Cryptocurrencies rebound amid strong venture funds inflows

US and European stocks rose on Wednesday as the earnings season continued. In Europe, Credit Suisse noted that its costs rose in the first quarter and warned of a loss. The firm said that it would set aside over $600 million in provisions for litigation. It also blamed the situation on the ongoing crisis in Ukraine that has cost it over $200 million. The biggest concern among investors was streaming companies like Netflix, Disney, and Paramount. In its earnings report, Netflix said that it lost customers for the first time on record. It blamed the situation on slow growth, password sharing, and Russia.

The euro bounced back against the US dollar after the strong Eurozone industrial production numbers. According to Eurostat, the bloc’s industrial production rose from -0.7% in January to 0.7% in February. This increase was better than the median estimate of 0.2%. The production rose by 2.0% on a year-on-year basis. Additional data from Germany showed that the producer price index (PPI) rose to a multi-decade high of 30.9%, which was also higher than the expected 28.2%. Like other countries, the euro has been in a strong bearish trend against the US dollar recently.

Cryptocurrency prices rose on Wednesday as activity in the industry remained vibrant. For example, according to Bloomberg, The Sandbox is raising $400 million from investors at a $4 billion valuation. Other companies in the sector have also raised millions of dollars in the past few months. For example, Ava Labs, the parent of Avalanche raised $300 million while Near Protocol raised over $350 million from investors. Other blockchain companies that have raised funds recently are Mina Protocol and MoonPay.

EUR/USD

The EURUSD pair continued its bullish momentum after the strong European economic data. It rose to a high of 1.0866, which was the highest level since April 14th. On the hourly chart, the pair moved above the important resistance at 1.0820, which was the highest point on April 15th. It has moved above the 25-day moving average and is along the upper side of the Bollinger Bands. The stochastic oscillator has also moved above the overbought level. Therefore, the pair will likely keep rising during the American session.

USD/JPY

The USDJPY pair retreated slightly as some investors started taking profit. The Japanese yen also reacted to the mixed exports and imports data. It is trading at 127.8, which was slightly below this week’s high of 129.60. On the hourly chart, the pair moved slightly below the 25-day moving average while oscillators like Chaikin and the RSI pointed lower. Therefore, the pair will likely keep falling for a while.

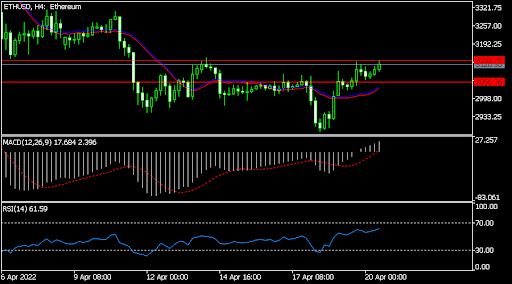

ETH/USD

The ETHUSD pair rose to a high of 3,120, which was the highest level since April 13. This is a strong recovery considering that the price fell to a low of 2,877 this week. The pair has moved slightly above the important resistance level at 3,000. It also crossed the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising as bulls target the resistance at 3,300.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.