Dow Jones Plummets Over 150 pts on Last Week of the Year

Stock markets continue being traded on the bear side on Tuesday despite the likely signing of phase one agreement next week.

The DAX 30 plummets 182.1 points or 1.37% dropping to 13,126.5 points, whereas the French index CAC 40 only moves 3.9 points or 0.06% to 5,977.6 points, and Euro Stoxx 50 drops 41.2 points or 1.09% touching the 3,738.4 points.

The declarations made on Monday by the commercial advisor of the White House, Peter Navarro, on the probable signing of the agreement of phase one of the United States and China next week, were not enough to support the optimism on traders.

This Monday, Dow Jones plunged over 150 points, closing at 28,478 points.

Technical Overview

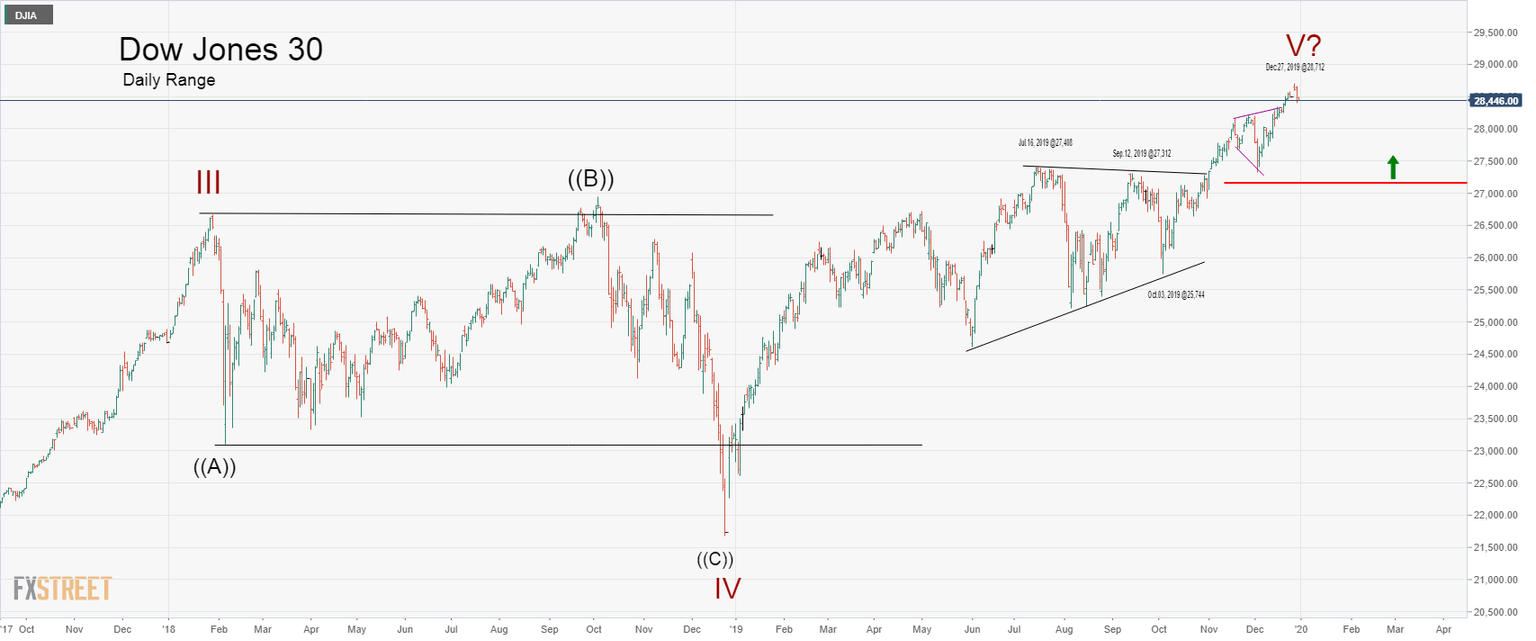

Dow Jones, in its daily chart, presents the retracement the price is developing after the last record high reached on December 27th at 28,712 points.

