DAX: Strong support at 15340/300

DAX, EuroStoxx, FTSE

Dax 30 June topped exactly at the next target of 15500/520. We bottomed just above strong support at 15340/300.

EuroStoxx 50 June reversed from 4000 to test first support at 3975/70.

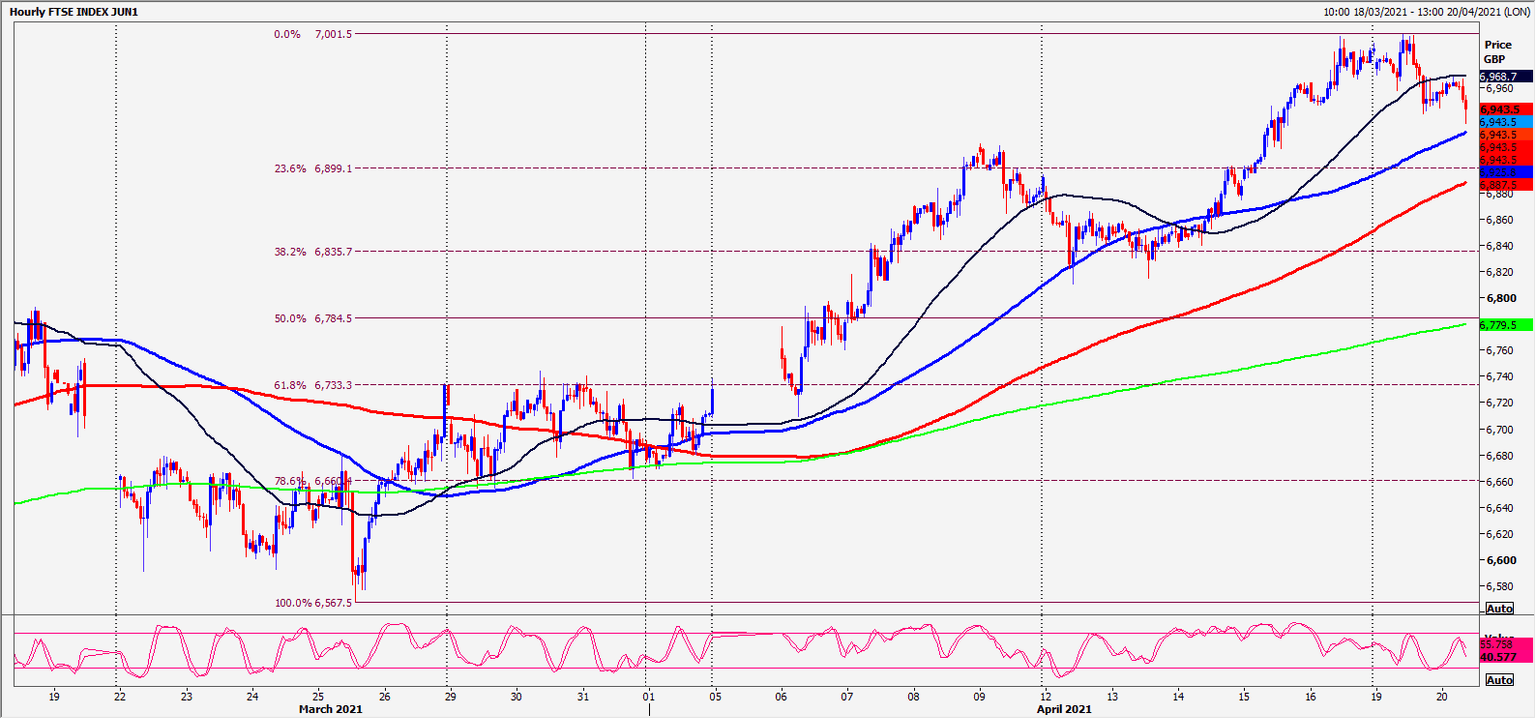

FTSE 100 June hit 7000.

Daily analysis

Dax strong support at 15340/300. Longs need stops below 15270. A break lower to however targets 15180/160 with support at 15120/100.

Minor resistance at 15440/450. Above 15460 looks for a retest of 15500/520. Further gains are likely eventually in the bull trend targeting 15650/700 & resistance at 15800/850.

EuroStoxx hits 4000! Further gains target 4018/22 & 4032/35.

First support at 3975/70. Below 3960 tests strong support at 3945/40. Longs need stops below 3930.

FTSE beat 6950/60 & closed the week above the 100 weeks moving average at 6980/85 after hitting 7000. We held this big number yesterday. A break above 7000 today targets 7035/45 & 7090/95.

Good support at 6940/30 with better support at 6910/6890 likely to see a low for the day if tested. longs need stops below 6880. The next target is 6855.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk