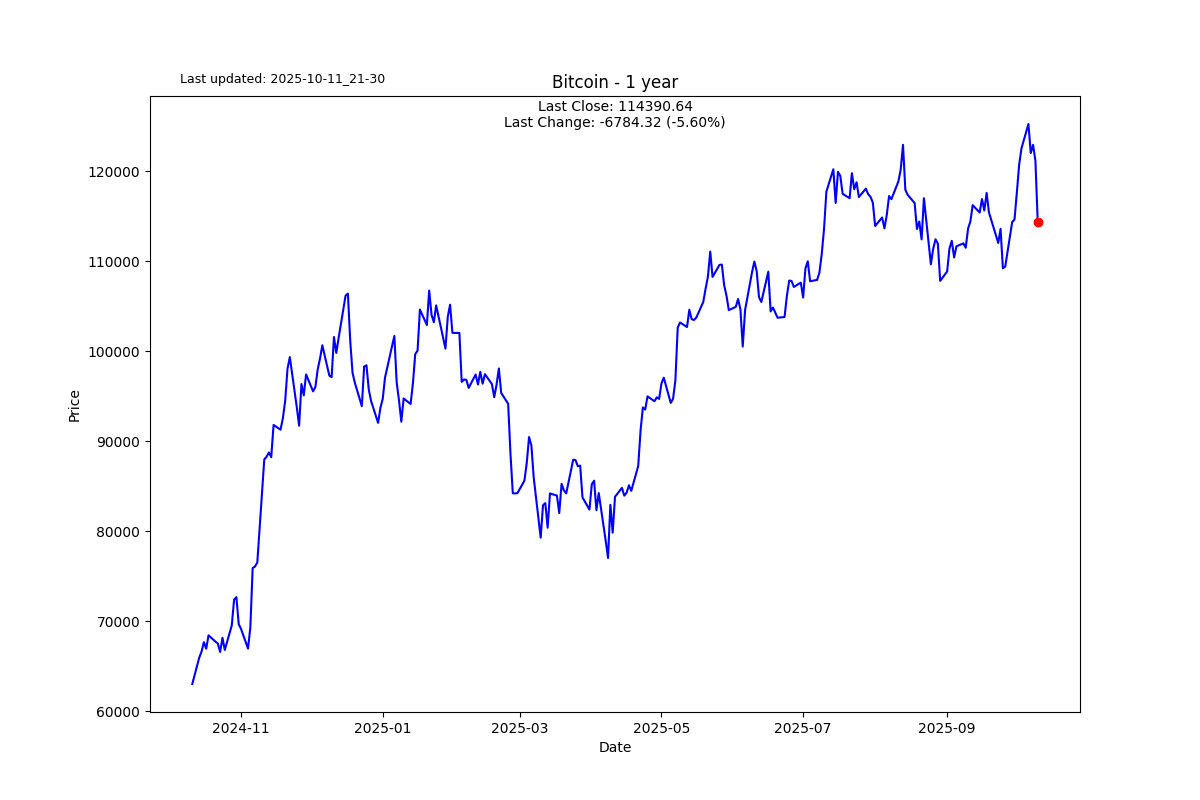

Crypto gets liquidated

S2N spotlight

Traders know how powerful leverage is. The buying power that derivatives give you can make you feel like a master of the universe. The danger becomes greater when you believe that markets only go up; then the power of leverage can become lethal as it works both for and against you.

For the first decade crypto was largely traded on the spot market. That means if you buy a bitcoin for $10,000, you pay with $10,000 of your cash. It didn’t take long for the derivative market in the form of perpetuals to become the dominant force.

In 2025, perpetual contracts account for about 68% to 75% of all Bitcoin trading volume, compared to the spot market's 25% to 32% share. Why so popular?

With a perpetual, you can buy bitcoin at $100,000 with only $1,000 of cash. If Bitcoin goes up 1% to $101,000, you have made a 100% return on your $1,000. The opposite is also true: if Bitcoin drops 1% to $99,000, you have lost 100% of your cash investment.

As you can imagine, the crypto bros just kept buying the dip. Just like me at the falafel stand; you've got to love the dips. There is a wrinkle with crypto derivative exchanges. They don’t do margin calls like your local broker. Hey bro, please top up your account; you are about to get stopped out. No, these exchanges know that there is no time for phone calls. If the price moves against you towards your liquidation value (a formula), bam, it closes you out as the trigger gets hit.

