Crude oil fundamentals

Oil prices fell yesterday after investors weighed the effects of surging CV cases seen in the United States and China, the two biggest consumers of oil. Traders have been torn about how to react to the future outlook for demand and supply of oil. On the supply side, the data for crude inventories is set to be released today and it is expected to be lower. This supported the price from falling even further.

Similarly, traders are cautious of Iran increasing the global supply of oil. Iran's new President, Ebrahim Raisi, has vowed to work to lift the "tyrannical" sanctions imposed by the US on its banking and energy sectors. Iran has been in talks with the US about reviving the nuclear agreement, but no agreement has been reached.

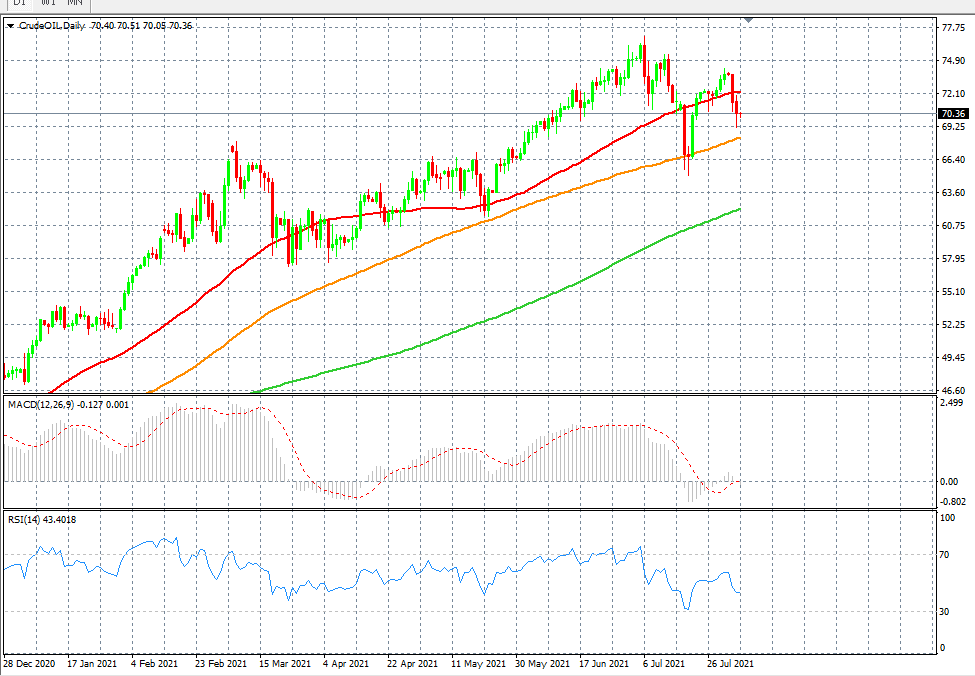

The futures for Brent crude settled at $72.41 per barrel, dropping 0.66%, and the futures for WTI crude settled at $70.56 per barrel, falling 1.0%.

Investors must keep an eye on the upcoming Crude inventory as that can bring higher volatility for both Crude and Brent oil prices. Remember, big institutions such as Goldman Sachs and JP Morgan believe that the oil prices will continue to move higher and they could touch the 100 dollar price mark.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.