Crude Oil poised for bullish breakout [Video]

![Crude Oil poised for bullish breakout [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-pumps-25838229_XtraLarge.jpg)

Watch the video extracted from the wlgc session before the market open on 26 mar 2024 below to find out the following:

- The key characteristics of the Wyckoff accumulation structure in crude oil

- The change of character to signal pending upside movement

- Why the current bullish flag could be a sweet spot

Market environment

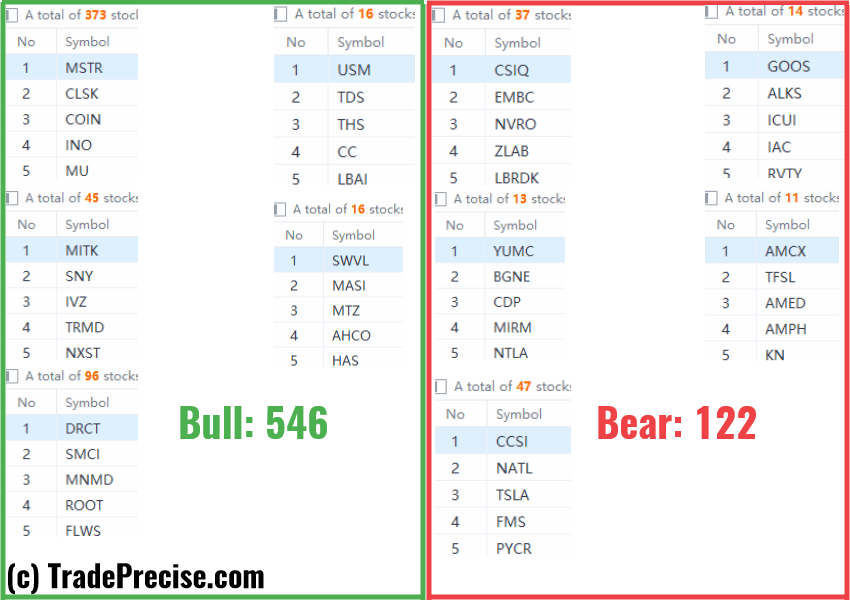

The bullish vs. bearish setup is 546 to 122 from the screenshot of my stock screener below.

This is still a bullish market environment with plenty of setups.

Wyckoff method stock screener

Market comment

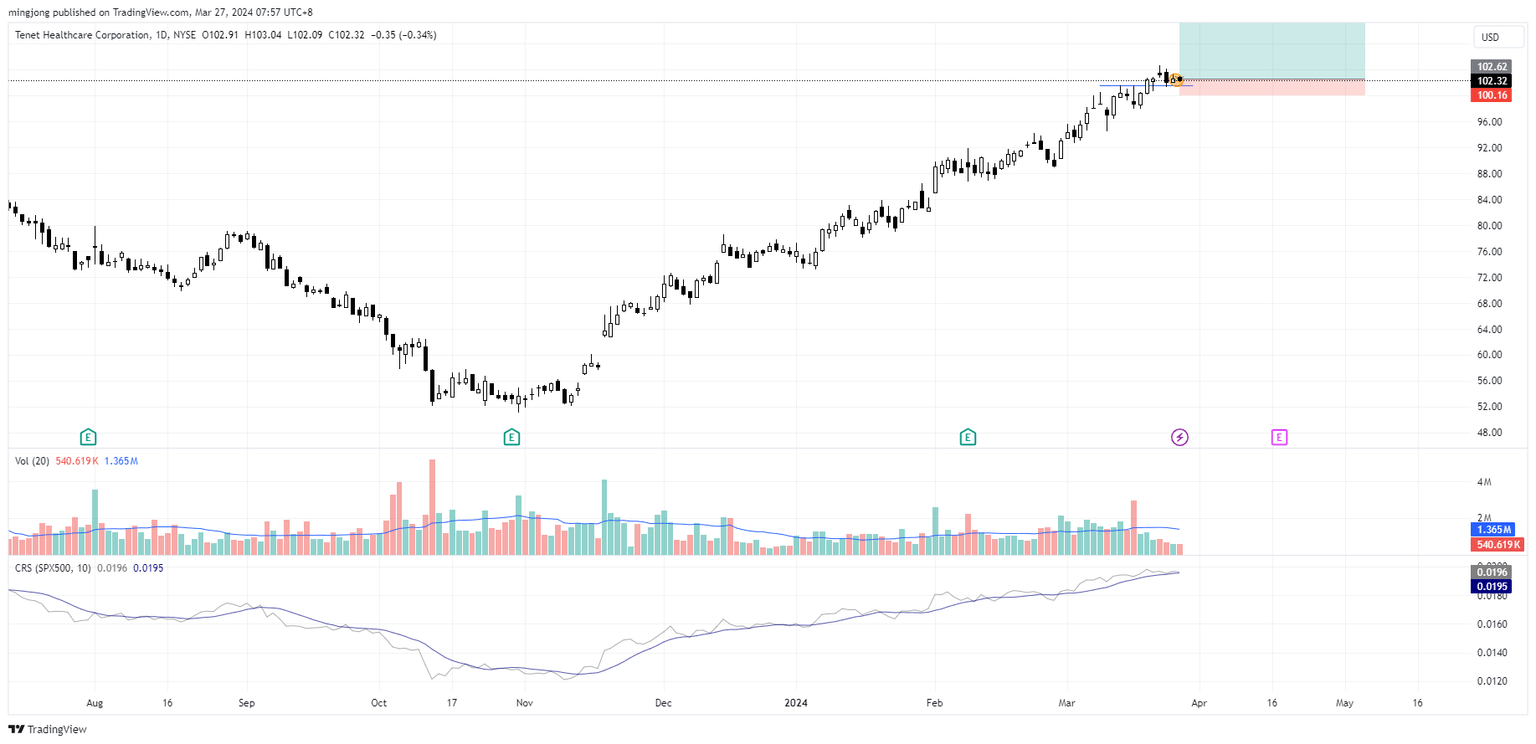

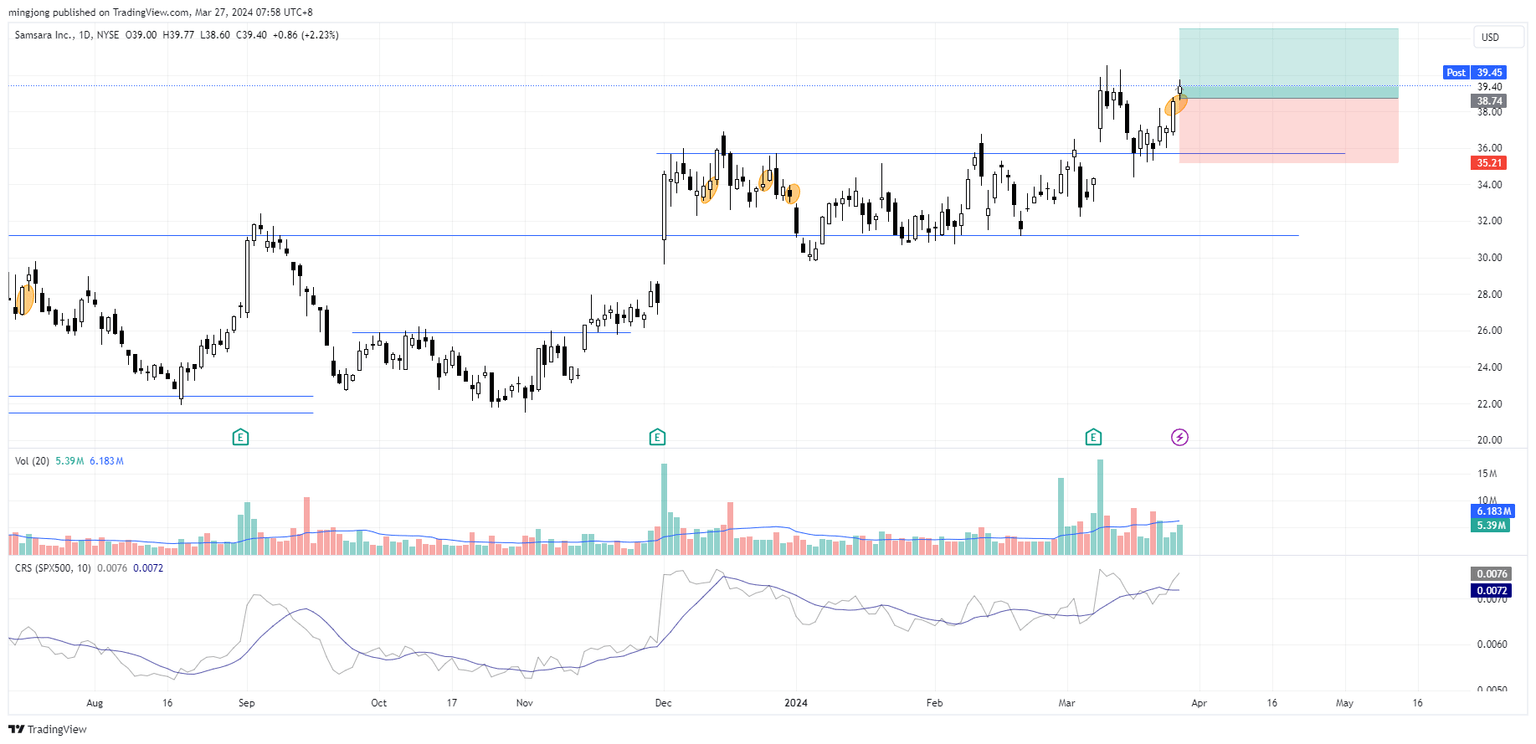

8 “low-hanging fruits” (TOL, THC, etc…) trade entries setup + 17 actionable setups (IOT etc…) were discussed during the live session before the market open (BMO).

TOL

THC

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.