Cycle Trading: Weekend report preview

The Dollar

The dollar printed a bullish candle on Friday.

The dollar printed its lowest point on Friday, day 36, placing the dollar deep in its timing and for a daily cycle low. Friday’s bullish candle eases the parameters for forming a swing low. A break above 93.51 forms a swing low. Then a close above the 10 day MA will signal the new daily cycle. Then the dollar should rally enough to break above the declining trend line. The dollar is in a daily downtrend. It will remain in in its daily downtrend unless it closes above the upper daily cycle band.

Stocks

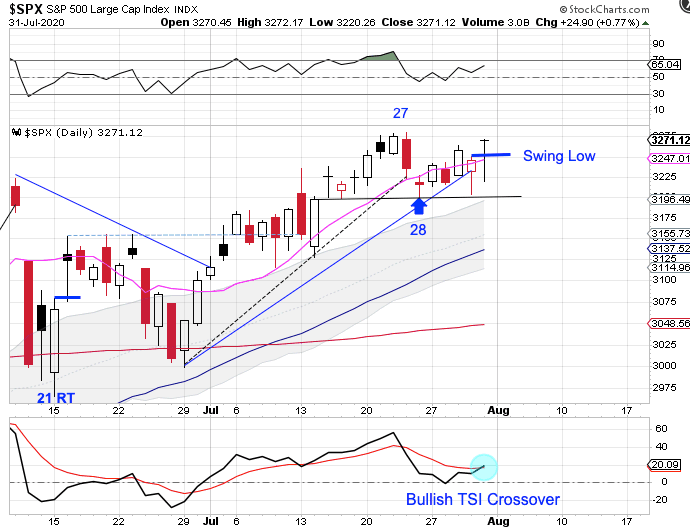

Stocks formed a swing high and closed below the 10 day on day 28 to signal the daily cycle decline. However, stocks found support at the 3200 level.

Support at the 3200 level prevented stocks from completing their daily cycle decline. Since the 10 day MA did not turn lower we did not label day 28 as the DCL. Which makes Friday day 33, placing stocks in their timing band for a daily cycle low. The last cycle ran short at 21 days, so stocks could see an extended daily cycle - which will allow for the cycle counts to balance out.

The Fed has been flooding the market with an unprecedented amount of liquidity and this may be obscuring the equity cycle. We may need to rely on our cycle band tool, which tells us that stocks are in a daily uptrend. Since Friday’s swing low formed above the upper daily cycle band that indicates that stocks remain in their daily uptrend and triggers a cycle band buy signal. One could use the trailing 10 day MA as a stop.

Author

LikesMoney

Independent Analyst

Assets (such as stocks, gold, and the dollar) have identifiable cycles.