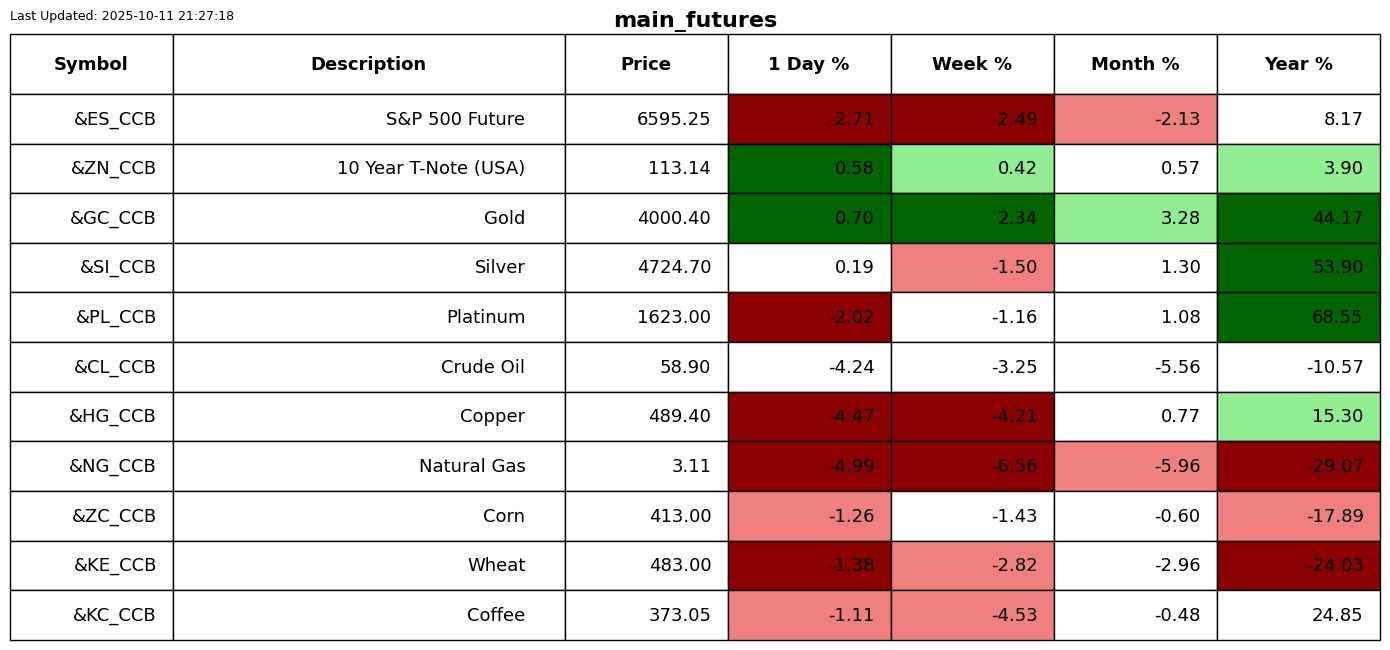

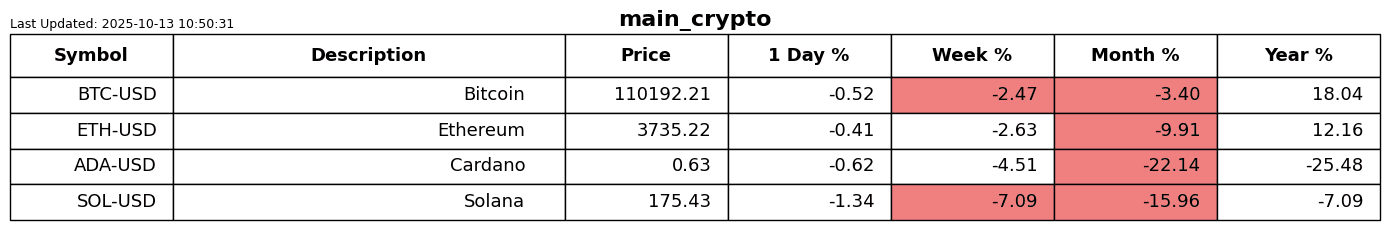

Friday was the largest single liquidation day in crypto history. $19 billion of losses were realised. I am saying $19 billion was taken out of people’s pockets and, making some space for nuance, placed in someone else’s pockets. Usually this is when the bros realise that playing with the big boys who have a lot more backstop than they do can be rather rough.

