December CPI: No coal in the stocking

Summary

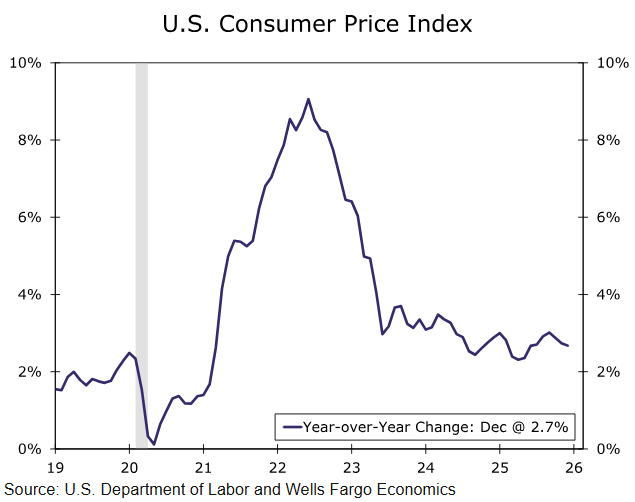

The CPI report covering the final month of 2025 generally was encouraging. Core CPI in December rose 12 bps less than our forecast, largely on the back of a smaller-than-expected bounce back in core goods inflation after November's unusually soft, shutdown-delayed report. On a year-over-year basis, the core CPI held steady at 2.6%, an improvement from the 3.1% reading in August and the 3.2% pace seen in December 2024. A quirk related to shelter inflation is depressing the year-over-year CPI readings by a tenth or so. Furthermore, we are not out of the woods yet on the tariff front, as Q1 seasonality related to companies updating their prices at the start of the year is an important hurdle yet to be cleared.

That said, there is still plenty of signal in today's report, and it strengthens our conviction that inflation will show continued progress toward returning to 2% in 2026. With the labor market still showing signs of flagging, we continue to think the FOMC will continue to gradually move the federal funds rate toward neutral in the coming months.

Encouraging CPI report to finish 2025

Consumer price inflation came in a bit slower than expected to finish 2025. Headline CPI rose 0.31% over the month, while core CPI was a cooler 0.24%. Food inflation came in hot in December, rising 0.7%, while energy inflation was a tamer 0.3%. Despite monthly fluctuations, inflation for food and energy commodities (e.g., gasoline) remains relatively modest. Over the past year, food inflation stands at 3.1%, while energy commodity prices are down 3.0%. One exception is energy services inflation where electricity prices (+6.7% year-over-year) and piped gas prices (+10.8% year-over-year) have grown much faster, a trend likely to continue amid the ongoing AI buildout (chart).

Author

Wells Fargo Research Team

Wells Fargo