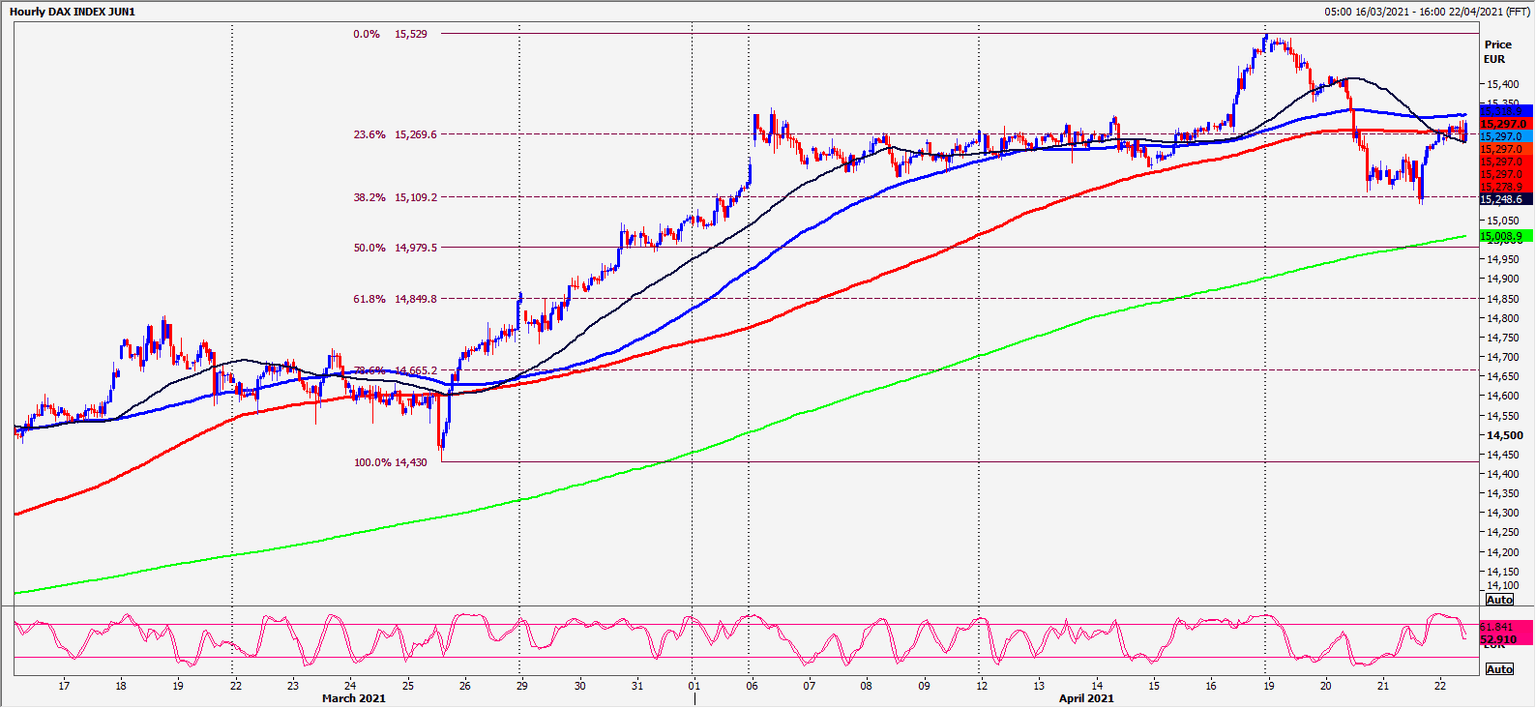

DAX: Strong support again at 15120/100

Dax, EuroStoxx, Ftse

Dax 30 June bottomed exactly at support at 15120/100. Longs worked perfectly on the bounce to first resistance at 15290/330. As I write we topped exactly here.

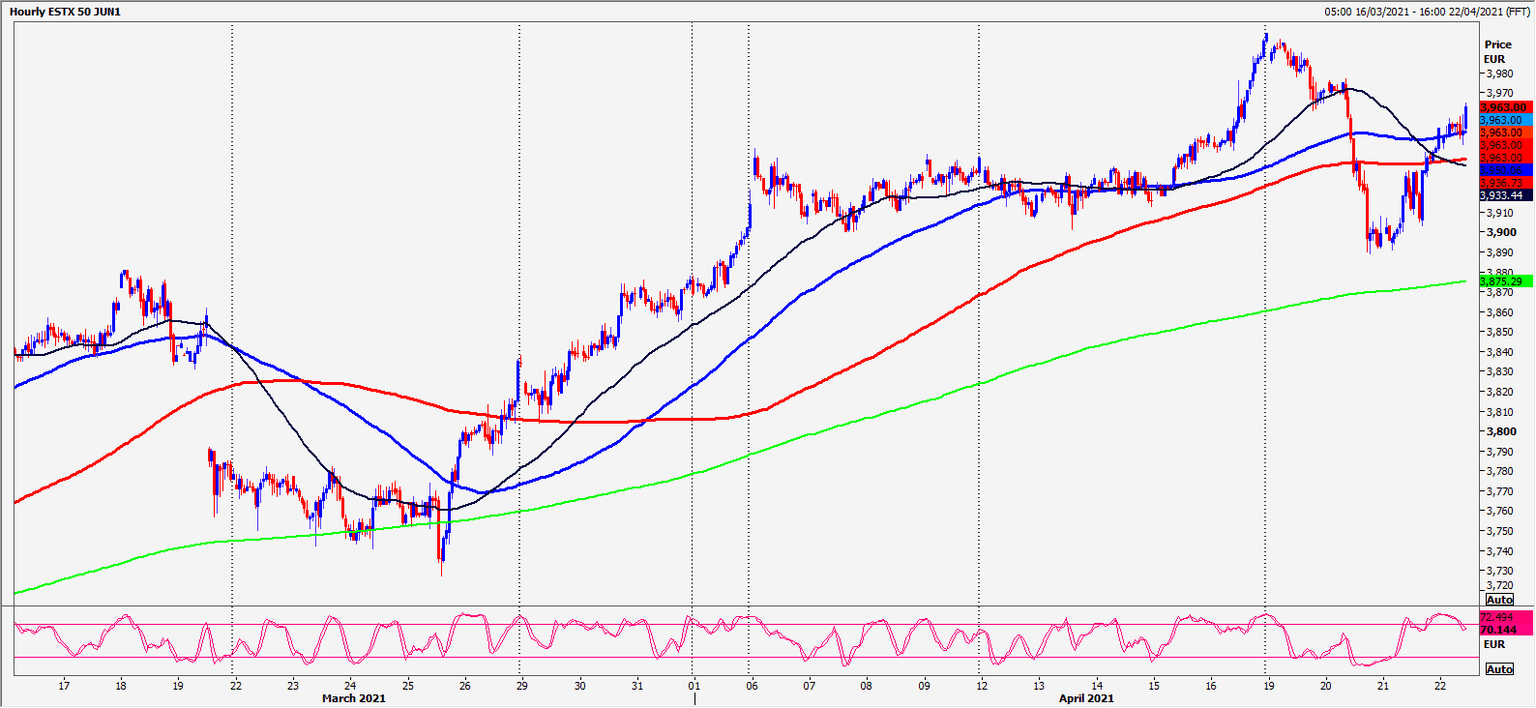

EuroStoxx 50 June bottomed exactly at strong support at 3900/3890 & longs worked perfectly on the bounce to 3955.