S2N observations

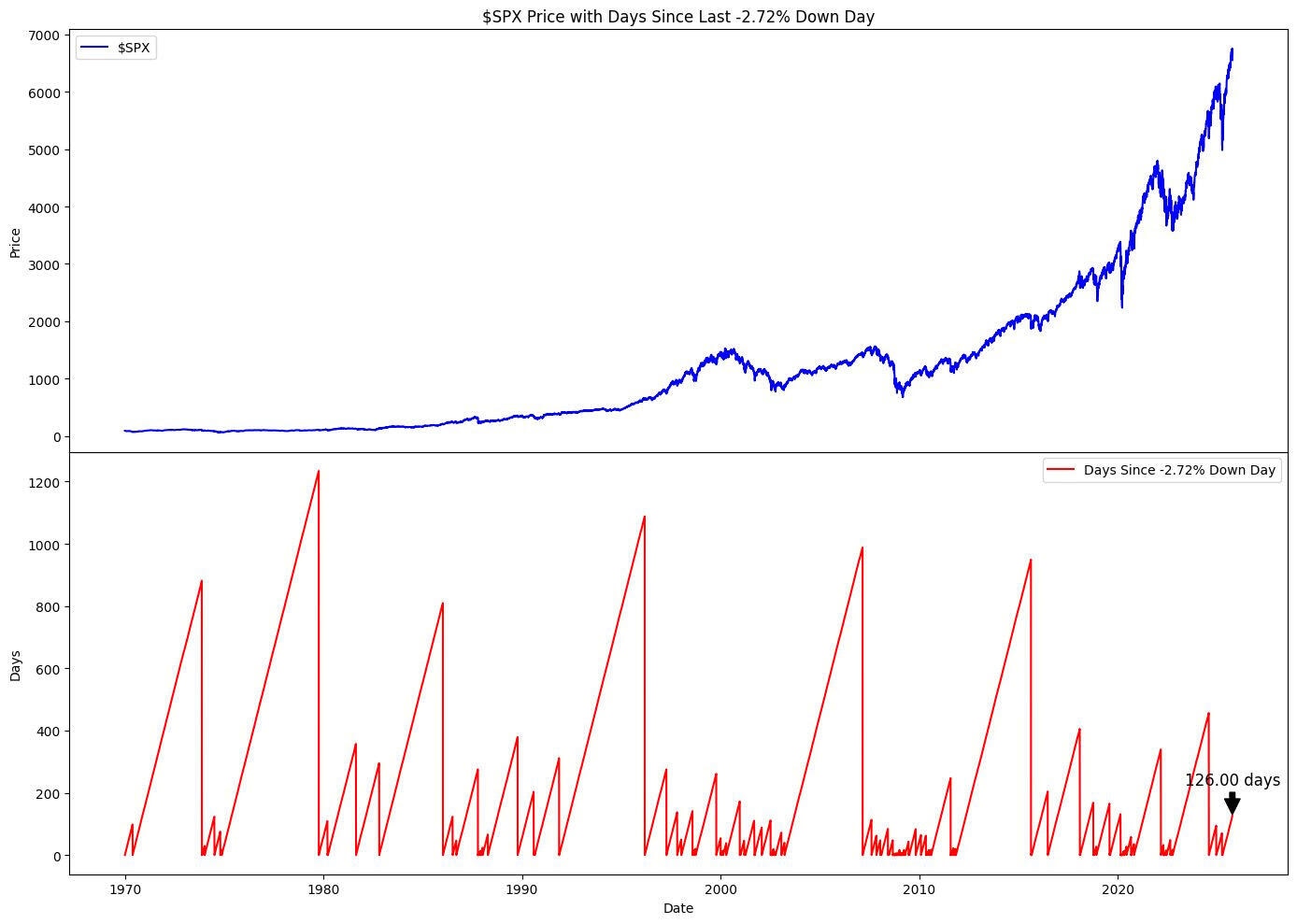

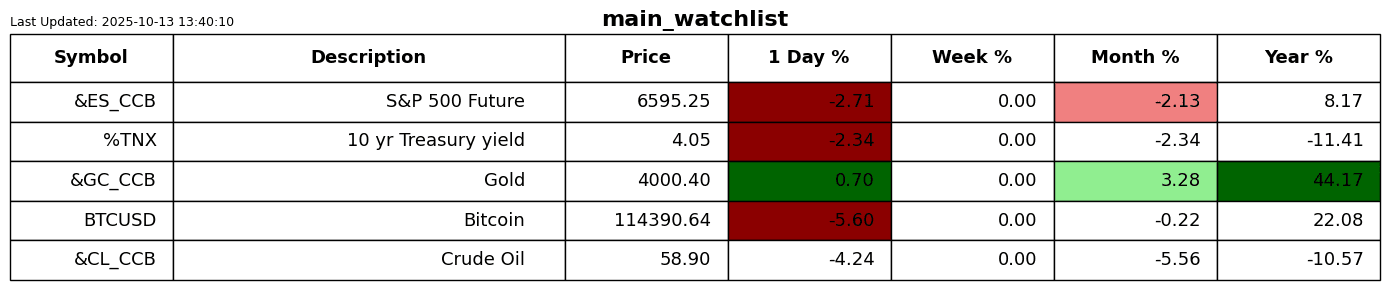

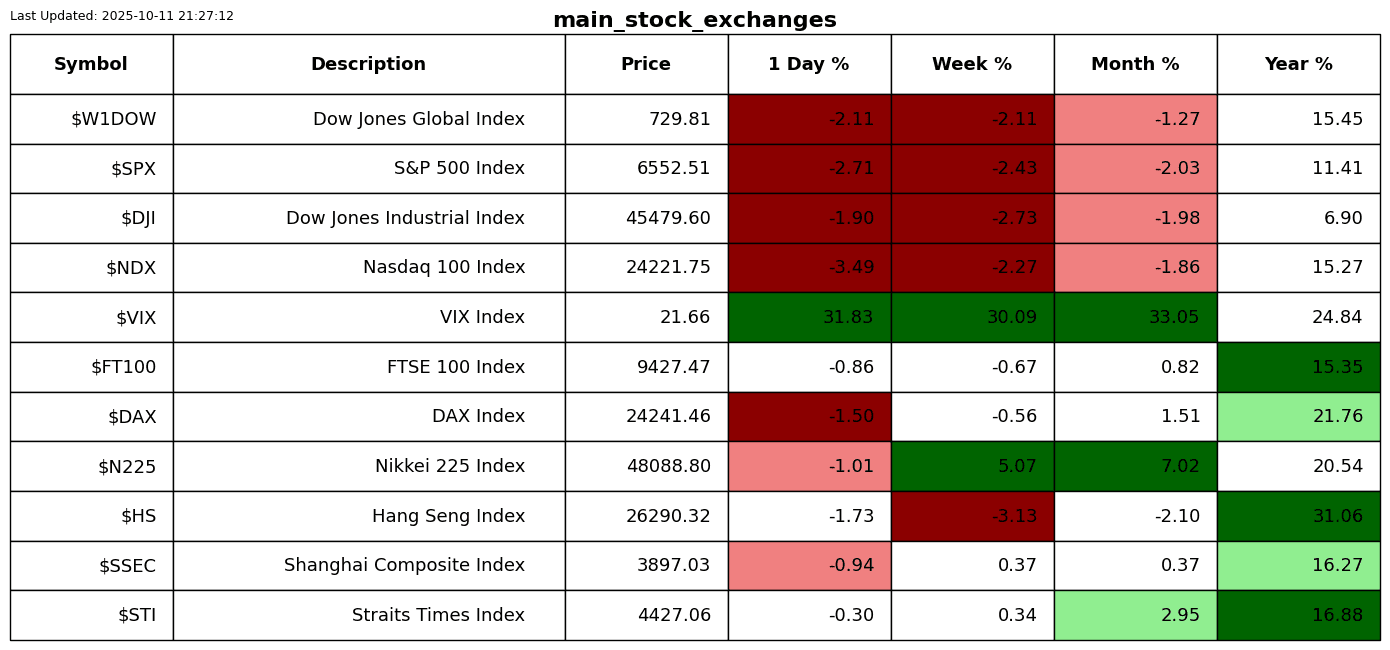

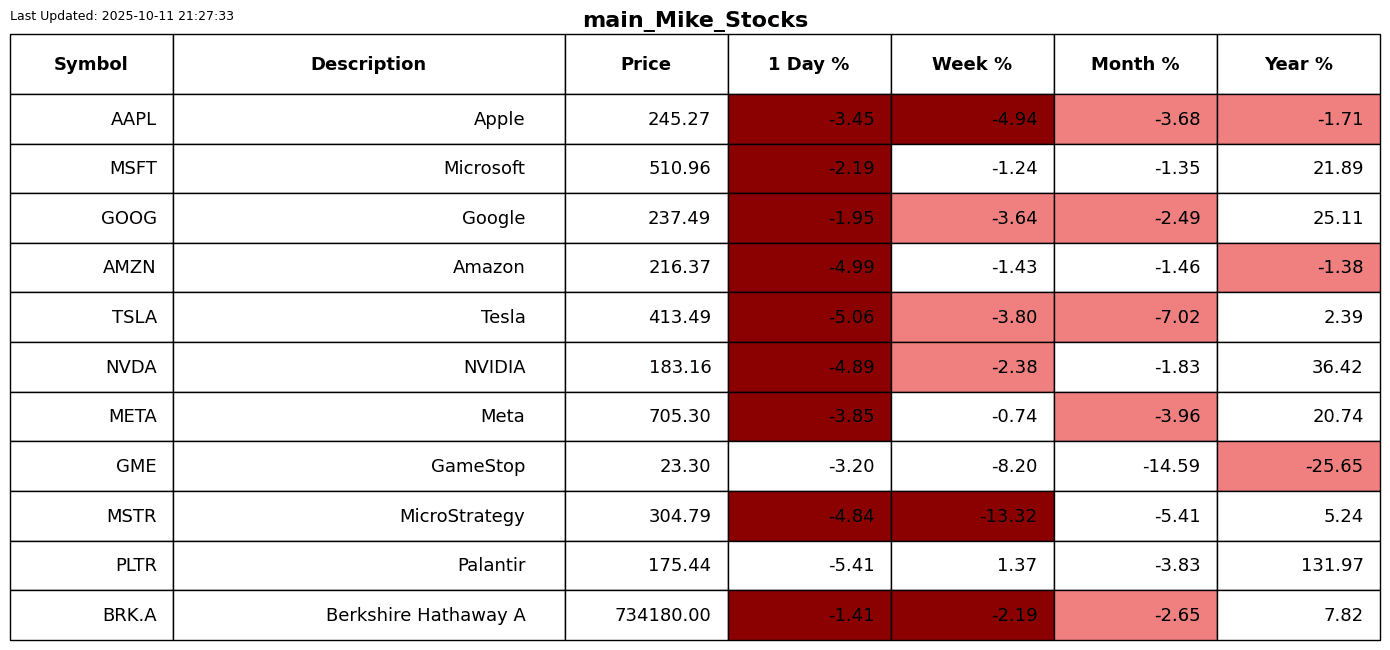

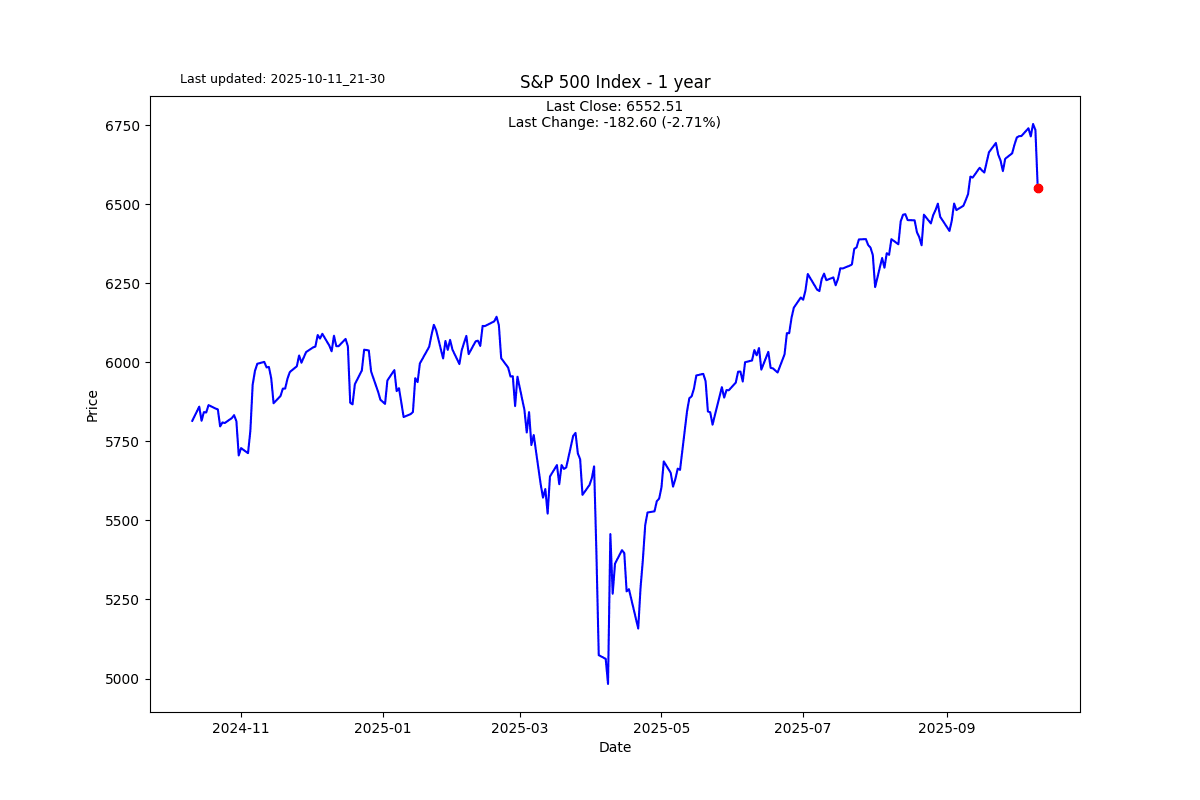

On Friday the S&P 500 had a down day of -2.71%. If you look at the streak counter of 126 days since a -2.72% day, it is not that extreme. However, it has felt like an eternity since the market had any decent correction. Probably because the day counter doesn’t capture the strength of the market in the last 126 days, which has been exceptional.

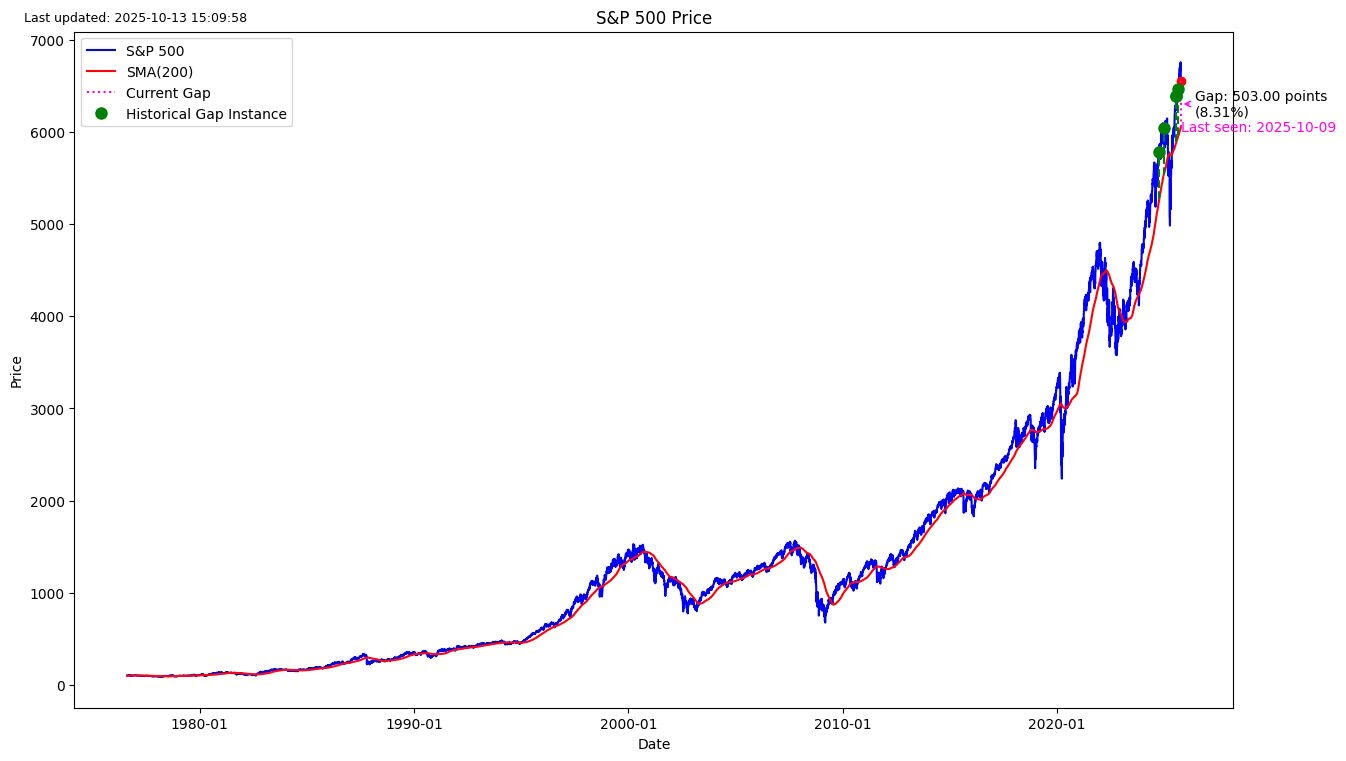

This chart of how strong the momentum has been best captures the strength of the bull market with a gap of more than 8% above its 200-day moving average.

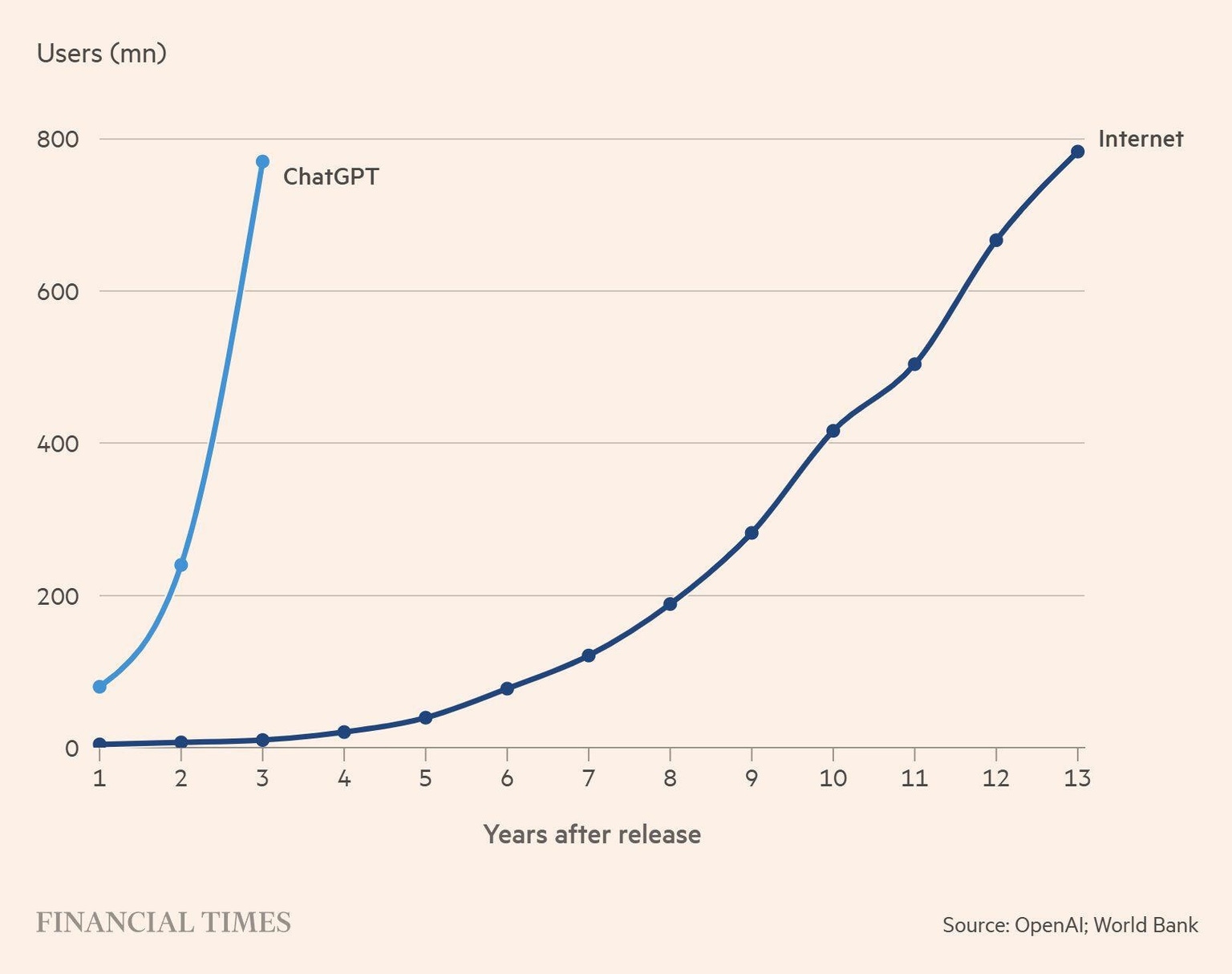

The buzz around AI has clearly been the driver of this market. The adoption of AI makes the internet feel like a 14 kb/s dial-up modem by comparison for those of age.

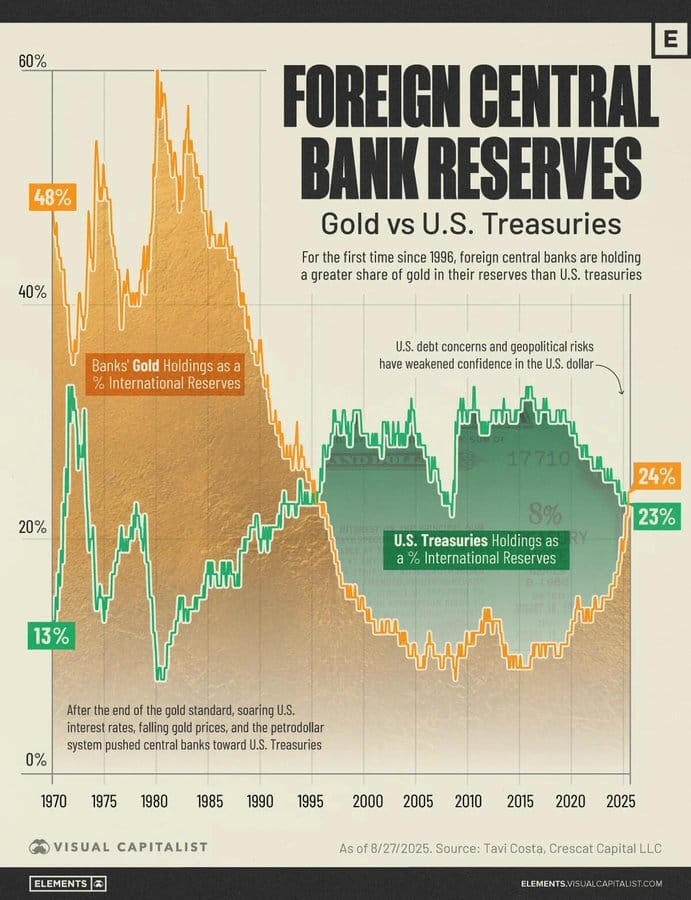

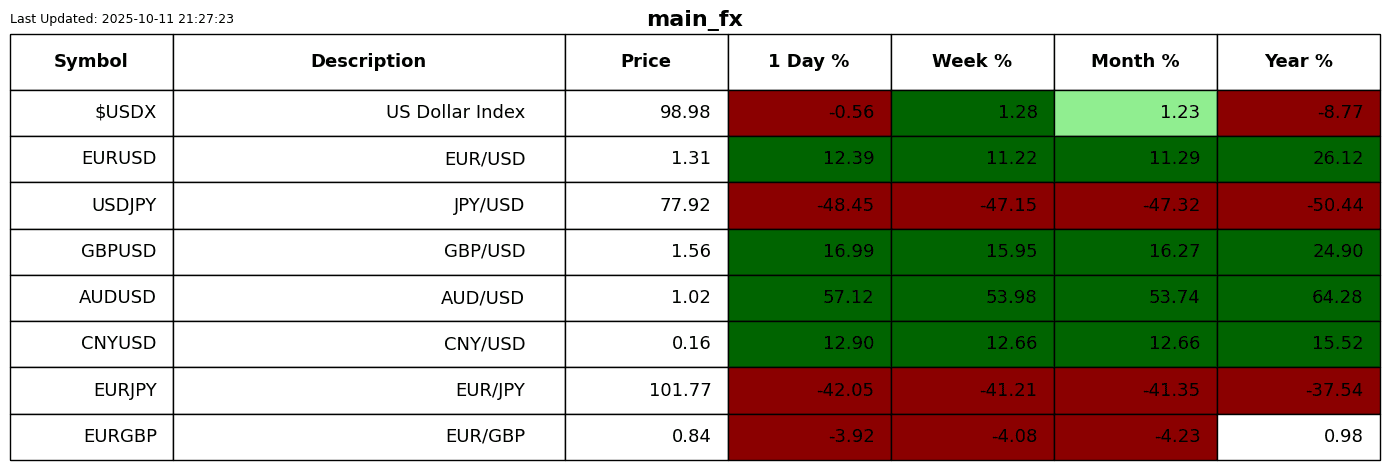

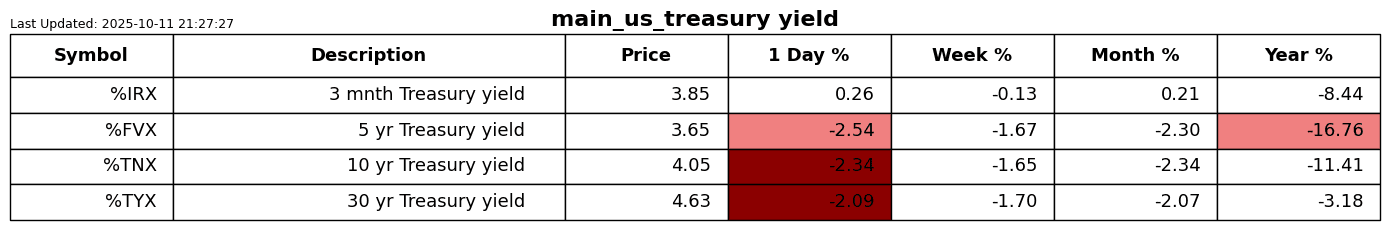

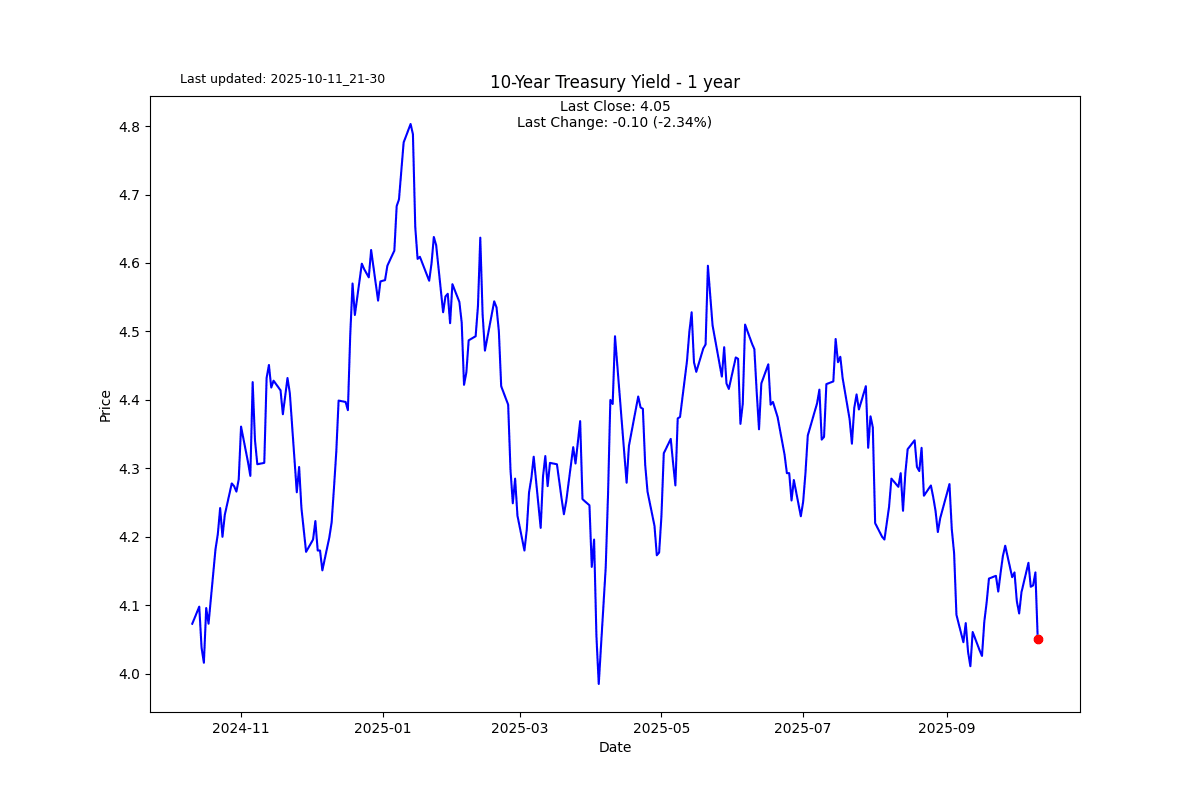

This is an interesting fact, but it is not getting in the way of the