Divided Fed cuts as expected

It was all about the Fed decision yesterday. As widely expected, the central bank lowered the target range to 3.50% - 3.75% in its final meeting of 2025, marking the third consecutive cut this year and representing a cumulative 175 bps since the Fed’s easing cycle began in late 2024.

While the rate reduction met widespread expectations, the decision was far from unanimous, with three dissents. Fed Governor Stephen Miran opted for a bulkier 50-bp cut and Kansas City Fed president Jeff Schmid voted to hold things steady – no surprises there. What did raise a few eyebrows, however, was Chicago Fed president Austan Goolsbee joining Schmid and choosing to hold steady (a 9-3 vote). You may recall that the last time there were three dissents at a Fed meeting was back in late 2019.

Frankly, I expected to see more dissent. Given recent divisions among Fed officials, I was watching for the possibility that more members might vote to hold rates – in effect, making a statement and pushing back the possibility of a Trump-influenced Fed. Yet without concrete data supporting such a stance, it proved difficult for the Fed to muster anything approaching unanimous conviction.

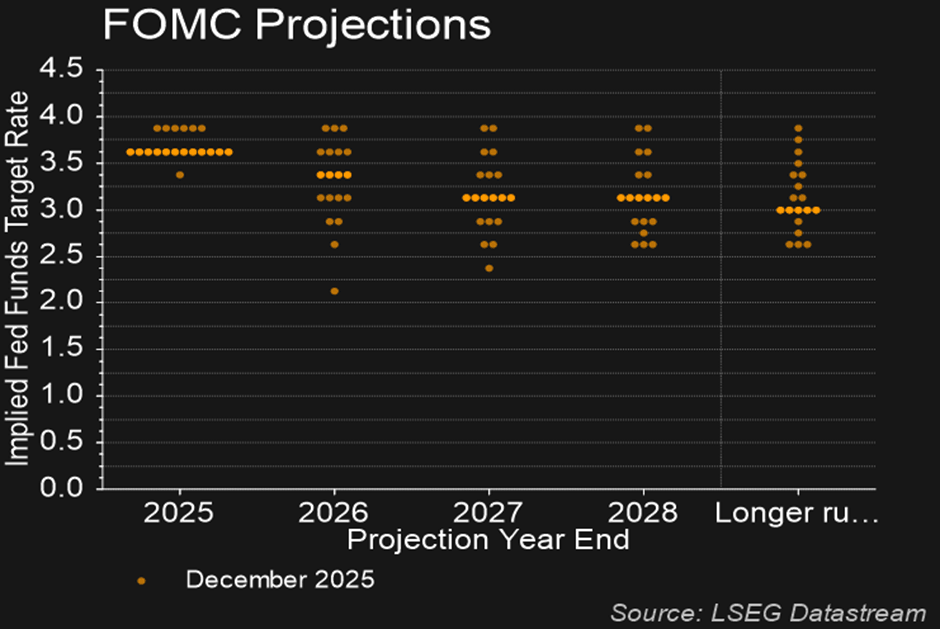

While we know that Schmid and Goolsbee voted to hold things steady, you will see from the Fed’s dot-plot below that an additional four members opted for no change in the target rate yesterday, offering a somewhat hawkish tilt to the meeting.

Fed projections: Stronger growth, lower inflation and unemployment

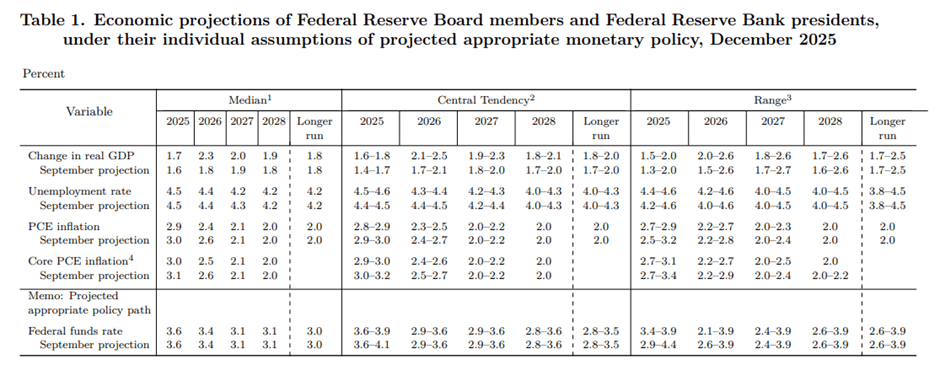

As shown in the table below, the Fed's updated Summary of Economic Projections (SEP) anticipates continued economic expansion, steady unemployment this year, followed by gradual improvement, and cooling inflation.

GDP is now expected to expand by 2.3% in 2026, revised up from September's 1.8% estimate. Fed Chair Jerome Powell attributed this revision to stronger productivity gains, potentially driven by AI advancements. However, he noted that ‘productivity has just been almost structurally higher for several years now’.

Unemployment is forecast to remain at 4.5% this year, then decline to 4.4% in 2026 and to 4.2% in 2027 and 2028.

Inflation is anticipated to ease to 2.9% at the headline YY level this year, from 3.0%, with price pressures further moderating to 2.4% in 2026 (from 2.6%). Core YY PCE inflation is also expected to ease this year to 3.0% (from 3.1%), and is estimated to cool to 2.5% next year (down from 2.6%). Both headline and core measures are forecast to return to the Fed's 2.0% target in 2026.

The Fed funds rate held steady, with one rate cut priced in for next year. However, markets are still pricing in two reductions (-55 bps).

Shorter-dated US Treasury yields eased slightly in the immediate aftermath of the announcement, with the USD Index also trading at lower levels. Stocks responded positively, with the S&P 500 rallying 0.7% and the Dow Jones Industrial Average surging nearly 500 points.

Thoughts ahead

While more members opted to hold rates steady and with recent forecasts showing GDP will grow next year, the pendulum is swinging toward further easing, I believe. With inflation expected to cool in 2026, a softening jobs market, and a new Fed Chair stepping into the fray mid-2026 – all of which are likely conducive to policy easing – I expect at least two cuts next year.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,