Dollar doldrums continue

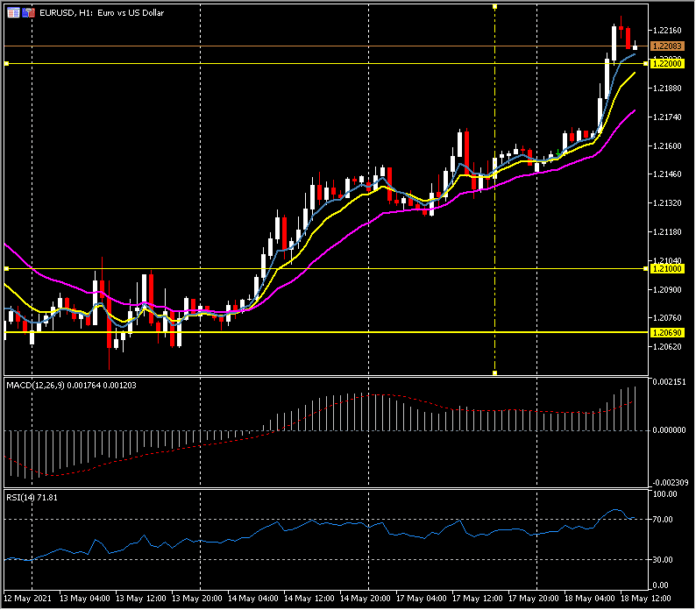

EUR/USD, H1

The Dollar has tracked lower, which shouldn’t be too surprising given the prevailing buy-in of the Fed’s transitory narrative on inflation alongside the fact that the US inflation rate is markedly higher versus peers, which imparts (all else equal) a weakening dynamic on the nominal value of the Greenback.

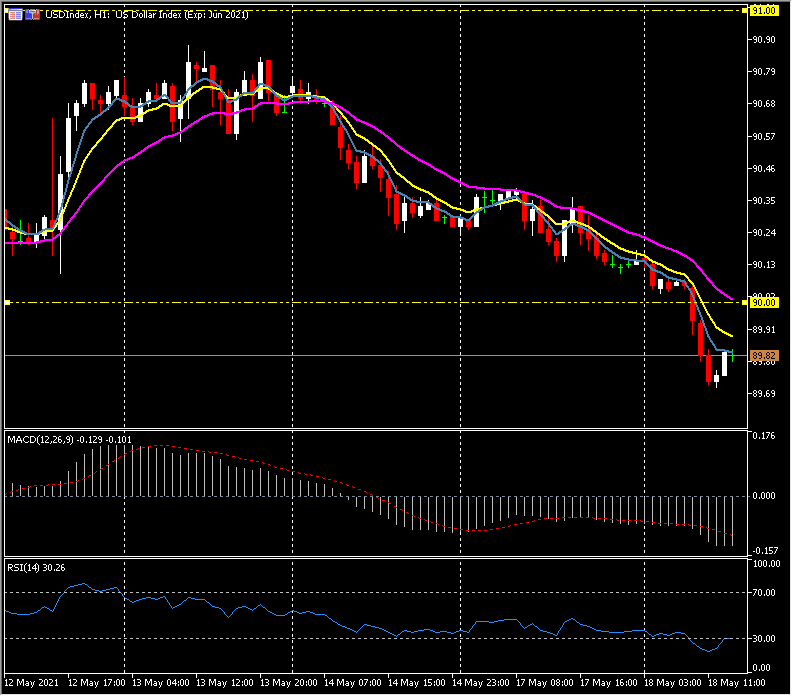

The USDIndex breached the trend lows that were seen before the release of the US CPI data last week, pegging a three-month low at 89.71. EURUSD concurrently posted a three-month high above 1.2220, USDJPY ebbed under 109.00 for the first time since last Wednesday and Cable poked over 1.4200.

With risk appetite returning in global asset markets, the dollar bloc and other cyclical currencies have been in outperforming mode. USDCAD tumbled to a six-year low at 1.2012, and CADJPY vaulted farther into 40-month high territory. The Canadian Dollar also edged out a three-day high versus the Euro, zoning in on 15-month highs. AUDUSD printed a six-day high at 0.7812. The biggest mover of the day, ahead of the US open, is the Kiwi, with NZDUSD rallying +0.72% from the open and 70 pips from yesterday’s low to break 0.7250.

Global stocks are up, as are base metal prices, though both asset classes remain comfortably below recent highs. Oil prices rallied over 1% in making 10-week highs.

Bitcoin steadied after yesterday crashing to below $42,000, which marked just over a one-third decline from the record high that was seen last month.

Ahead, the calendars in both Europe and North America are on the quiet side. Tomorrow’s release of the minutes from the Fed’s April FOMC meeting will interest given the inflation debate and heightened focus on monetary policy, though the meeting was obviously conducted before the data showing the spike in prices but weakness in job gains. The minutes can be expected to reflect the Fed’s prevailing guidance that there will be no tapering until “substantial further progress” is made on the employment and inflation goals.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c