US Treasury's strength, with the 10-year on the verge of dipping below 4%.

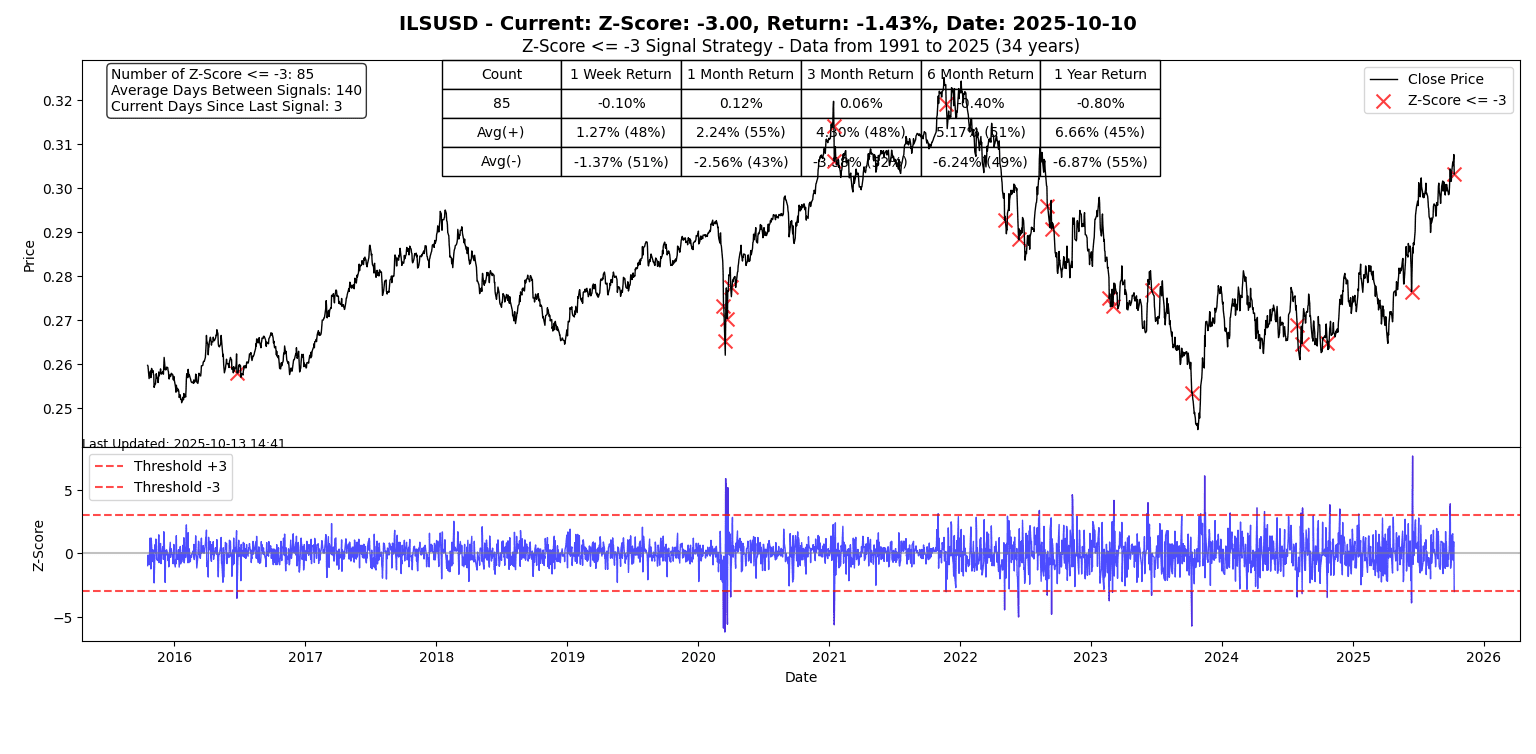

S2N screener alert

The Israeli shekel had an unusually weak day.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.