Deeply split Fed still poised to cut rates

The Federal Reserve begins a two-day policy meeting today, and it is widely expected to lower interest rates on Wednesday. Markets are currently assigning an 89.6% probability to a 25-basis-point cut. Officials are anticipated to reduce the central bank’s benchmark rate to bring down borrowing costs and help stabilize the weakening labor market.

This week’s key question is whether Powell can build enough agreement on the Fed to limit dissent. The most likely path would be a quarter-point rate cut, bringing the target range to 3.5% - 3.75%, paired with signals via the post meeting statement that further easing will face a higher bar. This “cut-and-cap” strategy would mirror how Powell wrapped up a series of three rate cuts in 2019 that similarly split the committee.

Powell steered the Fed toward rate cuts in September and October after concluding that the labor market was softening and the feared tariff-driven surge in inflation had not occurred, an assessment that could also justify another cut this week. Still, resistance remains up to five of the 12 voting members of the policy committee, and 10 of the full 19-member group, have said publicly they do not see a convincing case for further easing. Yet only one of them formally dissented from October’s cut, while another governor dissented in the opposite direction, favoring a bigger reduction.

Hawkish officials warn that too many cuts now could worsen inflation by next spring. With inflation still above target, a fed-funds rate near 4% “isn’t as restrictive as it might seem,” Dallas Fed President Lorie Logan said last month.

Dovish officials worry that delaying action until weakness is obvious could cause labor-market damage that is harder to repair. The job market is “vulnerable enough now that the risk is it’ll have a nonlinear change,” San Francisco Fed President Mary Daly said.

Investors are now focused on the Fed for signals about whether there will be additional rate cuts in 2026, though the outlook has become more uncertain after December’s “hawkish cut.” White House economic adviser Kevin Hassett, widely viewed as the leading candidate for the next Fed chair, has adopted a cautious stance, saying it would be “irresponsible” to lay out a six-month plan at this point.

The tougher challenge may be setting expectations for January, when officials will have data through December. For Powell, firmly signaling an end to cuts will be difficult without knowing whether that data will justify holding steady or force a quick reversal.

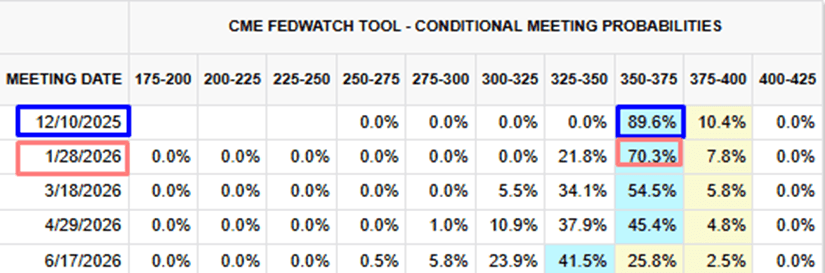

US Interest Rate Probabilities:

· US IR probabilities show about 89.6% and 70.3% rate cut in December and January, respectively.

Technical analysis perspective:

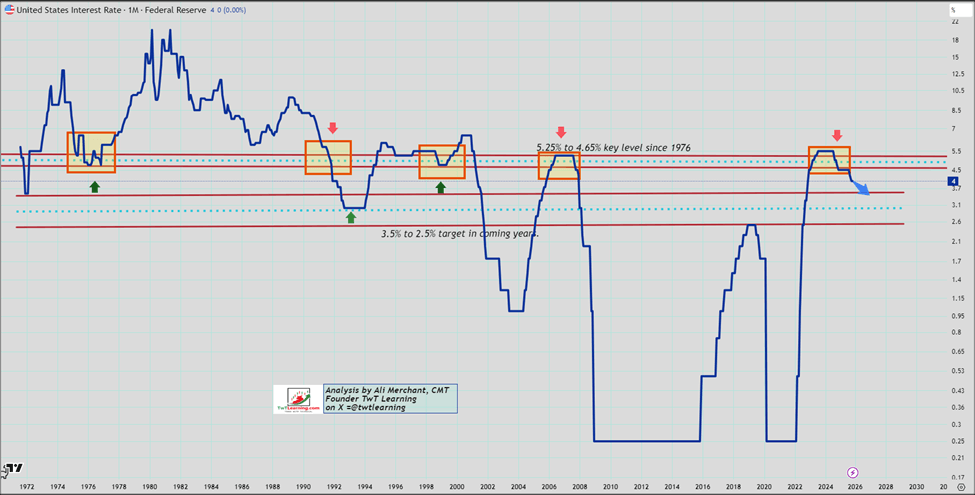

US Interest Rate:

· U.S. interest rates fell below 4.50% in October, opening the door to several additional cuts.

· Historically, a decisive move below 4.65%–4.50% has often preceded a sharp decline toward 3.50%.

· A sustained break under 3.50% could set the stage for rates to fall toward 2.50% in the coming years.

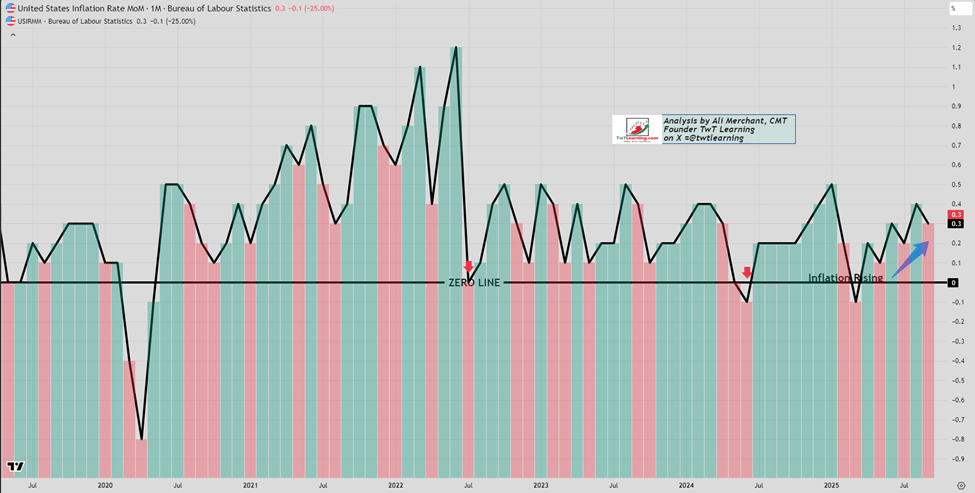

US Inflation is heading higher:

- Higher US inflation is causing Fed members division in rated opinion.

- While higher debt and debt servicing costs remain a key focus for the US administration.

Author

Ali Merchant, CMT

TwT Learning

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, & Fund Management, He has been trading FX, FX options, US stock