December employment: Just right

Summary

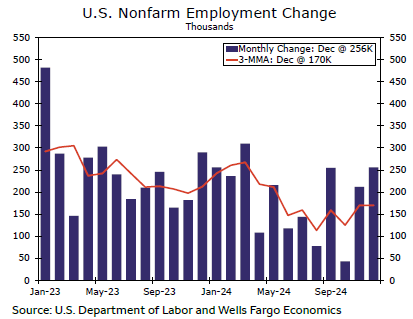

The employment data for December pointed to a resilient U.S. labor market. Nonfarm payrolls rose by 256K in the month, topping consensus expectations by nearly 100K. Over the past three months, nonfarm payroll growth has averaged 170K, a solid pace of hiring that should be fast enough to keep the unemployment rate relatively steady. To that end, the unemployment rate fell by one-tenth to 4.1% and is right in the sweet spot of the Fed's projections for a "not too hot" and "not too cold" labor market. Similarly, wage growth of 3.9% is roughly consistent with an eventual return to the Fed's 2% inflation target after accounting for 2% labor productivity growth seen over the past year.

The FOMC made clear at its December meeting that it would take additional progress on moving inflation back to 2% before future rate cuts materialized, assuming that the labor market remained in a healthy position. Today's employment data should give policymakers more confidence in that assumption. A solid pace of hiring as measured by the nonfarm payrolls figures, when paired with an unemployment rate that has been relatively flat since the summer, likely will push the central bank to be patient with future rate cuts. We still expect the FOMC to cut rates again at some point this year as it searches for the neutral rate, but a rate cut at its meeting on January 29 is off the table, and March looks increasingly unlikely as well.

Author

Wells Fargo Research Team

Wells Fargo