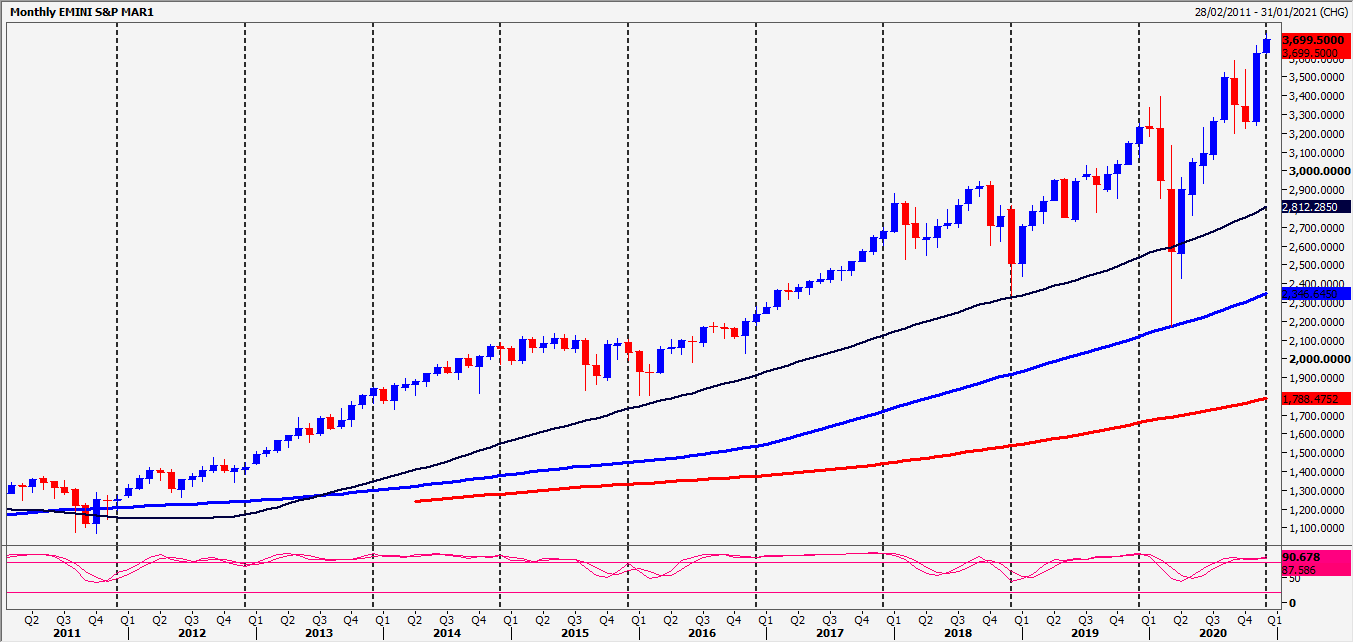

S&P 500: No sell signal

Emini S&P 500, Nasdaq, Emini Dow Jones

Emini S&P September started last week with a buy signal & gained another 70 points, reaching next targets of 4320/23 & 4340/45 on Friday. A new all time high at 4347.

Nasdaq September finally beat the next target of 14590/600 after a short consolidation in the bull trend hitting the next target of 14660/680.

Emini Dow Jones September consolidated at the start of last week allowing us to buy into longs at best support at 34130/100. This worked perfectly with a 600 tick bounce to the next target of 34500/510, then 34652 & as far as the June high at 34700 on Friday.

Today’s analysis

Emini S&P higher to the next targets of 4320/23 & 4340/45 as predicted.

No sell signal despite severely oversold conditions so we must assume the downside will be limited in the strong bull trend. First support at 4300/4295, 2nd support at 4270/65.

Nasdaq holding first support at 14460/440 to target 14550, 14590/600 & 14660/680. Further gains are expected to 14750/800 & 14940/990.

The downside should be limited in the strong bull trend. First support at 14610/580. Second support at 14510/470.

Emini Dow Jones September retests the June high for the September contract at 34700/720. A break higher targets.

Downside is likely to be limited with minor support at 34660/630 & again at 34460/430, best support at 34320/280. but longs need stops below 34200.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk