Daily technical and trading outlook – GBP/USD

DAILY GBP/USD TECHNICAL OUTLOOK

DAILY GBP/USD TECHNICAL OUTLOOK

Trend Daily Chart

Sideways

Daily Indicators

Rising

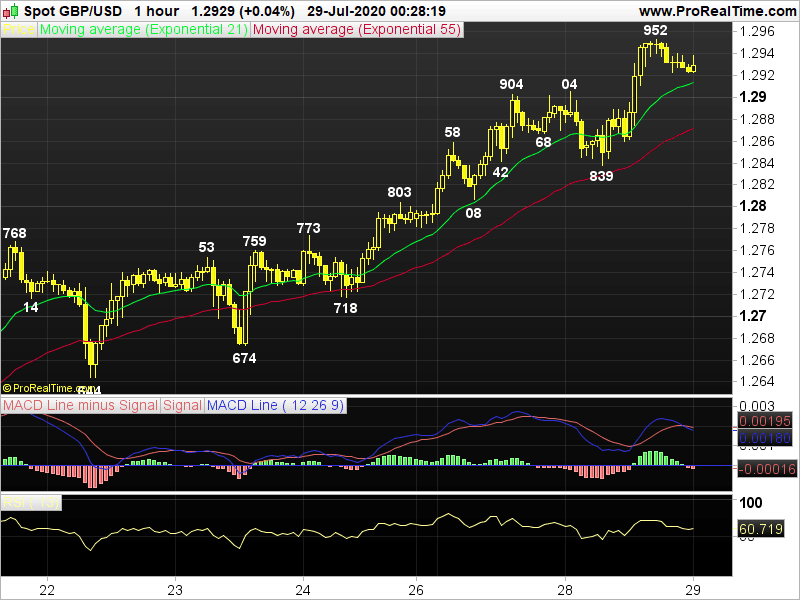

21 HR EMA

1.2913

55 HR EMA

1.2871

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

60

14 HR DMI

+ve

Daily Analysis

Resumption of recent upmove

Resistance

1.3000 - Psychological res

1.2977 - Mar 11 high

1.2952 - Y'day's high

Support

1.2904 - Mon's high (now sup)

1.2888 - Y'day's hourly res (now sup)

1.2839 - Y'day's low

GBP/USD - 1.2881...Although the British pound dropped fm 1.2904 to session lows at 1.2839 in Europe, price erased its losses n rallied to a 4-1/2 month peak at 1.2952 in NY on cross-buying of stg vs euro b4 stabilising.

On the bigger picture, despite cable's brief break of 2016 post-Brexit low of 1.1491 to a near 35-year trough of 1.1412 in mid-Mar on safe-haven usd's demand following almost free fall in global stocks, sterling strg rebound to as high as 1.2648 (Apr) on broad-based usd's weakness suggests low has been made. Although price fell to 1.2075 in May, price climbed to a near 3-month peak of 1.2812 in Jun. Although selloff to 1.2252 in late Jun signals MT uptrend fm 1.1412 has made a top, last Fri's rally to 1.2803 suggests pullback has ended n upside bias remains for re-test of 1.2812 next, break would extend twd 1.2894 but reckon 1.3000 would hold. Only below 1.2644 signals top n risks 1.2480.

Today, although y'day's rise to 1.2952 signals MT upmove fm 1.1412 (Mar) remains in progress n gain to 1.2990/95 would be seen, reckon bearish divergences on hourly indicators would keep price below 1.3000/10 n yield correction. Only below 1.2904 wud risk stronger retracement to 1.2888, 1.2839.

Interested in GBP/USD technicals? Check out the key levels

Author

AceTrader Team

AceTrader

Led by world-renowned technical analyst Wilson Leung, we have a team of 7 analysts monitoring the market and updating our recommendations and commentaries 24 hours a day.