ECB delivers another 25 bp cut

The ECB (European Central Bank) continued policy normalisation today, with another 25 basis points (bps) worth of cuts across all three benchmark rates. This marks the fourth consecutive rate reduction, bringing the Deposit Facility Rate, the Refinancing Rate, and the Marginal Lending Facility Rate to 2.75%, 2.90%, and 3.15%, respectively.

Frankly, I was not expecting fireworks from this week’s policy meeting. Unless I missed something, aside from Governing Council Member Robert Holzmann talking up a possible pause, most Members favoured further easing.

However, one strikingly apparent fact we can garner from today’s meeting is that the ECB intends to continue lowering rates – quite a divergence from the wait-and-see approach the US Federal Reserve has adopted, and one that could weigh on the EUR/USD currency pair (euro versus the US dollar).

The accompanying rate statement reiterated the central bank’s meeting-by-meeting approach and acknowledged that monetary policy remains in restrictive territory. This emphasises the possibility of further easing this year and aligns with market forecasts. As of writing, investors are pricing in another three 25 bp rate cuts, with a reduction on the table for the next meeting in March.

Disinflation process well on track

The ECB appears content with the current progress on inflation, underscoring that the ‘disinflation process is well on track’ and that price pressures are ‘set to return to the Governing Council’s 2% medium-term target in the course of this year’.

The CPI inflation (Consumer Price Index) report for December 2024 revealed an ‘expected’ uptick in the headline year-on-year (Y/Y) measure to 2.4% from 2.2% in November amid base effects; core Y/Y inflation held steady at 2.7%, and services inflation nudged higher to 4.0% from 3.9%.

Economy still faces headwinds

Regarding GDP growth data (Gross Domestic Product), the ECB underscored that the ‘economy is still facing headwinds’ but believes a recovery will be seen over time, reinforced by ‘rising real incomes and the gradually fading effects of restrictive monetary policy’. During her press conference, ECB President Christine Lagarde emphasised that risks are ‘tilted to the downside’ for the eurozone economy and ‘is set to remain weak in the near term’. This follows GDP data showing the eurozone stagnated in Q4 24, recording 0.0% growth versus the market’s consensus of 0.1% expansion. We also saw contractions in GDP numbers from France and Germany.

Consumer confidence is weighing on sentiment here, influenced by the possibility of a trade war escalation between Europe and the US. Lagarde noted: ‘Greater friction in global trade could weigh on euro area growth by dampening exports and weakening the global economy’.

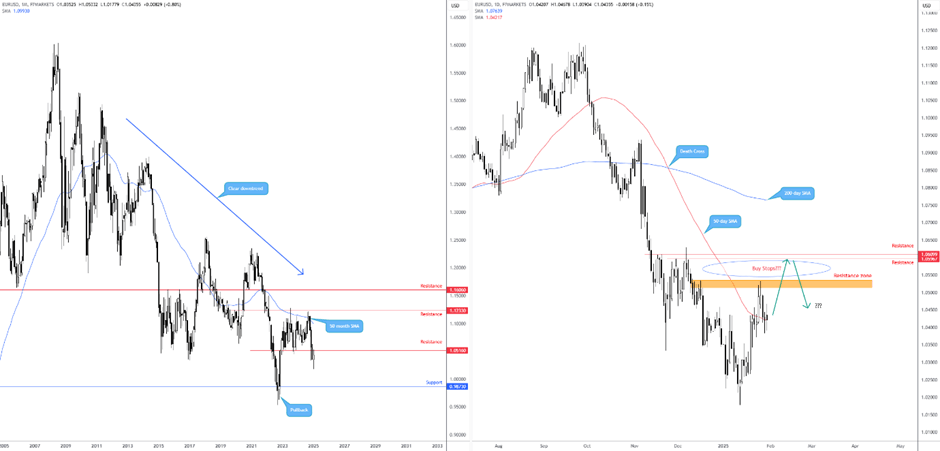

Downside risks for EUR/USD; parity eyed

I have highlighted in several posts the importance of where the EUR/USD is trading on the bigger picture. As evident from the monthly chart below, the currency pair is trending southbound and found resistance from the underside of the 50-month simple moving average (SMA) at US$1.0992 in Q4 24. Subsequently, further underperformance led price action south of support from US$1.0516, currently serving as possible resistance. If this level holds ground, parity calls for attention, closely shadowed by another layer of support at US$0.9873.

Meanwhile, buyers and sellers have been squaring off around the 50-day SMA at US$1.0422 on the daily chart. This is a particularly interesting timeframe, as resistance around US$1.0536-US$1.0514 also recently entered the fight. As for current movement, trading appears difficult unless you are a fan of playing ranges (potentially between the 50-day SMA and the noted resistance area). Nevertheless, a breakout beyond current resistance could be a move larger traders fade from resistance at around the US$1.06 level for three primary reasons: the liquidity (buy stops tripped) above resistance at US$1.0536-US$1.0514, and, of course, the downtrend and monthly resistance in play at US$1.0516.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,