ECB cuts pave the way to higher term risk premia

Historically, before QE, higher policy rates have corresponded to lower term premia and incoming rate cuts would therefore be conducive to higher premia. Going forward, QT should have a large enough impact to revive the term risk premium back to positive territory. But currently, the inverted curve points at poor reward for taking on duration.

Rate cuts can actually increase the term premium for Euro rates

Historically, before quantitative easing (QE), higher policy rates have corresponded to lower term risk premium and the incoming rate cuts should therefore be conducive to higher premia. The term risk premium is defined here as the expected difference between the yield on a longer-dated bond (e.g., 10y Bund) and the expected future short rates (i.e., policy rate). We argue that the monetary policy stance is not only a determinant of future rate expectations, but it also impacts the term risk premium. Since QE, the correlation between the policy rate and term risk premium broke down, as can be seen in the chart, but with quantitative tightening (QT) gaining ground, the relationship will be restored.

Before QE, lower policy rates corresponded with higher term risk premium

One channel through which higher policy rates translate to lower risk premia is through the hedging value of bonds in a diversified portfolio. Higher policy rates give central banks more room to cut rates and push the yields down through the expectations of the future rates path. This means bonds have higher potential gains in price if a recession were to materialise, which would then offset losses on risky assets (e.g. equities). This strong hedging potential raises demand and compresses the term premium. For lower policy rates and during recessions, the room for central bank cuts is limited, reducing bonds’ hedging potential and thereby widening the term risk premium.

With the European Central Bank set to cut rates this week, the first step to reviving the Bund term risk premium will be taken. For a material increase in the term risk premium, we would likely need a bit more than 25bp – but with 75bp of cuts still pencilled in by our economist by year-end, this should help the term premium up. At the risk of committing econometric crimes, an estimate of the term premium increase from 75bp of cuts can be estimated using the coefficient on the 1y yield in the excess return model further down. The coefficient is -0.15, which means that a 50bp lower 1y yield by the end of 2024 would translate to a 10y term premium increase of 8bp.

If, however, the Federal Reserve remains on hold while the ECB starts cutting, the upside potential of the Bund term risk premium could be limited. The strong correlation of global risk premium means that diverging central banks can limit the room for the term premium to widen in the short term.

The current 10y Bund yield is around 2.6%, close to the expected future short rates and thus even a moderate increase of the term premium could push yields higher. Our economist estimates a terminal ECB policy rate of 2.5% and the 2Y1M forward also sees the policy rate settling around that level. From these numbers, the term premium must be close to zero given that the 10y yield is almost equal to these long-term short rate expectations. This means that outright 10y yields could even end the year higher despite cuts.

QT is the elephant in the room and will increasingly have more impact

When it comes to more structural effects on the term risk premium, the current QT following from QE is the elephant in the room. QE has had two effects. First of all, it has reduced the supply of bonds, acting to compress the term premium. The chart below shows how, since 2014, the ECB purchasing programmes have kept the term premium suppressed by lowering the amount of outstanding government debt. But the net supply is at a turning point and is increasing again.

QT and high debt issuance now a positive effect on term risk premium

Ongoing QT will have a large enough impact to revive the term risk premium back to positive territory. The large ECB balance sheet will continue to dampen the term risk premium, but with the ongoing normalisation, we should see excess liquidity come down significantly by 2025 and 2026. QE unwind has the potential to add another 50bp of term premium over the coming two years.

Even after a full unwind of central bank balance sheets, we do not expect the term risk premium to make a return to the pre-QE historical average of 1.9%. The introduction of QE as a tool of itself means that investors know that central banks are willing and able to drive up the price of bonds during recessions, which increases the hedging value in diversified portfolios, thereby increasing structural demand and deducing the term risk premium.

The inverted curve is a bad omen for holding duration

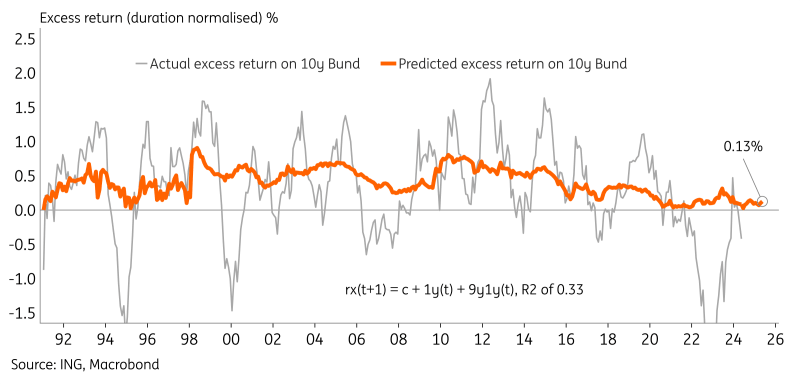

But until monetary policy starts normalising, the current inverted yield curve points at poor reward for taking on duration over a one-year horizon. The 1s10s slope alone can predict excess returns on holding a 10y Bund versus the 1y short rate with an R2 of 0.18. A more elaborate model based on the 9y1y forward rate and 1y short rate shows even better predictability of excess bond returns with an R2 of 0.33 based on data going back to 1990 (see figure below). This model estimates that expected excess bond returns would be close to zero currently – well below the historical average of 0.4%.

Model using forward rates predicts close to historic lows for excess returns on 10y Bunds

Read the original analysis: ECB cuts pave the way to higher term risk premia

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.