirmed the Fed’s hawkish stance in the face of high inflation. Following a sharp decline to its lowest level since June 2020, however, EUR/USD managed to stage a decisive rebound during the first half of the week and advanced beyond 1.1300.

In addition to renewed dollar weakness, hot inflation data from the euro area helped the pair push higher mid-week. Eurostat reported that annual inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), rose to 5.1% in January from 5% in December. This print came in higher than the market expectation of 4.4%. The Core HICP, which excludes energy, food, alcohol and tobacco prices, edged lower to 2.3% from 2.6% but surpassed analysts’ estimate of 1.9%.

With the first FOMC meeting out of the way, markets now await the European Central Bank’s (ECB) policy announcements and the euro could find it difficult to extend its rebound if investors are reminded of the policy divergence between the Fed and the ECB.

ECB on hold

The ECB is widely expected to leave its policy settings unchanged following the February policy meeting. In December, the ECB confirmed that it will end the Pandemic Purchase Emergency Programme (PEPP) in March. To soften the policy transition, the ECB announced that it will increase the monthly purchases under the Asset Purchase Programme (APP) to €40 billion in Q2 and €30 billion in Q3 from the current level of €20 billion. The bank intends to maintain the APP purchases at a pace of €20 billion for “as long as necessary” from the last quarter of the year.

While speaking at the press conference in December, ECB President Christine Lagarde refrained from dismissing the possibility of a rate increase before the end of 2022 and helped the common currency stay resilient against its rivals for the remainder of the year.

Commenting on the inflation outlook earlier in the month, several ECB members sounded relatively optimistic and EUR/USD struggled to preserve its bullish momentum. ECB policymaker Peter Kazimir noted that inflation in the eurozone was expected to peak in the “nearest months” before starting to decline. Moreover, ECB chief economist Philip Lane said that they are not yet seeing a big response from wages to inflation. Similarly, Lagarde explained that energy costs were rising due to temporary factors and added that there were no signs of wages being “bid up.”

Hawkish scenario: In case Lagarde hints at the possibility of a rate hike before the end of the year after the latest inflation report, that could be assessed as a hawkish tilt in the ECB’s policy outlook and provide a boost to the euro. Currently, eurozone money markets are pricing in 30 basis points of rate hikes by the end of the year.

Dovish scenario: Lagarde might opt to communicate that inflation is close to peaking in the eurozone and outright reject a rate hike in 2022 while pushing back against market rate-hike bets. Lagarde might also mention that they don’t need to normalize the policy as fast as the Fed by highlighting the differences in economic conditions in the US and the EU.

Neutral scenario: Given the fact that the ECB will not release its revised economic projections until March, it would be surprising to see an obvious shift in the ECB’s tone. The accounts of the ECB’s December meeting revealed that policymakers are divided over the inflation outlook and February's policy statement is unlikely to touch on that. The ECB should reiterate that it stands ready to act if inflation becomes persistent in the euro area and that it remains committed to ensuring price stability.

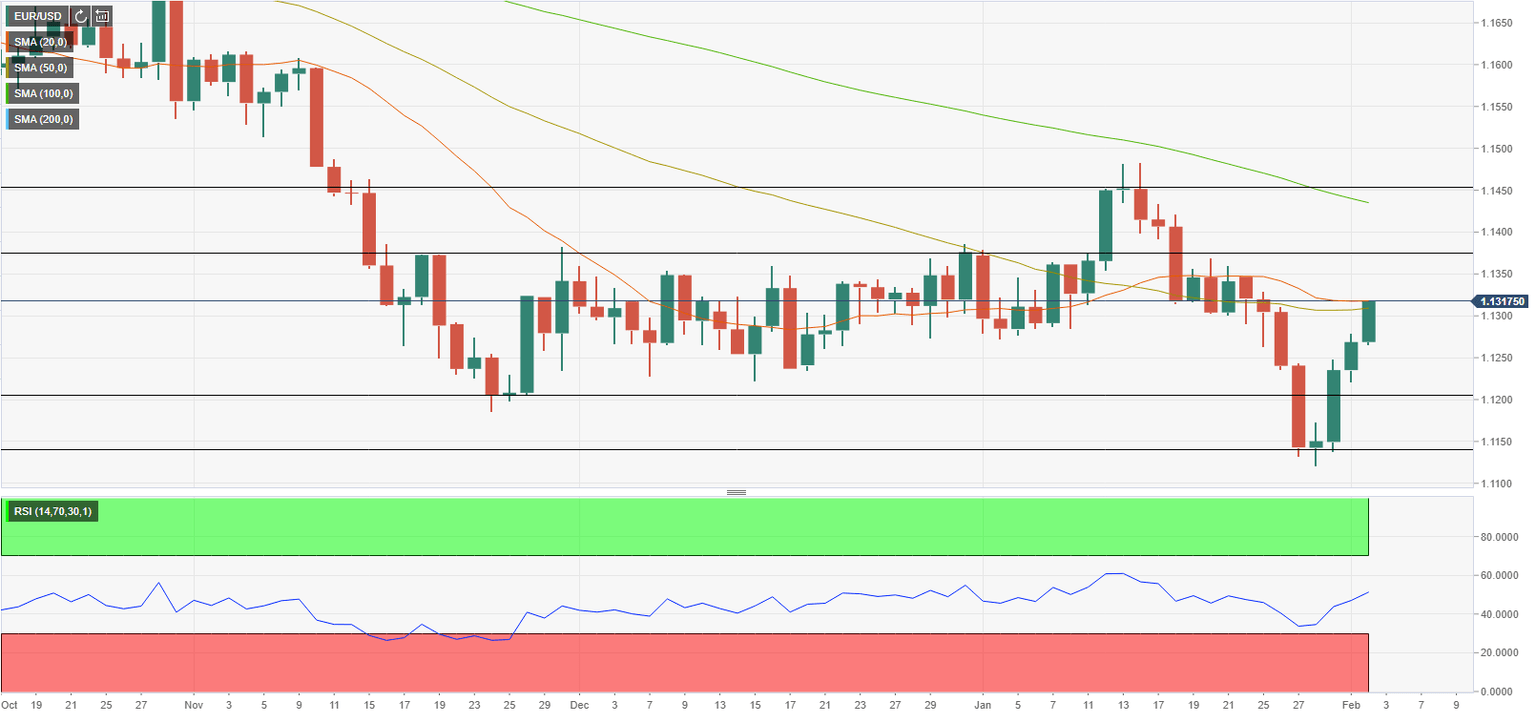

EUR/USD Technical Analysis

Unless the ECB delivers a hawkish surprise, the policy divergence between the Fed and the ECB should continue to favour the dollar over the euro and limit EUR/USD’s upside.

At the time of press, the pair was trading near 1.1300, where the 20-day and the 50-day SMAs are located. In case EUR/USD starts using these levels as support, it could target the next static resistance at 1.1375 ahead of 1.1430 (100-day SMA).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart stays near 50, suggesting that the pair needs to push higher to convince investors that the latest advance is the beginning of an uptrend rather than a correction.

On the flip side, a dovish ECB statement could attract bears and cause the pair to slide toward 1.1200 (psychological level, static level). If this support fails, EUR/USD could touch a fresh 19-month low at 1.1100.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.