Cycle Trading: The weekend report preview

The Dollar

The dollar broke below the day 44 low on Friday.

Breaking below the previous daily cycle low forms a failed daily cycle and extends the intermediate cycle decline. Friday being only day 6 indicates that the dollar can trend lower for the next 3 to 6 weeks before printing its DCL. The dollar is in a daily downtrend and will remain so unless it can close back above the upper daily cycle band.

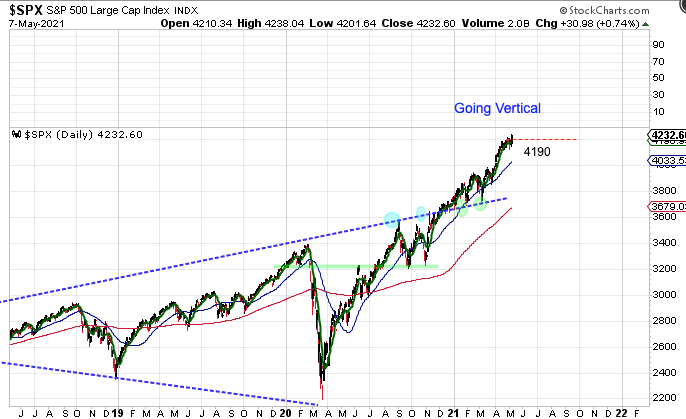

Stocks closed below the 10 day MA on Tuesday to signal the daily cycle decline.

Stocks printed their lowest point on Tuesday, day 42 to place them in their timing band for a daily cycle low. Stocks formed a swing low on Wednesday and closed above the 10 day MA on Thursday so we will label day 42 as the DCL. Stocks then delivered bullish follow through on Friday to close at a new all time high.

Stocks are in a daily uptrend. Thursday’s swing low formed above the upper daily cycle band to signal that stocks remain in their daily uptrend and triggers a cycle band buy signal. The 4190 resistance level can now be used as the stop.

Author

LikesMoney

Independent Analyst

Assets (such as stocks, gold, and the dollar) have identifiable cycles.