DAX30 bearish monthly candle confirms waves B-C and downtrend

-

German stock index DAX 30 is breaking below the monthly candle lows from July to September. This month’s monthly candle is likely to close firmly bearish.

-

How will the bearish close impact the Elliott Wave patterns and outlook? This article reviews what DAX traders can expect in the next 6 months.

The German stock index DAX 30 is breaking below the monthly candle lows from July to September. With only two trading days remaining in October, this month’s monthly candle is likely to close firmly bearish.

Price Charts and Technical Analysis

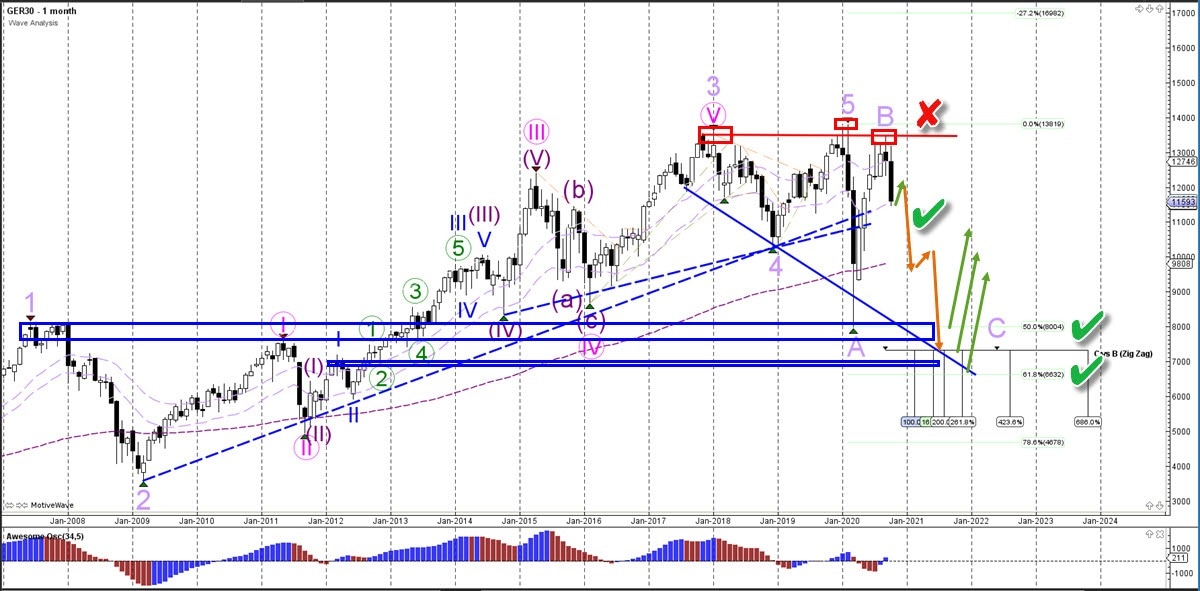

A bearish monthly candle close near the candle low on the DAX 30 in October could confirm as expected the end of the wave B (purple). The bearish bounce at the resistance trend line (red) confirms a head and shoulders pattern (red boxes) as well.

The end of a wave B indicates the start of the wave C (purple). Price action could drop (orange arrows) as low as the previous bottom or even the 61.8% Fibonacci retracement level before finding support (green arrows).

If the wave C is completed within the usual time frame, then we expect the DAX 30 to reach a low between February and May 2021 before starting a new uptrend again.

The bearish outlook is invalid if price action is able to recover above the resistance (red x). Otherwise the bears look solidly in control at the moment.

On the daily chart, we can see another head and shoulders reversal chart pattern (red boxes). Price action made a very strong breakout below the support trend lines (dotted green lines).

The bearish impulse is probably confirming a wave 3 (purple) pattern. Price action is expected to drop further towards the 261.8% Fibonacci target first of all (orange arrow).

Later on, a choppy and corrective pattern should take place (green arrow). The bearish outlook is invalidated if price action breaks above the resistance (red x).

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.