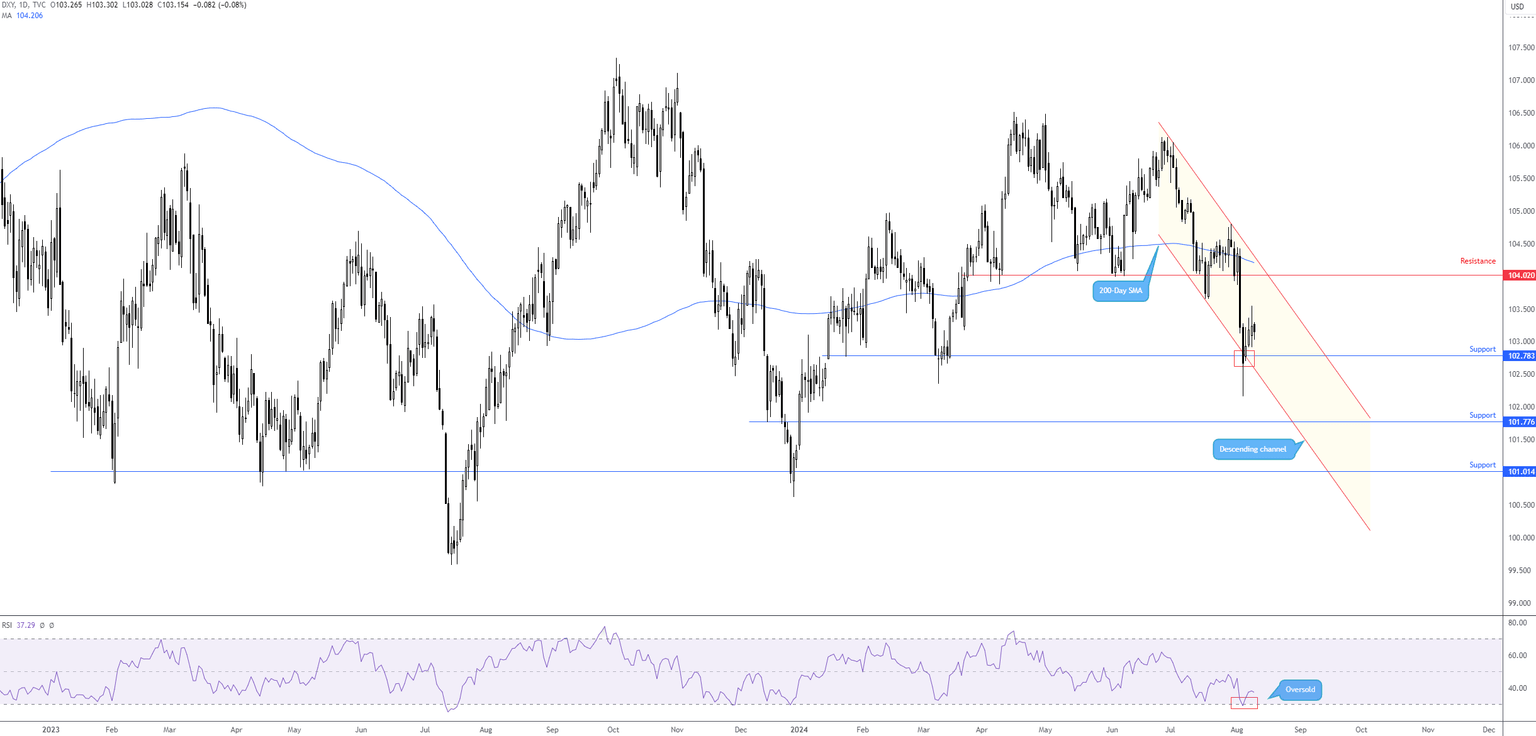

Dollar Index: Vulnerable support ahead of CPI inflation data

Ahead of this week’s CPI inflation print, the US Dollar Index has moderately bounced back from support at 102.78. Despite benefiting from additional channel support (taken from the low of 103.65) and the Relative Strength Index (RSI) recently shaking hands with oversold space (< 30.00), bullish resolve from the support has been uninspiring.

Lacklustre rebound from support

The lacklustre reply from support could be due to sentiment favouring bears; since topping at 106.13 in late June, sellers have dominated price action, pushing the unit through the 200-day Simple Moving Average (SMA) at 104.21.

Further downside?

Should bulls change gears and extend the pullback from support, resistance at 104.02 calls for attention. This base also shares chart space with channel resistance (extended from the high of 106.13), and the 200-day SMA underlined above. Alternatively, in light of the feeble response from current support and sentiment favouring downside at this point, breaching current support could be on the table this week, with the pendulum swinging in favour of reaching support from 101.78 and 101.01.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,