Although at a first look, it might be possible to think the Industrial Average could begin to develop an in-depth corrective process, the bias of the primary trend remains bullish as long as DJIA remains above 28,048 points.

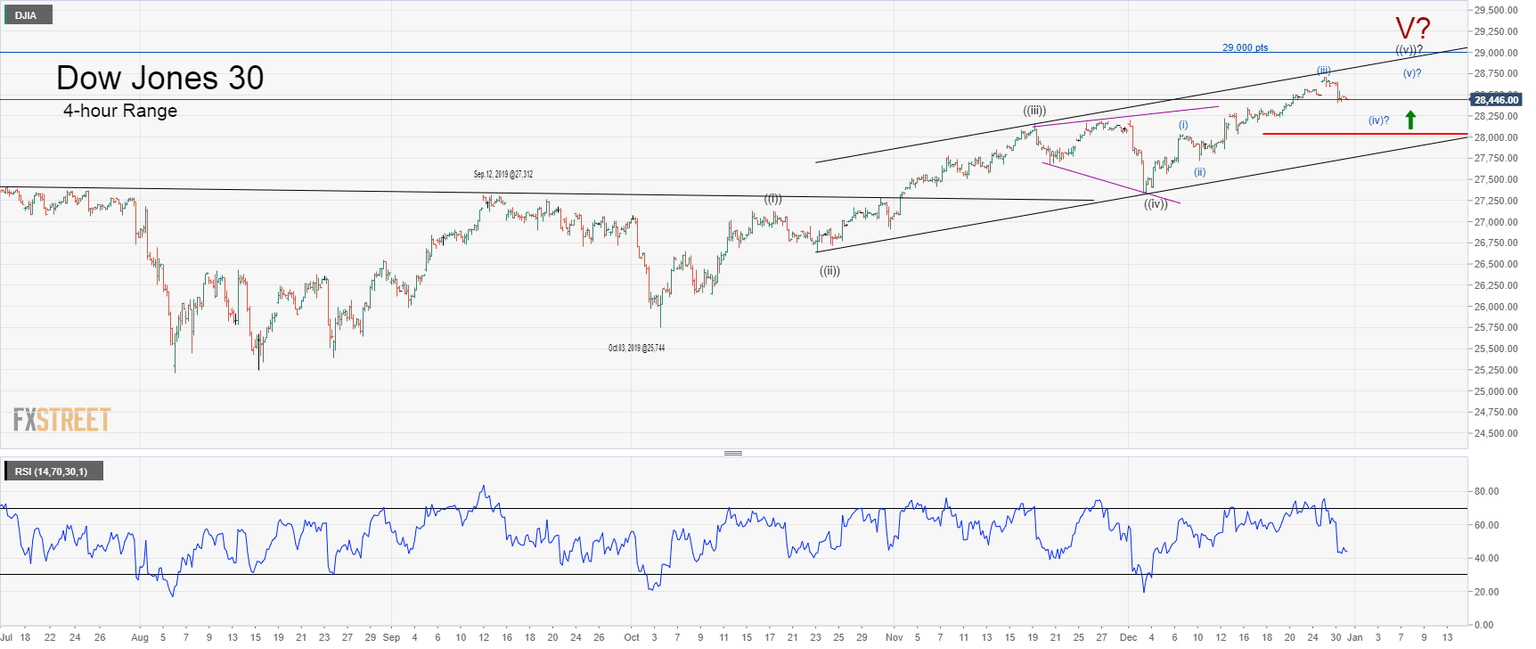

According to the Alternation Principle from the Elliott Wave Theory, the current move could most likely correspond to a wave (iv), labeled in blue.

This potential sequence in development could evolve as a complex wave because the last time, wave (ii) labeled in blue appeared as a simple correction, which was completed in a short time.

This scenario would be valid if the price of the Industrial Average holds above the 28,048 points.

Finally, the price action could carry the Dow 30 to exceed the upper line of the ascending channel, which is kept intact since October 3rd when the price found buyers at 25,744 points.

In conclusion, as long as the Dow Jones continues moving above 28,048 points, a new bullish movement making another new all-time high is possible for the Blue Chip average, before a more profound corrective sequence begins.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and