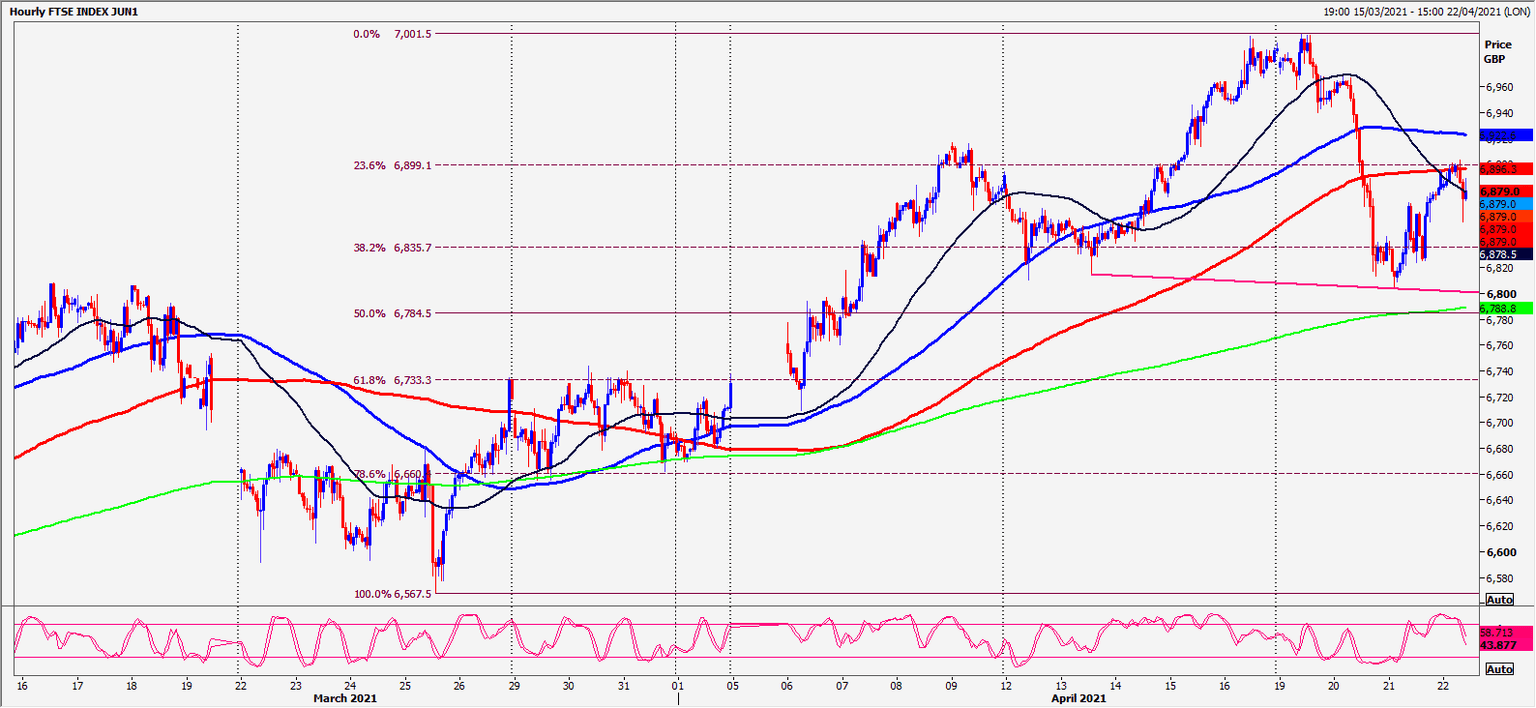

FTSE 100 June recovered to the first target & strong resistance at 6900/6920. We topped exactly here.

Daily analysis

Dax longs offered almost 200 ticks profit on the bounce to our target & first resistance at 15290/330. A break higher targets 15440/450 before a retest of the all time high at 15500/529. A break higher in the bull trend targets 15650/700 & resistance at 15800/850.

Strong support again at 15120/100 today. Longs need stops below 15070. Further losses meet the strong support at 14990/940. Longs need stops below 14890. A break lower to targets 14820/800.

EuroStoxx longs at 3900/3890 work on the bounce to first resistance at 3935/45. A break above 3955 allows a retest of 3990/4000 Further gains target 4018/22 & 4032/35.

Strong support again at 3900/3890. A break below 3880 however risks a slide to 3865/62. Expect strong support at 3845/35. Longs need stops below 3825.

FTSE topped exactly at the first target & strong resistance at 6900/6920 as I write this morning. Holding here risks the formation of a head & shoulders reversal pattern. We will watch this carefully. Shorts need stops above 6935. A break higher targets 6965/70 before a retest of resistance at 6990/7000.

Shorts at strong resistance at 6900/6920 target 6870/60, perhaps as far as 6840/35. Strong support at 6790/80. Longs need stops below 6770. A break lower targets 6735/30. Best support then at 6665/35. Longs need stops below 6615.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk